As global markets increasingly demand localization, personalization, and innovation, going global is no longer the exclusive privilege of large enterprises. Today, many brands that once existed only as OEMs in the domestic market are expanding into international markets through social platforms and e-commerce channels.

Haers, a company that once focused on OEM production, has achieved its own "counterattack" through this approach.

Image source: Haers official website

Transformation from OEM to Independent Brand

Haers’ origins can be traced back to 1997, when founder Lv Qiang failed in the electronic scale business, losing decades of savings and owing 800,000 yuan to the bank.

At that time, 800,000 yuan was no small amount. Facing this situation, Lv Qiang could have used substandard electronic scales to pay off the debt, but he insisted on "integrity first," believing that short-term gains were not worth losing more in the long run. Therefore, he preferred to mortgage the factory and face bankruptcy rather than compromise his principles.

He then switched to making stainless steel trash cans,and with only 20,000 yuan in cash, managed to grow the company’s revenue to the million level within two years.

In 1999, Lv Qiang set his sights on the insulated cup market, believing there was significant profit potential. Moreover, as one of the world’s largest producers of stainless steel vacuum vessels, China had great opportunities in both OEM exports and domestic sales.

Thus,Zhejiang Haers Industry & Trade Co., Ltd. shifted to the stainless steel insulated cup business, focusing on OEM and ODM, and began contract manufacturing for overseas clients.

In those years, almost all well-known brands in the market relied on OEM models, such as Stanley and Yeti, and Haers was the "factory" behind these brands.

However, although this model brought stable orders and revenue, as global market competition intensified and the global supply chain landscape changed, relying solely on OEM became increasingly risky. More importantly, this model made it difficult for the company to establish an independent brand image worldwide.

In 2016, Haers decided to step out from behind the scenes and embark on the path of branding,beginning to incubate its own brands and gradually building a brand matrix through the acquisition of well-known overseas brands.

Today, Haers owns four major brands: HAERS, SIGG, SANTECO, and NONOO, covering multiple segments from mass to high-end, from sports to fashion, to meet different market demands. Through the acquisition of Swiss brand SIGG and the creation of SANTECO and NONOO, Haers has successfully expanded its global market share, achieving remarkable results especially in Europe and America.

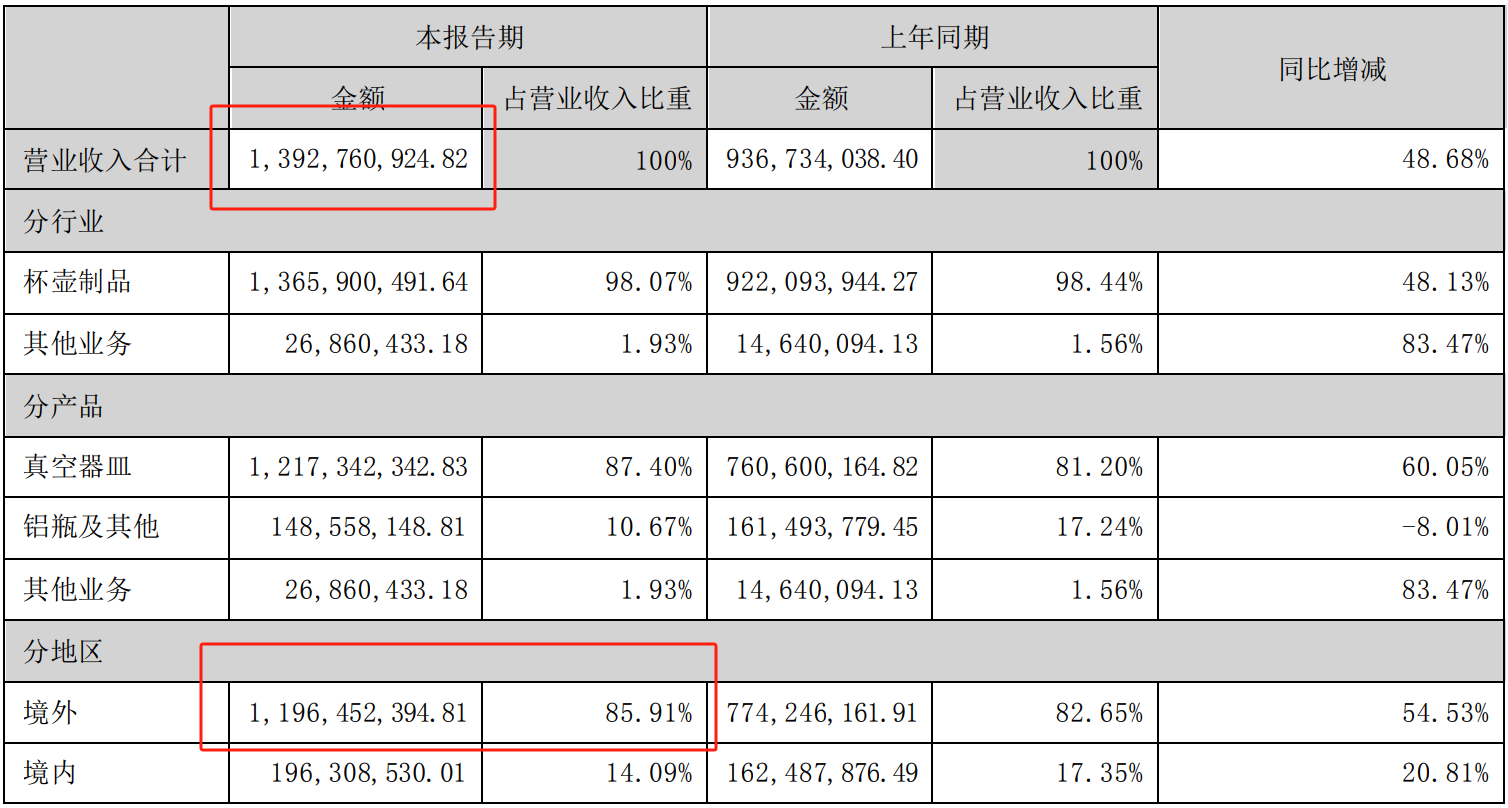

According to the latest financial report,in the first half of 2024, Haers’ total revenue reached 1.393 billion yuan, with overseas revenue of 1.196 billion yuan, accounting for 85.91% of total revenue.

Image source: Haers 2024 Semi-Annual Report

Overcoming Quality Barriers: Haers’ R&D and Innovation

Haers’ development is not only a success in branding, but also in its commitment to product quality. Since its founding, Haers has always regarded quality as the lifeblood of the company. From early incidents such as bearing a 1.3 million yuan loss for a client, to now investing tens of millions annually in R&D, Haers continues to innovate.

In 2023,Haers’ R&D investment was about 95.48 million yuan, with a total of 631 patents, covering multiple national standards and invention patents.

Especially in the development of smart products, Haers partnered with Huawei to launch a smart water cup, integrating IoT technology to achieve intelligent functions such as temperature control and drinking reminders, meeting modern consumers’ needs for a healthy lifestyle.

In terms of digital transformation, Haers is also at the forefront of the industry, adopting advanced IoT and cloud computing technologies to improve production efficiency and product quality.

Currently, Haers has established factories and R&D centers in multiple countries, not only enhancing local production capabilities but also better adapting to the needs of different markets. This highly internationalized layout enables Haers to respond flexibly to market changes and strengthens its global competitiveness.

Diversified Layout: Conquering Overseas Markets

In its overseas market layout, Haers realized early on that a single sales model could not meet complex market demands. Therefore, Haers implemented adual-track B2B and B2C strategy, retaining the advantages of OEM business while actively promoting the growth of its own brands.

Through OEM/ODM cooperation, Haers has worked deeply with well-known brands such as Thermos and Tiger, combining its manufacturing strengths with these brands’ market influence to quickly build its reputation in overseas markets.

Meanwhile, Haers did not limit itself to traditional sales channels. It recognized the potential of cross-border e-commerce early on and actively joined leading global e-commerce platforms such as Amazon, Wayfair, and Walmart, further expanding its global market reach.

Through these platforms, Haers not only sells its own brand HAERS, but also rapidly increases international exposure through high-end sub-brands such as SIGG.

In terms of social media marketing, Haers is also actively involved. The company has a global presence on mainstream platforms such as Youtube, Instagram, and Facebook, continuously enhancing brand-consumer interaction through multidimensional content marketing and advertising.

In addition, Haers has embraced the trend of short video platforms, actively marketing its brand on TikTok. By collaborating with global TikTok creators, Haers not only showcases its products’ functionality and design, but also cleverly communicates its environmental philosophy and sports attributes to young consumers worldwide through short video content. Especially in Europe and America, TikTok has become one of its key channels for acquiring new customers.

Among them, Haers’ SIGG brand, with its environmental philosophy and high-end sports attributes, has successfully entered the European sports market. Leveraging partnerships with top sporting events, SIGG has further expanded its brand influence. From the French Open, Wimbledon, to the Rolex Masters, SIGG has skillfully combined sports genes with fashion elements, attracting a large number of sports enthusiasts and environmentally conscious consumers, gradually establishing a foothold in Europe.

From "Made in China" to "Chinese Brand"

Haers’ success is not just the story of a brand, but also a microcosm of the transformation of Chinese manufacturing from "OEM" to "own brand." It also provides valuable insights for small and medium-sized brands going global: in global competition, brand size is not the only determining factor; precise market positioning and flexible cross-border e-commerce layout are equally crucial.

Rather than blindly pursuing "full coverage," it is better to cultivate deeply in niche markets, creating products and brand images that meet local consumer needs. Through differentiated marketing strategies, especially precise communication on social platforms, small and medium-sized brands can also leverage the power of cross-border e-commerce to capture niche blue oceans in the global market.

"Market first, innovation as the foundation"—it is precisely this flexible, targeted strategy that helps brands break through barriers to going global and find the best path for global expansion.