Under the performance pressure of "profitability race," Shopee is actively seeking new profit growth points, and raising the seller commission structure has become one of its key measures to increase revenue and reduce expenditure. Recently, Shopee issued a notice announcing adjustments to the commission rates for cross-border direct mail stores and third-party warehouse stores on the Malaysia and Singapore sites, with an overall focus on increasing rates.

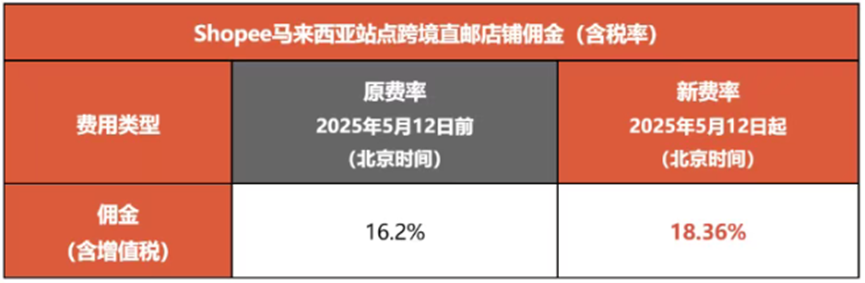

At the Malaysia site, the commission rate for cross-border direct mail stores has risen sharply from 16.2% to 18.36%, an increase of 2.16 percentage points; the commission rate including VAT for third-party warehouse related orders has increased by up to nearly 5 percentage points.

Commission increase for Malaysia cross-border direct mail stores. Image source: Cross-border Southeast Asia

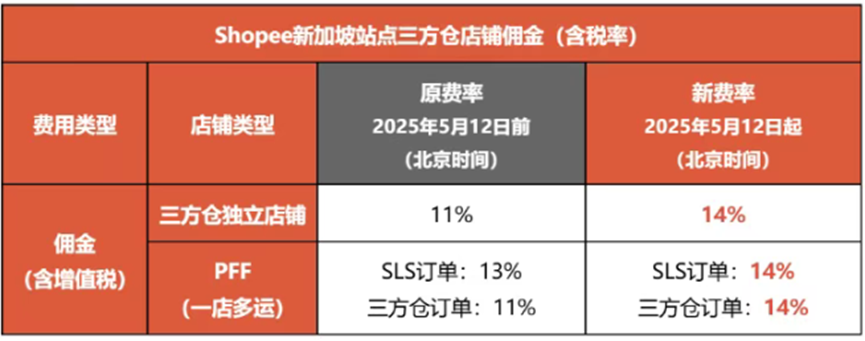

In contrast, the adjustment range for the Singapore site is relatively small. The commission rate for cross-border direct mail stores has been raised by 1 percentage point to 14%; the commission rate for third-party warehouse stores has been uniformly raised to 14%, an increase of 1 to 3 percentage points.

Commission changes for Singapore site third-party warehouse stores. Image source: Cross-border Southeast Asia

It is particularly important to note that this rate adjustment only applies to orders generated after May 12, 2025. Therefore, sellers need to pay close attention to this change and adjust order prices in a timely manner to cope with the impact of the commission rate adjustment and ensure the smooth development of their business.

Sellers Face Mounting Pressure

The increase in Shopee commissions has undoubtedly brought tremendous pressure to sellers. In recent years, Shopee has frequently adjusted commissions, and multiple increases have already overwhelmed sellers.

In February this year, the commission rate for non-mall orders at Singapore local stores was significantly increased. Although some sellers enjoyed the minimum basic commission preferential policy, the overall burden still increased. Starting in April, most category commissions rose from 3% - 6% to 7%, and some service category fees and event surcharges were newly added, further squeezing sellers' profit margins.

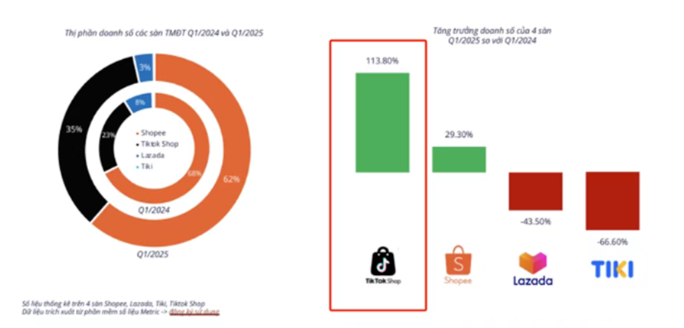

From the perspective of market competition, the strong growth of TikTok Shop in markets such as Vietnam poses a huge threat to Shopee. In the first quarter of 2025, TikTok Shop Vietnam's sales increased by nearly 113.8% year-on-year, and its market share rose from 23% to 35%. In contrast, although Shopee's sales increased by 29.3%, its market share fell from 68% to 62%. This competitive pressure is transmitted to the seller side, where they not only have to bear the cost pressure brought by commission increases, but also have to cope with the increasingly fierce logistics timeliness race.

Image source: Metric.vn

For example, Shopee's local store in the Philippines recently changed the seller's shipping days from 1 day to 0 days. The increased logistics pressure has forced sellers to re-examine and adjust their operational strategies to cope with current market challenges.

Shopee's Strategic Layout

Shopee's increase in commissions also has its underlying strategic considerations.

From the platform's own perspective, in order to continuously optimize infrastructure and services and expand profit margins, commission adjustments are a necessary means. The e-commerce market in Southeast Asia is highly competitive, and platform operating costs continue to rise. Shopee needs to maintain competitiveness and profitability through such measures.

However, this strategy also indirectly reflects the intensity of market competition. The development of competitors such as TikTok Shop has forced Shopee to take action to maintain its leading position in the market.

Image source: Google

The Seller's Path to Breakthrough

Faced with the pressure of Shopee's commission increase, sellers need to actively seek coping strategies.

First, sellers can optimize their product structure and choose products with higher profit margins for sale to offset the cost increase brought by the commission hike. Second, improve operational efficiency and reduce operating costs, such as optimizing logistics and distribution processes to reduce logistics costs. Furthermore, sellers can strengthen brand building, enhance the added value and competitiveness of their products, and attract more consumers through brand influence, thereby alleviating the pressure brought by the commission increase to a certain extent.

Image source: Google

Conclusion

Shopee's increase in seller commissions is a strategic decision under market competition pressure, but it also brings many challenges to sellers.

As a leading e-commerce platform in Southeast Asia, Shopee needs to find a balance between platform interests, seller interests, and consumer interests. Only by achieving a win-win situation for all three parties can the platform achieve long-term and stable development, sellers can continue to operate and profit on the platform, and consumers can enjoy high-quality products and services.