In the February issue of Cosmopolitan Korea, Jang Wonyoung’s set of retro denim skirt outfits once again became a viral sensation, and eagle-eyed fans quickly discovered that the skirt was from the Chinese brand Cider.

This is not her first time “promoting” Cider; from the bow cardigan at fan signings to the ballet-style camisole dress in her daily wardrobe, this “South Korean leg queen” frequently features this brand, which was established just five years ago.

Moreover, Blackpink member Jennie and Western influencer Mia have also been spotted wearing the brand’s clothing multiple times.

This brand, dubbed by top Silicon Valley VC A16Z as “the next SHEIN,”—what exactly is its appeal?

Image source: Cosmopolitan Korea scan

Four Rounds of Financing in One Year, Valuation Exceeds $1 Billion

In May 2020, the Cider brand was born in Hong Kong, China. According to information, its founder Wang Chen previously worked at the shared wardrobe platform “YCloset,” and is well-versed in supply chain and young consumer needs.

Therefore, from its inception, the brand targeted overseas Gen Z women and successfully entered the market with a “bold retro” design style. Within just one year, it completed four rounds of financing totaling over $130 million, with investors including IDG Capital, DST Global, and top Silicon Valley VC A16Z, which previously backed Facebook and Twitter. This propelled the brand to become one of the fastest unicorns globally.

A16Z officially announces investment in Cider. Image source: A16Z

After establishing itself in the European and American markets, Cider entered Southeast Asia in 2023, building three overseas warehouses in Indonesia and Thailand, with local teams accounting for over 60%. In 2024, the brand was selected for Fast Company’s “Important Brands” list, appearing alongside iconic brands such as Crocs, Arc’teryx, and Glossier.

Today, Cider has millions of followers across various social media platforms, with users in more than 130 countries and regions worldwide.

Image source: Fast Company

Multi-Platform Strategy: “Planting the Seed” Economics in the Traffic Pool

Sharp insight into consumer preferences and trends is key to creating hit products. Through continuous operation on social platforms like TikTok and Instagram, Cider has built a comprehensive trend monitoring and content marketing system. This deep engagement with social media has been a crucial factor in its rapid growth.

1. TikTok

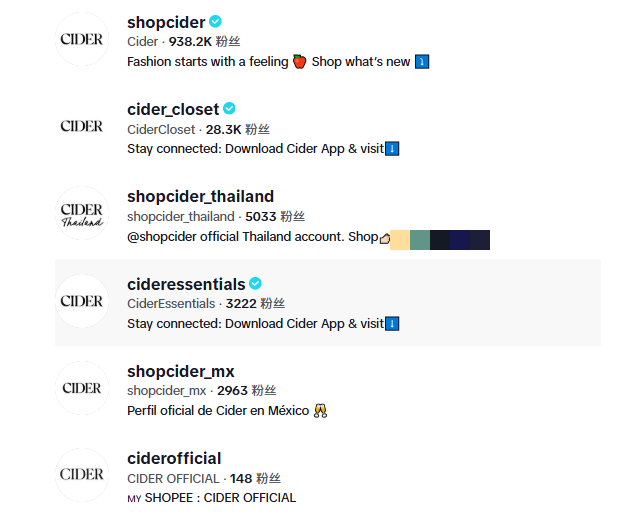

On TikTok, Cider mainly adopts a “social media matrix + influencer collaboration” strategy. Of course, this is not simply about volume, but rather achieving a closed loop of “traffic-conversion-user retention” through refined operations.

For different scenarios and audiences, the brand has set up six targeted TikTok accounts, covering users with different aesthetic preferences through niche accounts like “retro college style” and “Y2K hottie.” The total number of followers on the platform is now close to one million.

Image source: TikTok

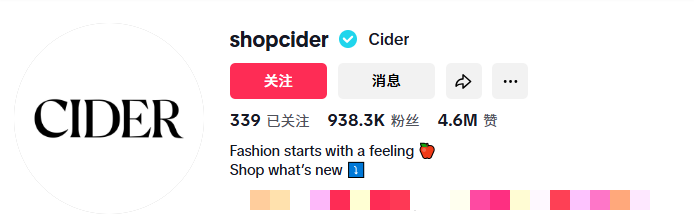

As of April 2, its main account @shopcider has accumulated 938,200 followers and about 37.72 million total views. The video style mainly features scenario-based clothing displays, focusing on diverse fashion elements. This presentation fits the brand’s “bold retro” style and subtly deepens users’ impression of the brand.

Image source: TikTok

For example, a viral video on this account showcased different styles of women’s outfits from the 1980s, fully displaying the beauty of Cider’s clothing. Upon release, the video garnered 7.8 million views for the brand.

Image source: TikTok

However, what truly helped Cider gain a foothold in the TikTok ecosystem is its deep collaboration with influencers.

In the past thirty days, the brand has added 164 new influencer partners, with a total of over 15,200 associated influencers. Among these, they focus on mid-tier influencers (over 60%), establishing long-term partnerships.

This approach casts a wide net, and the more videos are posted, the more likely some will go viral and drive product sales. Overall, it’s much more cost-effective than working with major celebrities.

Image source: Echotik

For example, influencer @mandapaints (171,700 followers) created 29 promotional videos during her collaboration with Cider, with a viral video reaching 48.4 million views and generating an estimated $1.29 million in sales for the brand.

Image source: TikTok

2. Instagram

Cider’s Instagram operation follows a “visual library” approach. From its inception, it locked in a Pinterest-style aesthetic, and this highly unified visual language helped the account quickly amass 2.4 million followers in 15 months, now reaching 5.71 million.

Image source: Instagram

Additionally, Cider showcases actual outfit effects of some Instagram users on its official website’s photo wall. This move inspires many young girls to spontaneously share their outfit photos on Instagram and tag the brand, hoping their photos will be featured on the official website.

This interactive approach undoubtedly brings Cider free promotional publicity.

Image source: Cider official website photo wall

The “Magic” of Independent Sites: Turning the Shopping Cart into an Emotional Diary

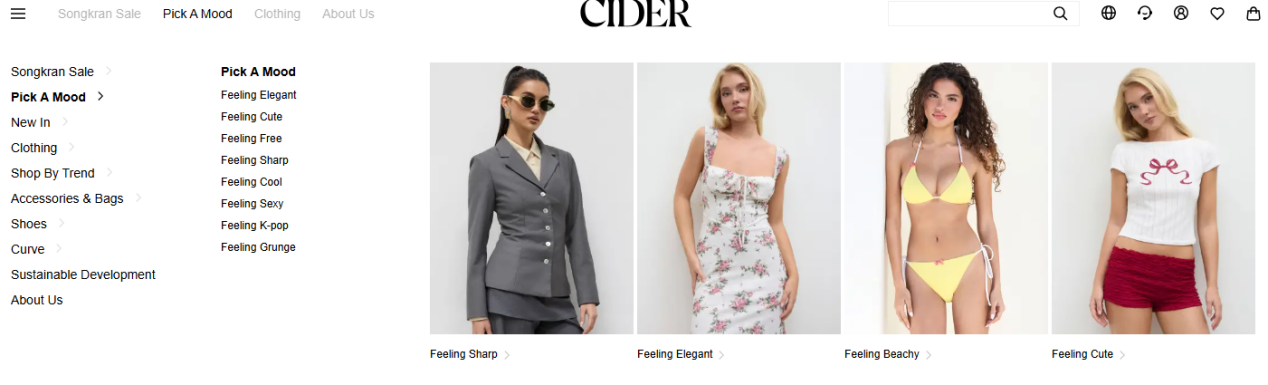

On its overseas independent site, Cider continues its Gen Z style, allowing users to filter by scenarios such as “date outfits” or “music festival looks,” and even select products based on mood.

This classification method, which caters to young people’s personalized needs, naturally attracts user participation and interaction, helping to enhance user identification with the brand.

Image source: Cider independent site

According to third-party data, Cider’s overseas independent site has exceeded 22.2 million total visits, with direct traffic accounting for 44.06%. This reflects the brand’s established position in users’ minds, as many consumers can recall and visit directly, bringing stable traffic to the brand.

Image source: similarweb

Traditional Giants Contract, Gen Z Demand Reshapes the Market

Of course, beyond successful social media operations, Cider’s rise also benefits from the current market environment and its precise market positioning.

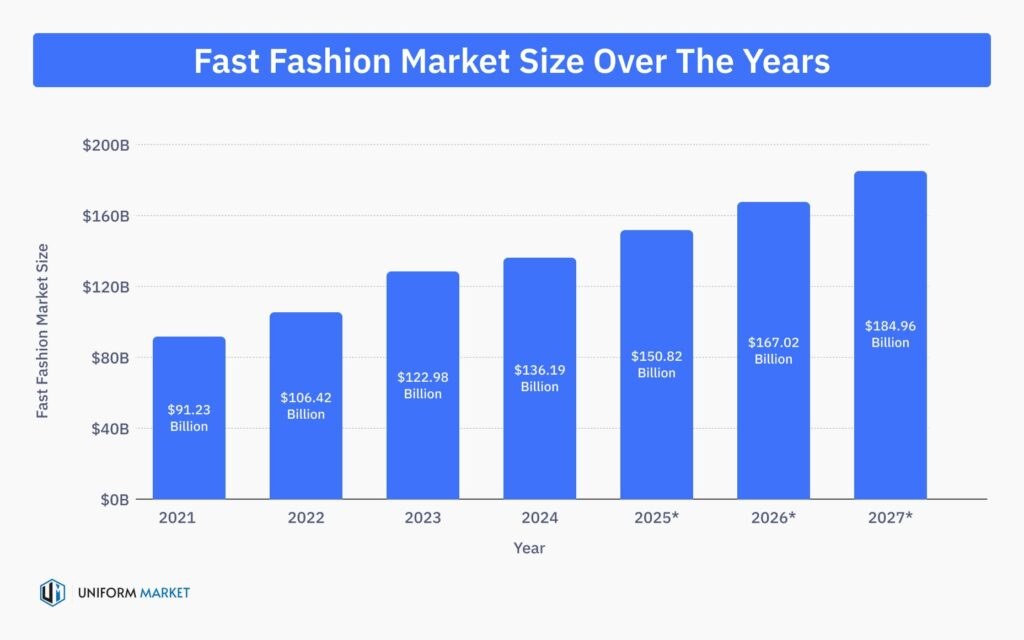

Data shows that in 2024, the global fast fashion market size reached $136.19 billion. At this time, traditional leading brands are strategically contracting, while emerging brands are rising at the right moment.

Take traditional brand Inditex (ZARA’s parent company) as an example: in 2024, it closed 1,831 offline stores on a large scale. Although the “store closure and cost-saving” strategy raised its gross margin to 57%, revenue growth still fell significantly short of market expectations.

This conservative strategy of “contracting to preserve profits” is essentially a passive choice by traditional fast fashion giants in the face of e-commerce impact and generational shifts in consumption. But it has precisely opened up market space for emerging brands like Cider, making its rapid rise understandable.

Image source: uniformmarket

The Next Stop for Chinese Brands Going Global

When people marvel at Cider’s growth rate, they should also see the industrial logic behind it: globalization is no longer a simple combination of “cheap manufacturing + traffic dividends.”

Currently, Southeast Asia’s e-commerce growth rate is three times that of North America, Latin America’s demand for personalized apparel is growing by 21% annually, and Gen Z in Europe and America is 45% more willing to pay for sustainable fashion. None of these tracks have a true monopoly yet.

For Chinese companies, this means the market opportunity is still huge. Rather than fighting price wars with established companies, it’s better to seek a differentiated path in overseas markets and carve out a “reserved territory” for themselves.

(Note: All information in this article comes from public reports and platform data; actual circumstances are subject to official information.)