As global e-commerce platforms fiercely compete in the Brazilian market, Southeast Asian e-commerce giant Shopee has once again unveiled a "big move." Recently, this platform, renowned for its "rocket delivery," announced the construction of a new logistics center in Porto Velho, the capital of Roraima state in northern Brazil. This marks the platform's 12th logistics hub in Brazil and its 7th major logistics node in the South American market in 2024.

Image source: e-commercebrasil

The choice of Porto Velho is no coincidence—this border city, adjacent to Venezuela and Guyana, is known as the "Gateway to the Amazon." Data shows that in 2023, Roraima state's e-commerce growth rate reached 18%, far exceeding the national average in Brazil.

The newly built logistics center will directly serve a population of 1.5 million within a 300-kilometer radius. By optimizing the trunk transportation network, it is expected to shorten the average local delivery time from 7-10 days to 3-5 days. For cross-border sellers, this means products can reach consumers in Brazil's northernmost region more quickly, which is especially beneficial for popular local categories such as home goods and 3C electronics.

Image source: Internet

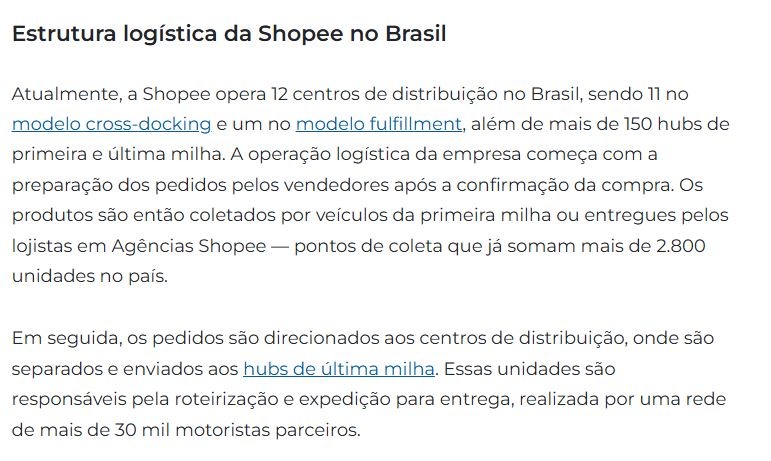

Since entering the Brazilian market in 2019, Shopee's logistics layout has been a "textbook-style" expansion: in 2022, five new distribution centers were added to cover core cities; in 2023, the focus shifted to the northeast market, with hubs established in Recife and Salvador; in 2024, the strategic focus turned inland, with network deployment completed in six states including Minas Gerais and Bahia within half a year.

Currently, its logistics system has formed a three-dimensional network of "12 core hubs + 150 terminal sites," supported by a delivery team of over 20,000 partner drivers, with daily parcel processing volume exceeding 800,000 items.

Image source: e-commercebrasil

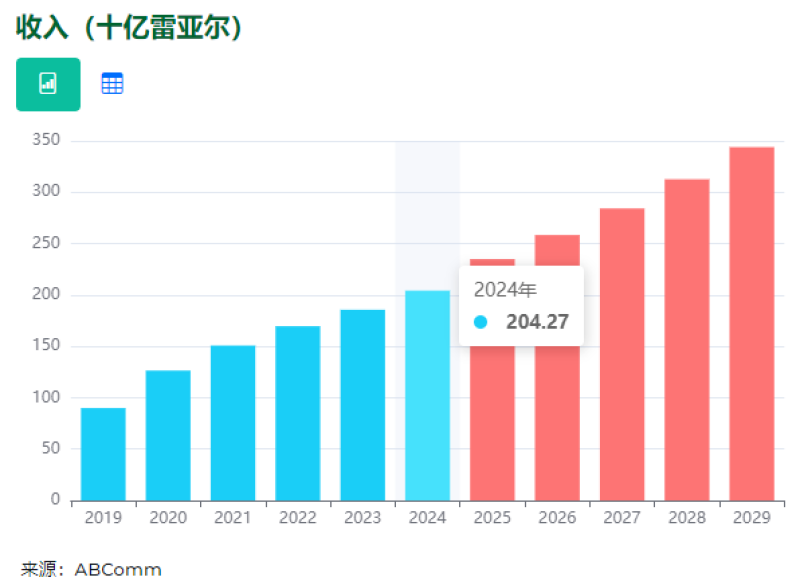

Behind this infrastructure boom is the continuous release of "golden signals" from the Brazilian e-commerce market. According to the latest report from the Brazilian E-Commerce Association (ABComm), in 2024, the country's e-commerce transaction volume exceeded 204.2 billion reais (about $36.2 billion), a year-on-year increase of 10.5%, setting a record of 414.9 million transactions. More notably, among 91.3 million online shopping users, 68% have tried cross-border shopping, with an average spend per order of 492.4 reais (about $87). These figures make Brazil one of the fastest-growing cross-border e-commerce markets in the world.

Image source: ABComm

Faced with this tempting cake, the arms race among e-commerce giants has already reached a fever pitch. Latin American local leader Mercado Libre announced in April this year an additional investment of 34 billion reais (about $6 billion), planning to build 11 new distribution centers by 2025. Its automated warehousing center in São Paulo has already achieved "same-day delivery" service.

Amazon, relying on its Prime membership system, has expanded the SKU count at its Brazil site to 80 million and launched localized strategies such as a "free shipping monthly card." Even AliExpress is experimenting with a "cross-border + local" hybrid warehouse model in Rio de Janeiro, pre-storing some hot-selling products to compress delivery times to 72 hours.

Image source: Exame

In this logistics infrastructure race, Shopee's strategy shows unique advantages. Its "cross-docking delivery + integrated logistics center" model enables rapid distribution of goods through 11 cross-docking centers, while the Manaus integrated logistics center handles bulk commodities. More importantly, the platform opens its logistics capabilities to small and medium-sized sellers—local merchants only need to deliver goods to the nearest "first mile" site, with subsequent warehousing, sorting, and delivery all handled by the platform. This asset-light operation model led to a 240% surge in the number of local sellers on Shopee Brazil in 2023, with over 500,000 small and medium-sized merchants now onboard.

Image source: Internet

As the Brazilian government launches the "Digital Highway Plan," investing 8.9 billion reais over the next three years to improve network coverage in remote areas, this South American e-commerce feast may just be beginning. For Chinese sellers, partnering with platforms with mature logistics networks may help reduce operational risks while seizing the growth dividends of this market with 130 million internet users.