Faced with skyrocketing product prices caused by import tariffs, young American consumers are setting off a strong wave of second-hand shopping. This trend is not only reshaping domestic consumption habits, but also triggering a chain reaction globally.

Image source: Internet

USA: Price and Environmental Protection Drive Second-hand Consumption

Under the influence of fluctuating tariff policies, prices of imported furniture, electronics, appliances, and other goods have soared. In order to cope with rising prices and seek more affordable shopping options, a large number of American Millennials and Gen Z consumers have turned their attention to the second-hand market.

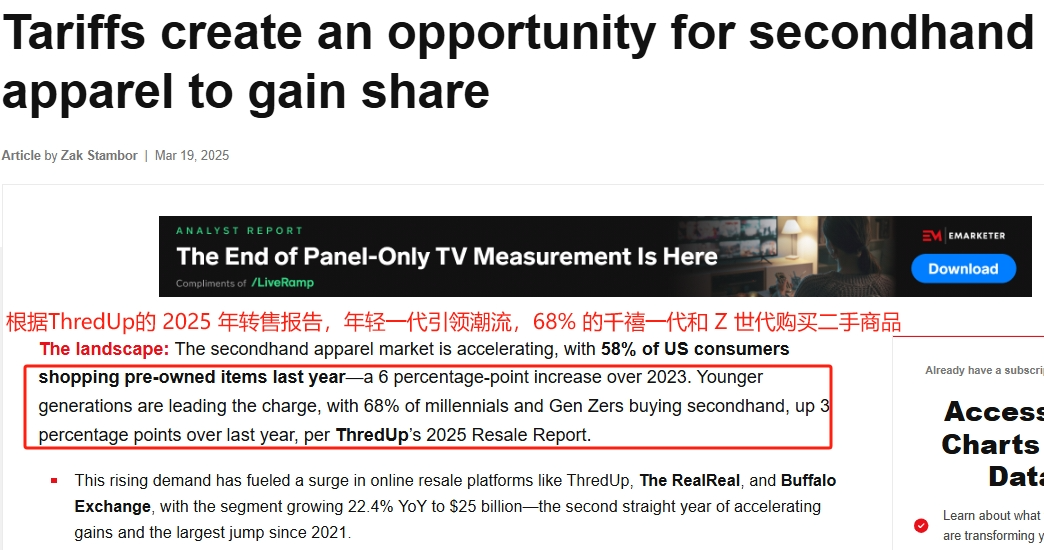

ThredUp's latest "2025 Resale Report" clearly reveals this shift: as many as 68% of American Gen Z and Millennial consumers are buying second-hand goods, an increase of 3 percentage points over last year. In addition to price pressure, the younger generation, who grew up in an era of rising environmental awareness, has a stronger sense of identity with sustainable consumption. Buying second-hand goods has also become an important way for them to practice environmental protection concepts.

Image source: emarketer

Second-hand Clothing: Rapid Market Growth and Broad Prospects

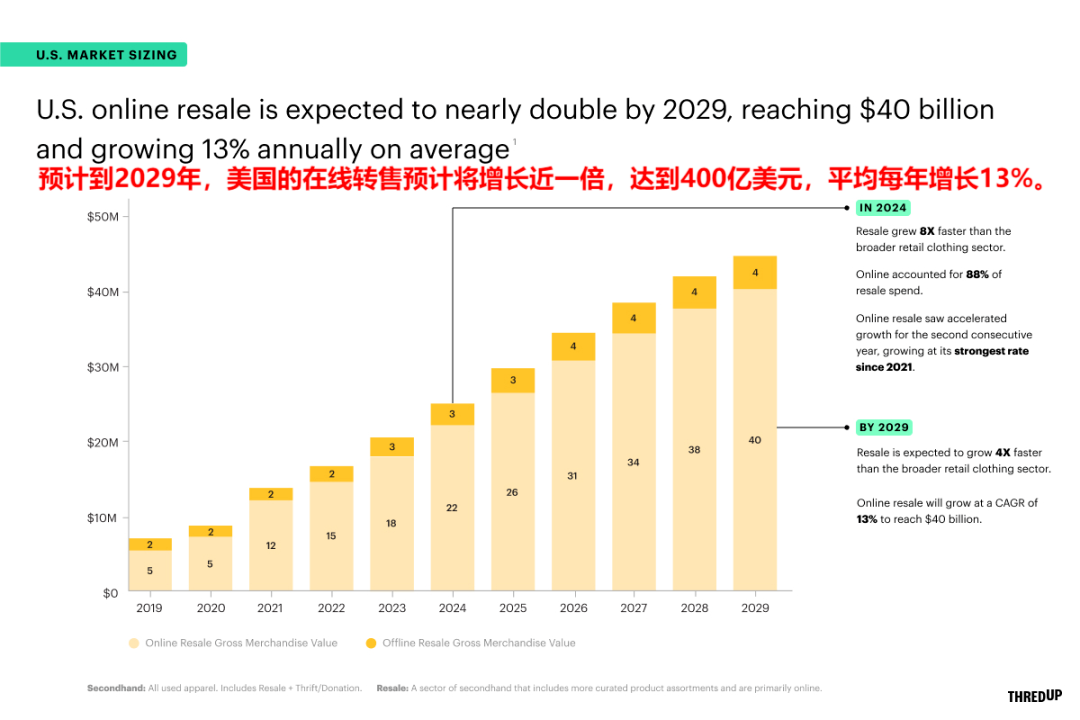

Among the many categories of second-hand goods, clothing stands out in particular. Its significant price advantage makes it an ideal choice for young consumers with limited budgets to meet their fashion needs. According to ThredUp data, in 2024, the US second-hand clothing market has seen its strongest growth since 2021, with a growth rate five times that of the overall retail apparel market. Among them, the online second-hand clothing market performed brilliantly, with a scale increase of up to 23% and a market value of $22 billion.

Looking ahead, the growth momentum remains strong. The report predicts that, following the current trend, the market value of US online second-hand clothing will further rise to $26 billion in 2025. In the longer term, the market size is expected to nearly double in the next five years, reaching about $40 billion by 2029.

Image source: businesswire

Global Resonance: The Second-hand Consumption Boom Sweeps Multiple Countries

This second-hand consumption boom led by young American consumers is by no means an isolated case; it is flourishing in many major e-commerce markets around the world.

Global scale forecasts are astonishing: Research data from Transparency Market Research indicates that the global second-hand resale market is expected to continue expanding from 2023 to 2031, eventually reaching an astonishing $1.3 trillion. During this period, its compound annual growth rate is expected to reach as high as 13.6%, demonstrating enormous development potential.

Image source: globenewsire

German market doubles steadily: Since 2019, sales in the German second-hand e-commerce market have almost doubled. According to a report released by the German Retail Association (HDE), in 2024, German second-hand e-commerce sales reached 9.9 billion euros, a 7.2% increase over the previous year.

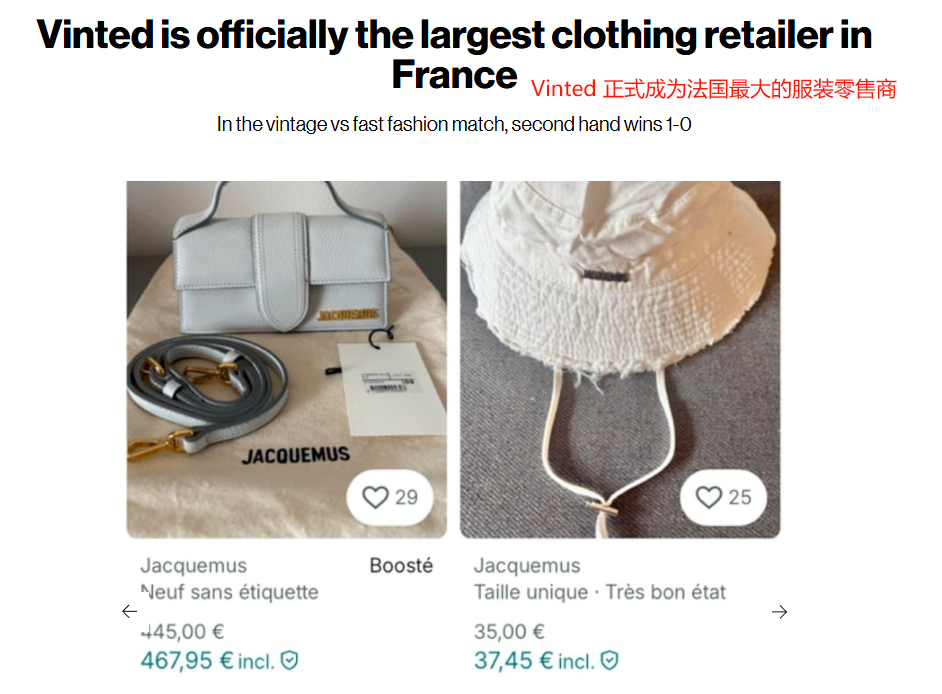

French market heats up: The resale business in the French market is also booming. According to an IFM report, in the first quarter of this year, second-hand clothing accounted for 10.9% of sales in France. Young people are the main force, contributing as much as 16.3% of the market share. Notably, in the first quarter of this year, platform Vinted's clothing sales have surpassed e-commerce giant Amazon and local omnichannel retailer Kiabi, rising to number one in France.

Image source: nss magazine

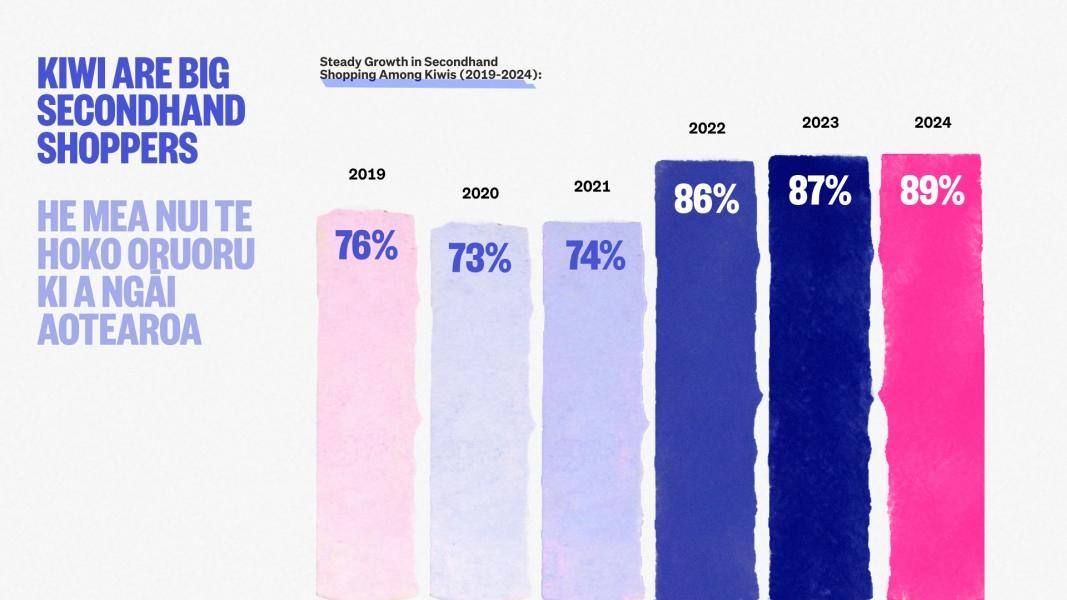

Circular economy deeply rooted in New Zealand: In New Zealand, the circular economy model is widely welcomed. A report released by Trade Me reveals that the total value of New Zealand's second-hand market has reached $5.5 billion, with each household owning an average of 20 second-hand items. Clothing, footwear, accessories, and home and lifestyle products are the most popular sales categories. Data shows that in the past six months, nearly 90% of New Zealanders have purchased second-hand goods, and nearly 80% of respondents said they had sold at least one second-hand item, indicating that second-hand trading has become deeply integrated into the daily lives of New Zealanders.

Image source: Trade Me

Industry Insights: New Directions and New Opportunities

The trend of American young people turning to second-hand consumption due to tariff pressure provides a new development direction for the global cross-border e-commerce industry. For cross-border e-commerce platforms focused on second-hand goods trading, it is necessary to further optimize the platform service experience, strengthen product quality review processes, and provide more accurate product search and recommendation functions to better meet consumer needs. At the same time, traditional cross-border e-commerce platforms should also pay attention to the huge potential shown by the second-hand goods market and consider timely expansion of related business segments.

For the majority of sellers, this ongoing second-hand consumption boom is undoubtedly an important market signal. Sellers can adjust their product selection strategies accordingly, focusing on and increasing the supply of popular second-hand categories in the market. Judging from the current global development trend, the second-hand consumption boom driven by tariff pressure, economic considerations, and environmental awareness is expected to continue fermenting for a long time to come, profoundly changing the global consumption landscape.