As the year-end shopping season approaches, the e-commerce platform Amazon has once again made significant policy adjustments, especially the launch of the "refund only" policy, which has attracted widespread attention.

Meanwhile, as sellers respond to these new policies, they are also beginning to consider the possibilities of other platforms, with TikTok gradually becoming a new blue ocean for cross-border e-commerce.

The Challenges of Amazon's "Refund Only" Policy

On September 12,Amazon announced the launch of the FBA refund without return solution at its US site, meaning that consumers can receive a refund without returning the product when making a return. This new policy aims to give sellers more flexibility in returns during the peak season, especially for product types with high logistics costs and complex return processes.

However, although this policy seems to ease the pressure on sellers to handle returns, it has also caused concerns for some sellers.

Many sellers believe that"refund only" will allow some malicious consumers to take advantage of the policy by requesting refunds without returning goods, especially for categories that already have high return rates, increasing the risks faced by sellers.

In addition, this policy is only open to specific types of products; hazardous goods, gift cards, and high-value items are not included, so sellers need to weigh whether to enable this feature themselves.

Amazon's original intention is to optimize the customer experience and enhance shopping convenience, but during implementation, how to effectively prevent abuse of this policy remains an issue that sellers need to consider. As the peak season approaches, many sellers not only have to cope with fierce market competition but also need to reasonably assess the impact of Amazon's policies.

US Holiday Season Sales Expectations Decline, Sellers Need to Find More Ways Out

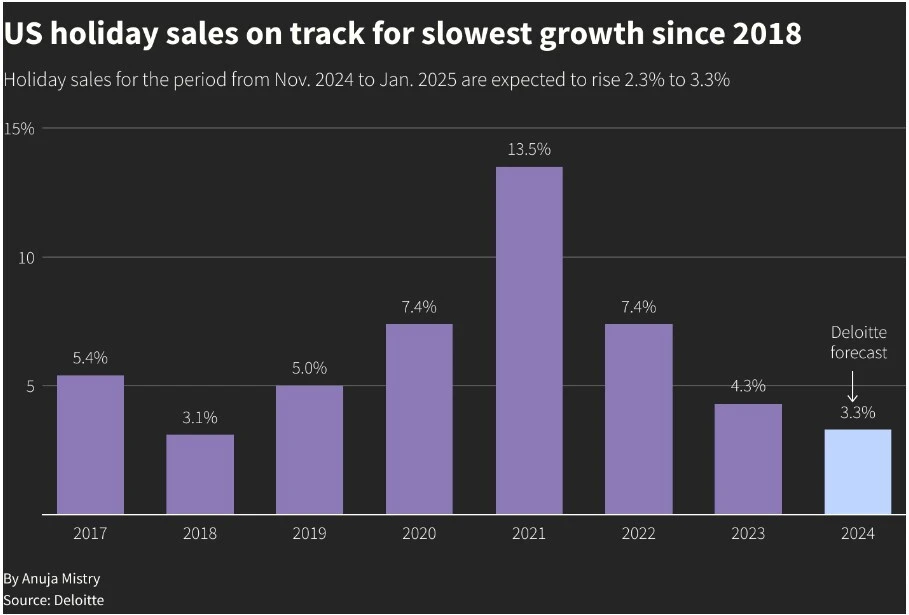

Although Amazon's "refund only" policy provides sellers with more options, the holiday season sales outlook is not optimistic. According to Deloitte's latest report, US holiday retail sales growth in 2024 is expected to be 2.3%-3.3%, much lower than last year's 4.3%. This expectation reflects the impact of inflation on consumers' purchasing power, with declining savings and rising living costs making consumers more cautious in holiday shopping.

Although e-commerce sales remain strong, competition on traditional e-commerce platforms is becoming increasingly fierce, and advertising costs continue to rise. This puts many sellers under double pressure: on the one hand, they need to seize the holiday sales market, and on the other hand, they must deal with changes in policies and platform rules. In the face of such a situation, many sellers are beginning to seek opportunities on other platforms to diversify risks and seek new breakthroughs.

US holiday season sales expectations decline, image source: Deloitte

Switching to TikTok: A New Blue Ocean for Cross-Border Sellers

As competition on traditional e-commerce platforms such as Amazon becomes increasingly intense, TikTok, as a representative of social e-commerce, is becoming a new choice for cross-border sellers. With its unique model of short videos and live streaming sales, it has attracted a large number of young consumers, providing brands with a brand new way to reach them.

Compared to Amazon's rigorous e-commerce model, TikTok's content-driven and interactive experience makes the connection between sellers and consumers more direct.

Moreover, TikTok Shop is also continuously expanding its global market. Recently, TikTok announced that it will officially enter the Spanish market in December 2024, further strengthening its e-commerce presence in Europe.

Unlike Amazon, TikTok's recommendation algorithm accurately pushes content based on user behavior, enabling brands to find their target audience more quickly and shorten conversion times.

On TikTok, consumers are not just seeing product images or text descriptions, but intuitively understanding products through creative short videos, live streaming, and other forms. This highly interactive model not only reduces consumers' decision-making costs but also increases brand exposure and influence.

Finding Balance in Multi-Platform Deployment

For cross-border sellers, deploying on traditional e-commerce platforms such as Amazon is certainly important, but the risks of relying on a single platform cannot be ignored. Especially in the context of frequent policy adjustments, sellers need more diversified channels to spread risks and ensure continuous business growth.

The rise of TikTok has given sellers a new direction for thinking: how to enhance brand influence and sales through content-driven social platforms to achieve new growth.

In summary, whether coping with policy changes on Amazon or seeking new sales growth points on TikTok, sellers need to adjust their strategies more flexibly. As the peak season approaches, closely monitor the policy trends of each platform, optimize their own operations in a timely manner, and find new opportunities in the midst of change.