The U.S. retail industry is witnessing an unprecedented "tariff game." On May 17 local time, Walmart CEO Doug McMillon revealed at the quarterly earnings call that due to ongoing pressure from U.S. tariff policies on China, the retail giant may launch large-scale price adjustments in late May.

Image source: CNN Business

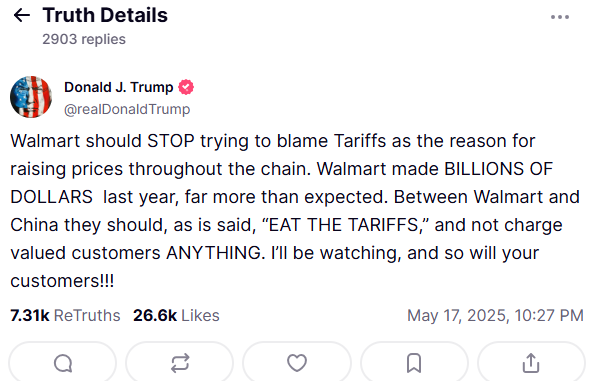

Just 12 hours after the news broke, Trump immediately posted on his social platform Truth Social, directly targeting Walmart: "You made billions last year, far exceeding expectations. Now you must swallow the tariff costs yourself—don’t even think about passing them on to consumers!"

Image source: Truth Social

Facing Trump’s pressure, Walmart unusually went public with its complaints. The financial report released on May 15 showed its net profit for the first fiscal quarter plunged 12.1% year-on-year to $4.49 billion, and revenue grew 2.5% to $165.61 billion, both below market expectations.

In fact, Walmart has changed its stance multiple times in the tariff game. In early April, when U.S. tariffs on China soared to 145%, Walmart once demanded Chinese suppliers cut prices by 10% to share the costs, but was forced to compromise due to supply chain disruption risks, eventually resuming orders and promising to bear the tariffs itself.

Even so, the landed cost of a string of Chinese-made LED lights still soared from $9.9 to $26.3, and the retail price was forced up to $28.5. CFO John David Rainey bluntly stated: "Even if tariffs are lowered, the special tariffs imposed on Chinese goods remain unbearable for us."

Image source: CCTV News

Walmart’s predicament is just the tip of the iceberg. As early as April, Florida toy brand Basic Fun announced it would suspend imports of hot-selling products such as Tonka trucks from China.

Its CEO Jay Foreman revealed that tariffs have significantly increased the overall cost of products. "If the policy continues, these classic toys may disappear from the U.S. market."

Image source: brandequity

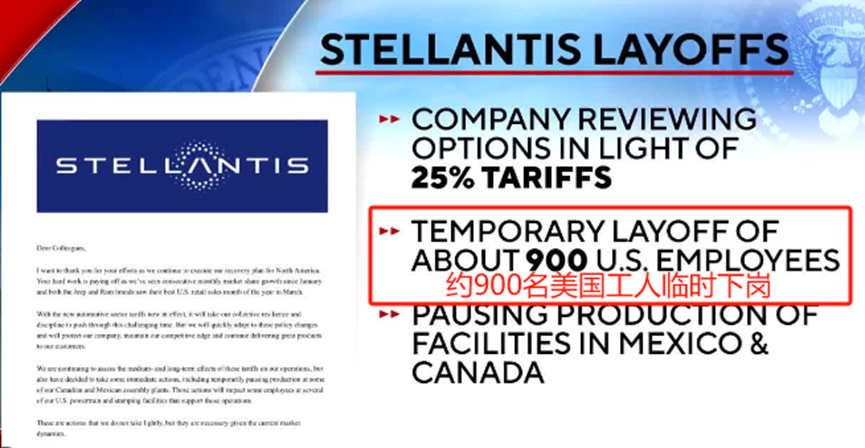

A more severe chain reaction is emerging on the manufacturing side. Multinational automaker Stellantis announced on May 8 that, due to surging tariffs on parts, its five factories in Michigan would temporarily lay off 900 workers. The sportswear sector is also on edge—Nike, Adidas, and Lululemon’s Q1 2024 financial reports show their China procurement orders dropped by 19%, 24%, and 31% year-on-year, respectively.

Image source: YouTube

The shadow of supply chain disruption has made retailers extremely anxious. During the suspension of shipments by Chinese suppliers, the vacancy rate on U.S. supermarket shelves once reached 30%, and the number of Chinese cargo ships at the Port of Los Angeles dropped by 33%. Walmart’s CEO even warned that if supply cannot be restored within two weeks, soaring prices could impact the midterm election results.

Although the "China-U.S. Geneva Economic and Trade Talks" on May 12 led the U.S. to withdraw 91% of tariffs on China and reduced international mail tax rates from 120% to 54%, the repeated policy changes have already severely damaged businesses. Amazon’s leading outdoor brand Solo Brands, which relied on Chinese manufacturing, delisted directly under tariff pressure, becoming a casualty of this "trade war."

Image source: Businesswire

It is clear that the U.S. government has been pushing for manufacturing to return home, but reality is harsh. A toy factory in New Jersey tried to use 3D printing to replace the Chinese supply chain, but the product pass rate was only 37%; the pass rate for Vietnamese factories dropped by 8%, and India can only meet 15% of Walmart’s demand for holiday goods. In fiscal year 2025, Walmart’s purchases from China will reach $30 billion, accounting for 40% of its global supply chain, especially in the affordable apparel and home goods sectors, which are almost irreplaceable.

The 72-hour sample response speed of Chinese suppliers makes it even harder for U.S. retailers to give them up.

Image source: Internet

This game proves the limitations of unilateral tariffs... When political slogans collide with economic reality, even Walmart has to bow to the Chinese supply chain. However, temporary compromise cannot solve the problem. If the U.S. does not abandon its containment strategy, the supply chain crisis may recur periodically. For ordinary consumers, the bill for this "tariff war" has already quietly slipped into their shopping carts.