Recently, the results of a survey conducted by the online shopping rewards app Smarty have attracted a lot of attention.

The survey shows that nearly half of American consumers say they plan to reduce their purchases, while 40% of consumers intend to choose cheaper brands.

This news instantly exposed the consumption attitude of American consumers. People are becoming more and more budget-conscious and seem to be less willing to spend freely.

So, what exactly has happened to make Americans so cautious?

Consumers will reduce shopping Source: newsbreak

Tariffs keep changing

The origin of the matter starts with the U.S. tariff policy.

A few months ago, Trump announced the cancellation of the $800 tax exemption policy, which means that small parcels imported from abroad will be taxed, and the prices of goods will rise accordingly.

This change directly poured cold water on the U.S. consumer market, causing many businesses and consumers to panic.

However, Trump’s tariff policy is not a one-off decision. Just as everyone was getting used to the policy change, Trump issued a new directive to temporarily suspend the taxation of small parcels. Such changes are like a roller coaster—no one knows what will happen next, so shopping plans naturally become chaotic.

As a result, many people chose to reduce their purchases, especially big-ticket items such as cars, home appliances, and furniture. Consumers would rather postpone their purchases or simply not buy, waiting to see if prices will be lower in the future.

Trump announces suspension of taxation on small parcels Source: BBC

Budgeting becomes the new normal

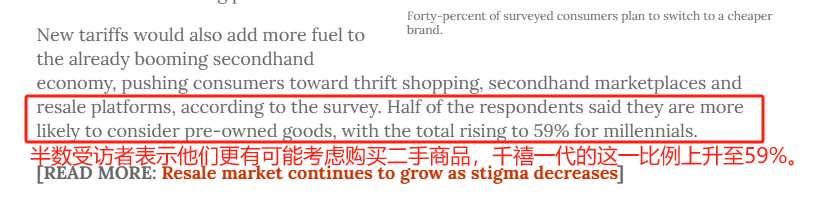

Due to rising prices, more and more American consumers are turning to second-hand goods. Smarty’s survey shows that about half of respondents said they are more willing to consider buying second-hand items, especially among millennials, where the proportion reached 59%. This trend is not just a short-term phenomenon. Data also shows that the U.S. second-hand market is growing rapidly, and by 2024, spending in the resale market is expected to surpass traditional retail.

Americans are more willing to consider buying second-hand goods Source: chainstoreage

This is actually a warning for businesses—the second-hand market is becoming a consumer trend that cannot be ignored in the future. Especially among young people, second-hand goods are no longer seen as “inferior products,” but rather as a “smart” choice. People can not only save money but also be more environmentally friendly, so why not?

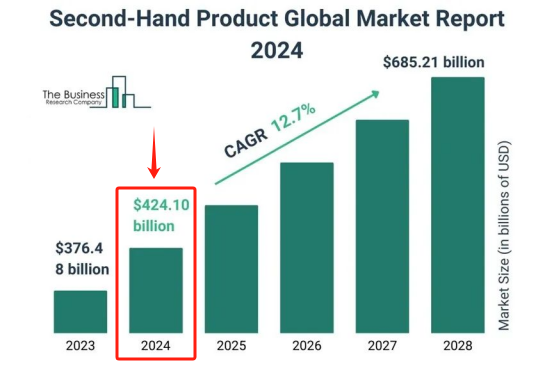

It’s not just the U.S.; the global second-hand market is also accelerating. According to The Business Research Company, by 2024, the global second-hand market will reach $424.1 billion, and the growth rate in the coming years will be even more astonishing, with a compound annual growth rate of 12.7%. This is a huge market that cannot be ignored.

The second-hand market is growing rapidly Source: The Business Research Company

Big-ticket consumption slows down, how should brands respond?

Although many Americans are turning to second-hand goods, big-ticket consumption still exists.

The problem is that consumers are now less interested in big-ticket items, and postponing purchases has become common.

Therefore, for businesses to attract these consumers, they must flexibly adjust their strategies. For example, offering more discounts, installment payments, and other methods to lower the psychological threshold for purchases and encourage consumers to place orders sooner. At the same time, facing unstable tariff conditions, businesses also need to localize their operations to reduce the cost pressure brought by tariffs.

Source: Internet

Major changes in consumption trends—where do we go from here?

At present, tariff fluctuations have made American consumers more cautious, and consumption habits are quietly changing.

So, in the face of such challenges, can businesses seize the opportunity in this wave of change?

The answer is yes. As long as businesses can keenly capture consumption trends and flexibly adjust their strategies, whether it’s localizing operations or embracing the second-hand market, they can stand firm in this consumer revolution.

In this tariff storm, who can break the traditional retail framework and lead a new wave of consumption?

Let’s wait and see!