On January 12, the State Council Information Office held a press conference to introduce the import and export situation for the whole year of 2023. Among them, China's total import and export value in 2023 was 41.76 trillion yuan, a year-on-year increase of 0.2%; cross-border e-commerce imports and exports reached 2.38 trillion yuan, an increase of 15.6%. The number of consumers participating in cross-border e-commerce imports has increased year by year, reaching 163 million in 2023.

All of this is sending us a signal—the global economy is beginning to recover.

In fact, looking at some changes domestically and internationally over the past two years, we can already see some clues.

First of all, Tuke is flourishing overseas, with daily active users exceeding 1.1 billion, far surpassing other overseas short video platforms. At the same time, the multi-country opening of Tuke Shop's full-chain closed loop has allowed Tuke e-commerce to enter a stage of rapid development overseas. Coupled with the new "Belt and Road Initiative" promoted by China, all these have played a certain role in boosting the global economy.

Therefore, it can be concluded that in 2024, cross-border expansion will continue to be booming and become a hot project involving the whole world.

But this also raises some questions—how should enterprises go global? Which region should they expand to?

Currently, there are many cross-border e-commerce platforms, with well-known ones including Tuke (Douyin's overseas version), Alibaba International Station, Temu (Pinduoduo's overseas version), etc., all of which can be chosen. But relatively speaking, TuKe would recommendnewcomers to choose Tuke.

Because as an overseas social media app, its audience size is more advantageous among cross-border platforms, making it easier to reach target audiences and increasing the probability of transactions.

Moreover, Tuke currently covers all major overseas countries, which can better help enterprises that want to go global.

As for regional choices, TuKe believes thatthe US region or Southeast Asian countries are both great options.

Because these regions have already opened Tuke Shop, making them very suitable for B2C enterprises to develop.

For B2B enterprises, in addition to the above regions,Brazil can be considered as a key target.

Because the number of Tuke users in Brazil ranks among the top in the world, and currently Tuke Shop has not yet opened in Brazil. This means that B2B enterprises can use Tuke to reach Brazilian audiences while minimizing the "interference" from e-commerce audiences, thus acquiring customers more precisely.

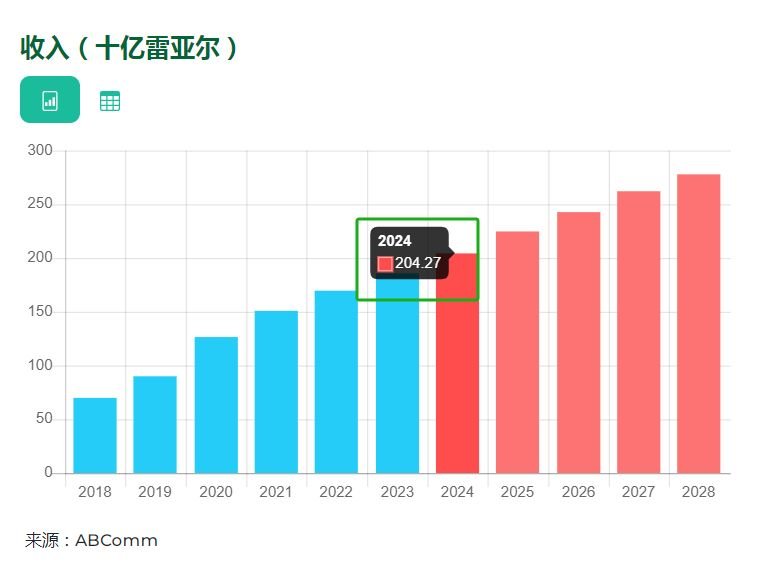

In addition, the Brazilian E-Commerce Association (ABComm) recently released news that Brazil's e-commerce market is expected to maintain steady growth in the coming years. By 2024, e-commerce revenue may reach 204.27 billion reais (US$41.94 billion), an increase of about 10% compared to the sales forecast for 2023.

This is undoubtedly a very positive signal for cross-border enterprises focused on B2B business.

Why?

Because the continued growth of Brazil's e-commerce will drive local distributors to seek more sources of goods, making it easier for these cross-border B2B manufacturers to enter the "field of vision" of local distributors. With timely operations and traffic generation, the probability of enterprise inquiries will also greatly increase.

Moreover, as a country ranking among the top in Tuke monthly active users, Tuke is unlikely to give up on such an e-commerce market as Brazil. There have also been reports that Brazil will open Tuke Shop, so Tuke stores will inevitably open sooner or later.

At that time, suitable B2B enterprises can also simultaneously develop B2C business, enhancing their own competitiveness and benefiting enterprise development.

In 2024, rather than waiting for opportunities domestically, it is better to prepare in advance.