In recent years, as global e-commerce competition has become increasingly fierce, Alibaba has been seeking breakthroughs in new markets, especially in overseas markets. The success of the Chinese e-commerce giant Taobao in the domestic market is well known, but as the domestic market gradually becomes saturated, Alibaba has begun to accelerate its pace of global expansion.

Japan, as an important part of the global e-commerce market, is obviously a target that cannot be ignored.

Recently, Alibaba officially launched TAO—a dedicated e-commerce platform tailored for Japanese consumers.

So, can this "Japanese version of Taobao" gain a foothold in the Japanese market? Can its localization adjustments successfully break through local consumption habits? This article will take you to explore the current situation and future of TAO.

Image source: Internet

TAO: Alibaba's "Japan Plan"

On the surface, the launch of the TAO platform seems like a "copy" of Taobao, but in fact, it has undergone a lot of localization adjustments. First of all, TAO's appearance is more concise than Taobao, and the interface style leans towards the aesthetics of Japanese consumers, better meeting the needs of the Japanese market. Behind this simplified design is Alibaba's in-depth research into the Japanese market: Japanese consumers generally prefer simple and fresh interface designs, and Taobao's complex and diverse style is clearly not in line with this market's taste.

TAO's category settings are also different from Taobao. Although it still revolves around daily consumer goods such as clothing, home, and office supplies, it pays more attention to refinement and localization. The products on TAO have a stronger sense of design, highlighting Japanese-style delicacy and practicality. This is also one of Alibaba's global market strategies—to win the market with products that fit local culture and aesthetics.

New user exclusive campaign just launched Image source: TAO

Merchant Resources: From Taobao to TAO

In terms of merchant resources, most of TAO's sellers actually come from the Taobao and Tmall platforms.

This means that most of the products on TAO are still shipped from China. Unlike traditional cross-border e-commerce platforms, TAO intentionally brings Chinese products into the Japanese market in a more localized form. This "from China to Japan" model, while leveraging Alibaba's vast product resources, also faces the challenge of how to ensure product quality and after-sales service. Especially the most common issue in cross-border e-commerce—returns and exchanges—TAO clearly needs to pay more attention to.

Product page Image source: TAO

Logistics and Payment: Adapting to Japanese Consumer Habits

In order to better adapt to the Japanese market, TAO has made many adjustments in logistics and payment methods.

First, TAO offers a free shipping policy for new users—the first order is free of shipping charges, and subsequent orders require a purchase of over 3,500 yen to enjoy free shipping.

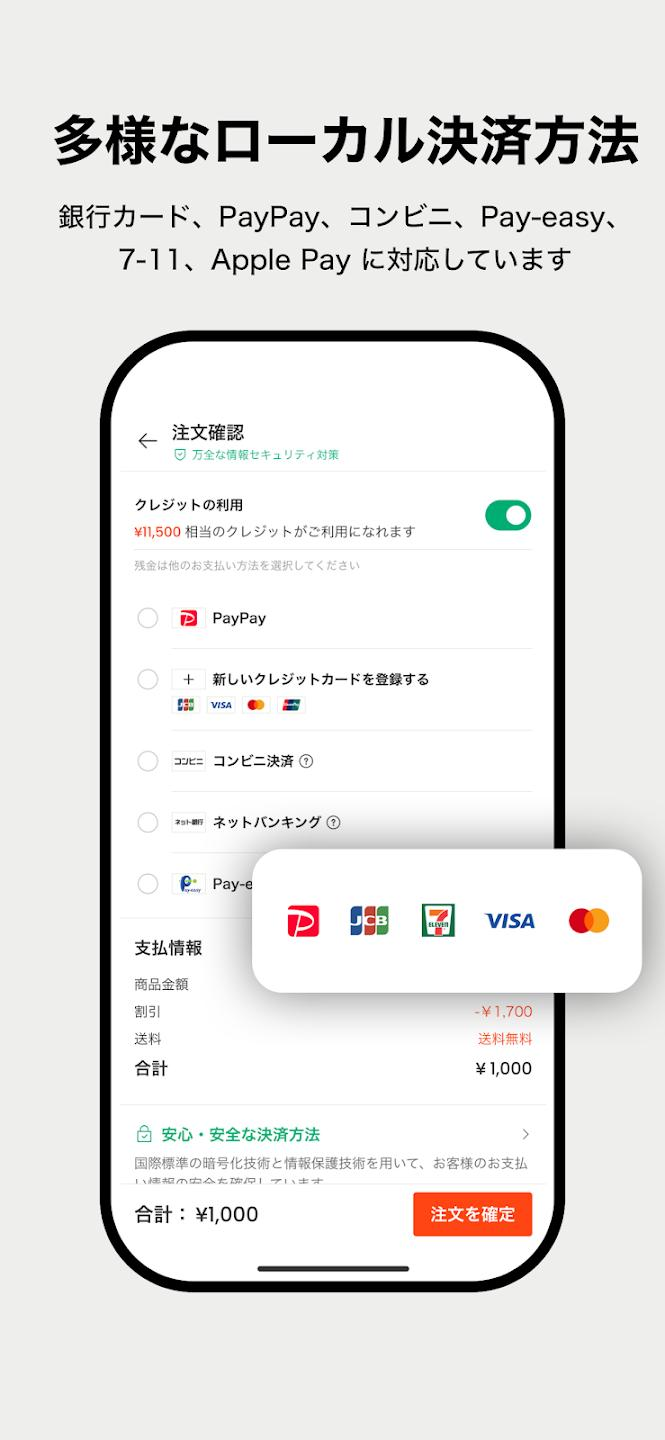

In addition, TAO's payment methods are also in line with Japanese consumers' payment habits, supporting a variety of payment methods such as credit cards, PayPay, and convenience store payments. This is undoubtedly one of Alibaba's key strategies in entering the Japanese market, as Japanese consumers have high requirements for the variety and convenience of payment methods.

Diverse payment methods Image source: TAO

Return and Exchange Services: Challenges and Opportunities

In addition, TAO has also made localized adjustments to its return and exchange policies.

The platform allows purchased products to be returned for free within 40 days, which is undoubtedly an attractive policy for Japanese consumers. Japan is a market that values service and consumer rights protection, and a sound after-sales service is key to winning market trust.

However, one of the biggest pain points in cross-border e-commerce is logistics, especially the handling of returns and exchanges. Although TAO provides a relatively complete return and exchange policy, in practice, the complexity and high cost of cross-border returns may pose considerable challenges for the platform. How to optimize the efficiency and cost of cross-border logistics while ensuring user experience will be a major challenge for TAO.

Free returns within 40 days Image source: TAO

Alibaba's "Localization" Path: How to Respond to the Particularities of the Japanese Market?

Although TAO has already made a lot of localization adjustments, the particularities of the Japanese market remain one of the biggest challenges Alibaba faces.

Japanese consumers have unique consumption culture and habits. They pay more attention to product quality, design, and brand reputation. Therefore, in addition to relying on Chinese product resources, TAO also needs to strengthen brand building and enhance consumers' awareness and trust in the platform.

In addition, competition in the Japanese e-commerce market is very fierce, with local platforms such as Rakuten and Yahoo Japan already having a strong market foundation. For TAO to stand out among these platforms, it not only needs to rely on Alibaba's global supply chain advantages, but also needs to continuously improve in user experience, product quality, and after-sales service, building an e-commerce platform that can compete with local rivals.

Image source: Internet

Can Alibaba Replicate Taobao's Success in the Japanese Market?

At present, TAO is still in its early stages of development. The platform's user base and market response are relatively stable, but whether it can achieve rapid growth like Taobao in China remains to be seen. Although the Japanese e-commerce market has huge potential, competition is also extremely fierce. TAO's success does not only depend on Alibaba's successful experience in the Chinese market, but also requires further deepening and improvement of localized operations.

By entering the Japanese market through TAO, Alibaba clearly hopes to replicate its successful model in China, using its vast product inventory and mature supply chain system to quickly seize market share. However, whether it can successfully replicate Taobao's success still requires the platform to make more flexible adjustments and responses when facing challenges such as local consumption culture, user experience, and service innovation.