Storage boxes casually picked up while shopping at IKEA, pet climbing frames snatched up in Amazon flash sales, and even the neighbor’s newly purchased patio lounge chair...

Eighty percent of these household products used daily by European and American consumers are stamped with “Made in China.”

According to data from the General Administration of Customs, from January to August 2024, China’s furniture export value reached 319.1 billion yuan, a 12.3% increase compared to the same period in 2023,which is equivalent to 1.3 billion yuan worth of furniture shipped from China to the world every day.

Interestingly, while overseas media are hotly discussing “reducing dependence on China,” Henan’s first cross-border e-commerce company—Zhiou Technology (SONGMICS HOME), has quietly expanded its business to more than 70 countries worldwide.

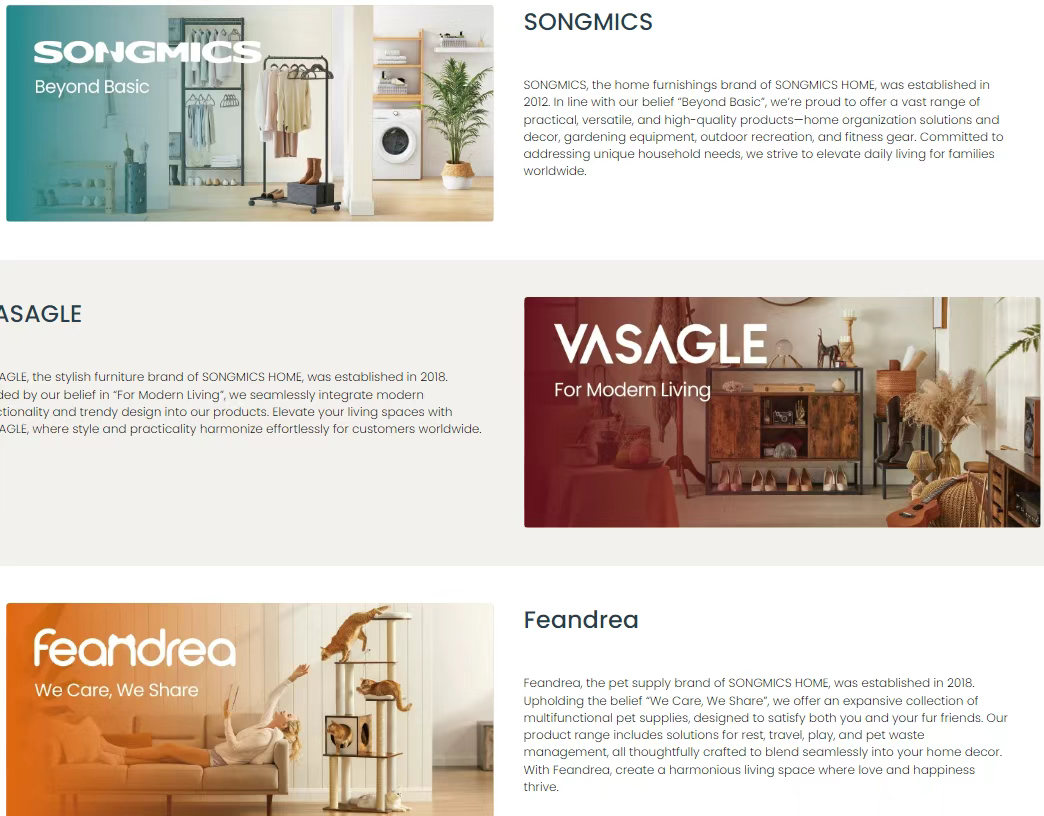

Image source: Zhiou Technology

Their shoe racks became bestsellers on Amazon Europe, pet climbing frames ranked among the top three in the North American market, and their revenue surpassed 5.4 billion yuan in 2022. Even more surprising, this brand that started in Zhengzhou beat local competitors on Amazon Europe, firmly holding the number one spot in furniture category sales.

How did a company that started by selling storage boxes, coffee tables, and cat climbing frames win over 20 million European and American households? By dissecting its path to going global, we may find a new logic for Chinese furniture to conquer the world.

Image source: Zhiou Technology

From International Student to Furniture Export Leader

In 2007, China’s total import and export trade exceeded $2 trillion for the first time, ranking second in the world for exports.

That year, while studying in Germany,Song Chuan discovered a business opportunity: a regular clothes hanger in European supermarkets could sell for 5 euros, while the same product cost less than 1 euro to produce in China. So, he started reselling Chinese-made shoe racks and storage cabinets on eBay, earning 20,000 euros in his first month. Although this “brick-moving” business made money quickly, Song Chuan soon realized thatwithout a brand and a team, he would always be just a middleman.

In 2010, Song Chuan returned to his hometownZhengzhou and founded Zhiou Technology. Initially, the company mainly did window display business, serving both B-end and C-end clients. In 2011, Amazon opened up to third-party sellers, and Song Chuan seized the opportunity to open a store on Amazon Germany, starting e-commerce operations.In 2012, Zhiou Technology launched its first brand, SONGMICS, focusing on home and garden products, including shoe racks, clothes hangers, sun umbrellas, lounge chairs, and more.

Image source: SONGMICS

However, as the product range expanded from 20 to over 200 categories, problems arose. German wholesalers were confused by a catalog covering clothes hangers, tents, and pet beds:“What exactly do you sell?”

It was precisely these doubts that led to the key transformation in2018.Zhiou Technology split SONGMICS into three vertical brands: home storage SONGMICS, furniture brand VASAGLE, and pet home FEANDREA.The results were immediate: four years after the split, the three brands achieved an average annual growth rate of over 30%, with total revenue reaching 4.84 billion yuan in 2022.

This"divide and conquer" strategy not only made the product lines more focused but also unexpectedly attracted the attention of Anker Innovations.

Image source: Zhiou Technology

In 2018, Yang Meng, founder of Anker Innovations, who had just completed an IPO, approached with a 20 million yuan investment. What attracted him was Zhiou Technology’s “online IKEA” positioning, usingextreme cost-effectiveness + full-scenario coverageto fully leverage Amazon traffic.

This investment became a turning point for Zhiou Technology. In June 2023, after three failed IPO attempts, Zhiou Technology finally landed on the Growth Enterprise Market and was officially listed.

Zhiou Technology rings the bell for its listing. Image source: Touzhongwang

From Listing to Omnichannel Layout

After successfully going public, Zhiou Technology began accelerating its global channel network layout.

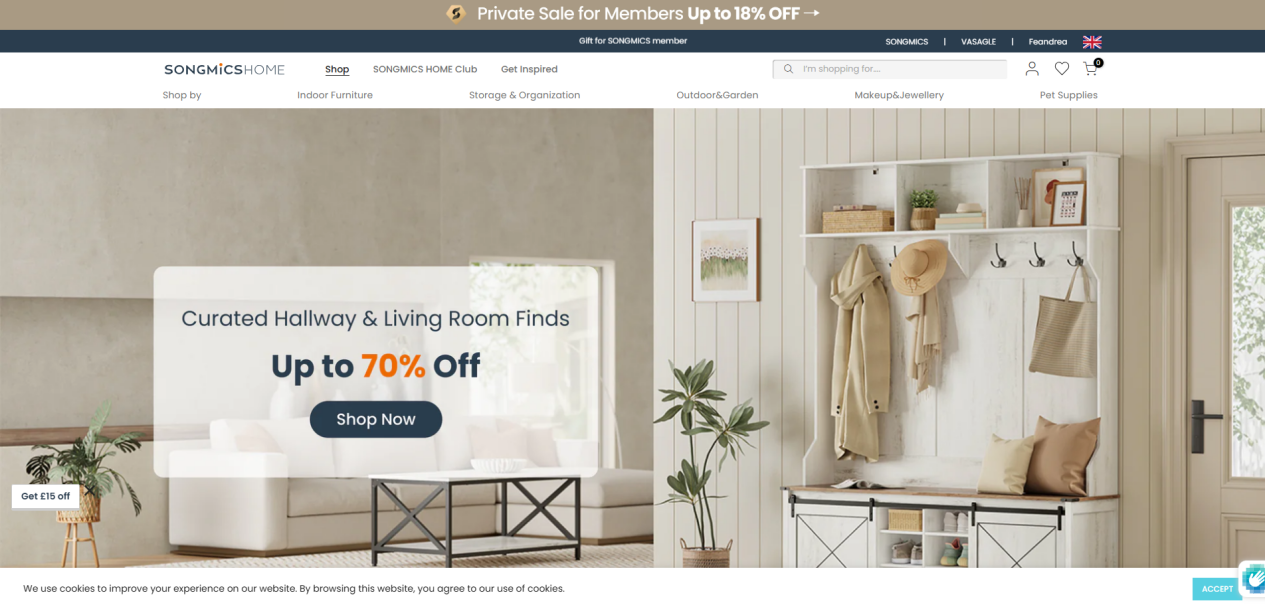

In the first half of 2024, Zhiou Technology’s revenue in Europe and North America grew by41.22% and41.12%, respectively, thanks to its“dual-track”strategy. The independent site is divided into six sections by usage scenario, covering 303 subcategories from $5 storage boxes to $800 sofa beds.

Unlike simply selling products, the independent site uses“scenario-based marketing”to increase average order value, such as displaying FEANDREA pet beds together with VASAGLE coffee tables to suggest a lifestyle of humans and pets cohabiting.

Image source: Zhiou Technology independent site

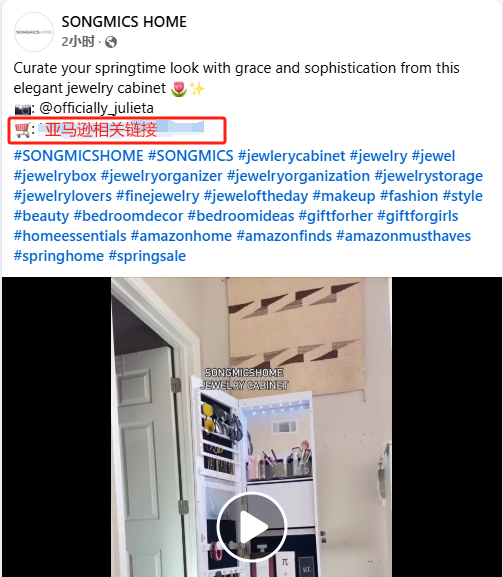

But Zhiou Technology does not blindly pursue independent site traffic. A close look at its Facebook page reveals that although external links point to the independent site, 80% of product posts still redirect to the Amazon store. This“Amazon guarantees sales, independent site builds brand”strategy maintains the existing base while gradually building brand awareness.

Image source: Facebook

The key step is the offline breakthrough. In 2024, Zhiou Technology’s products entered physical stores in Europe and North America through channels such as Target and Wayfair, achieving a“online seeding, offline fulfillment”closed loop. This omnichannel layout is quietly changing its label of “over-reliance on Amazon.”

Image source: Google

Precise Positioning on Four Major Social Media Platforms

Zhiou Technology has also set up official accounts on four mainstream social media platforms, each with its own content positioning and operation style, but all share the goal of reaching different user groups through differentiated content and ultimately driving traffic to the independent site and Amazon store.

TikTok

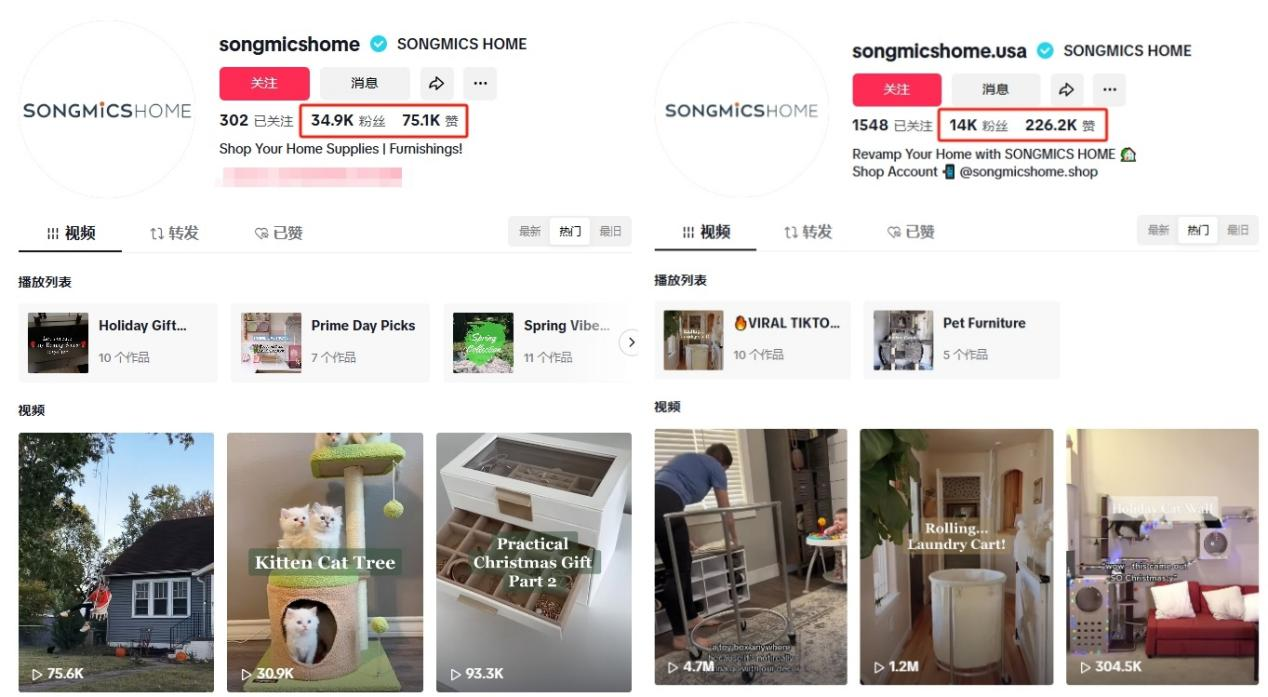

On TikTok, Zhiou Technology operates two accounts:@songmicshome and@songmicshome.usa. The former has34,900 followers and75,100 likes; the latter has14,000 followers but226,200 likes. Both accounts mainly featurebuyer showcases, using vertical videos under one minute to show products in real-life scenarios. This highly authentic UGC content perfectly matches TikTok users’ pursuit of “realness.”

Image source: TikTok

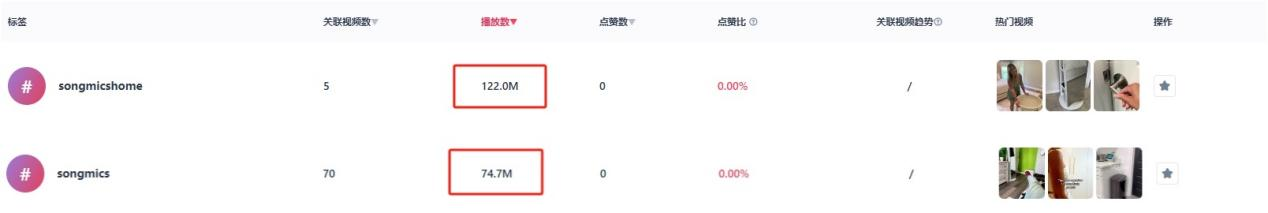

Zhiou Technology’s TikTok brand hashtag#songmicshomehas reached122 million views, and the related hashtag#songmicshas74.7 millionviews, showing impressive traffic.

Image source: Chaodian Youshu

In addition, Zhiou Technology collaborates with many TikTok influencers, such as home blogger@dailynchannel (690,400 followers), whose jewelry cabinet video reached4 million views and517,800 likes; home fashion influencer@marlenavelezz (462,300 followers) posted a shoe rack makeover video for the entryway, which hit5.1 million views. These collaborations not only boost brand exposure but also let users intuitively experience product practicality through real-life scenarios.

Image source: TikTok

YouTube

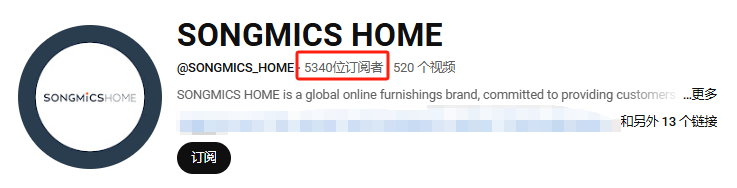

Besides TikTok, Zhiou Technology also has a presence on YouTube. As of now, its official account @SONGMICS_HOME has5,340 subscribers.

Image source: YouTube

The account’s content revolves around three main brands: SONGMICS focuses on home storage and garden products, VASAGLE emphasizes “modern minimalist design,” and FEANDREA centers on “human-pet cohabitation” solutions.

For example, VASAGLE’s videos show how to use modular furniture to create modern home spaces, while FEANDREA conveys the concept that “pets are family members” through products like pet beds and cat climbing frames. Thisintegration of product functionality and lifestylecontent strategy not only helps consumers intuitively understand the products but also subtly communicates brand values.

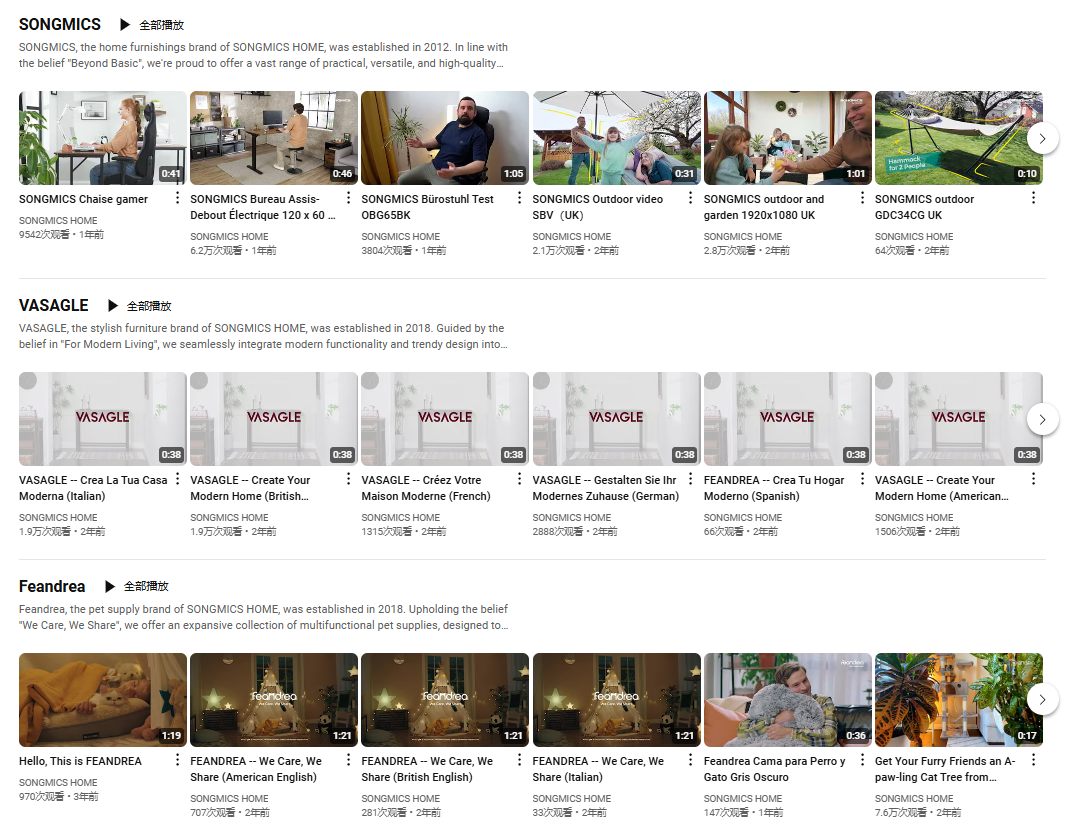

Image source: YouTube

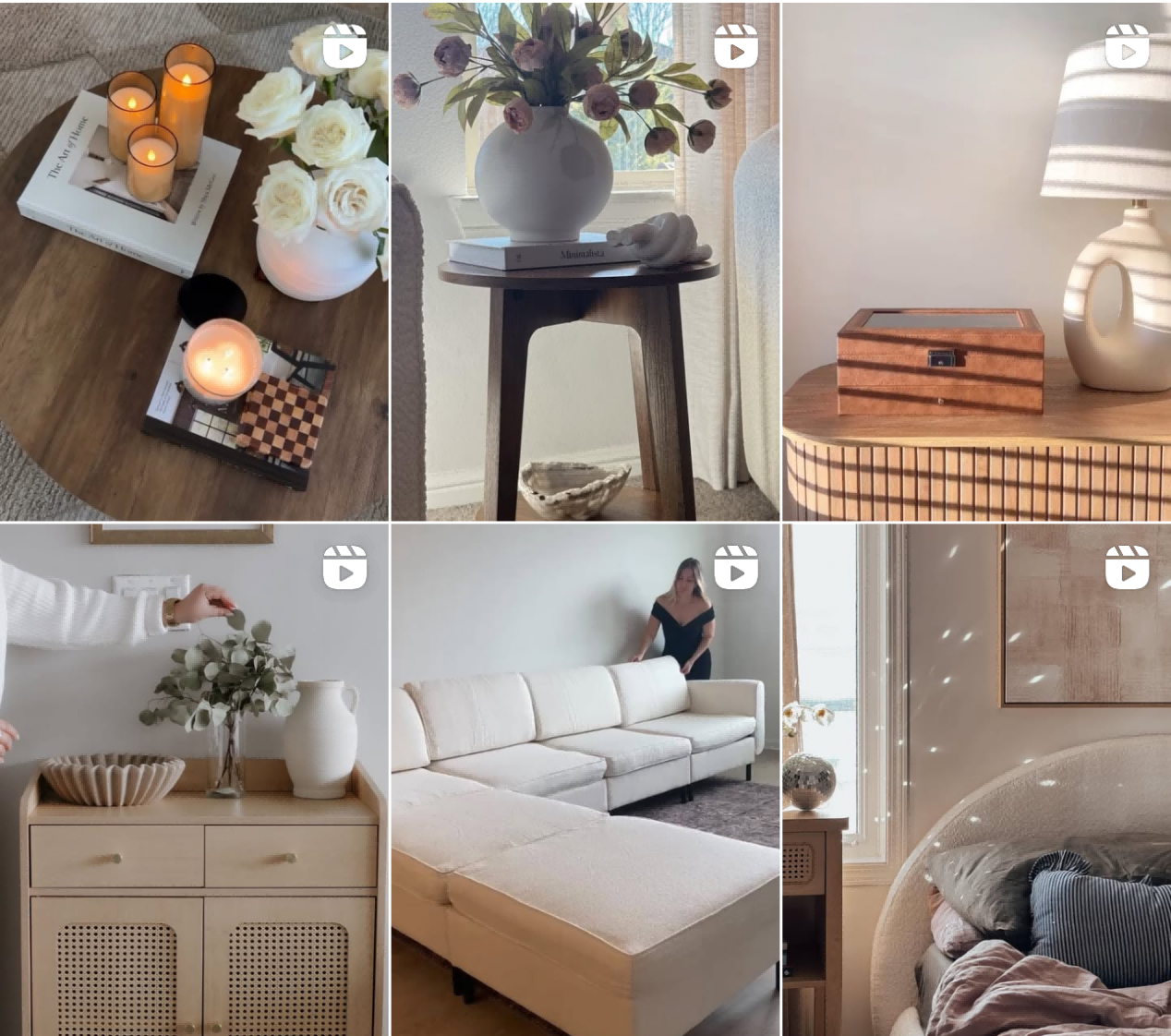

On Instagram, Zhiou Technology is also actively shaping its brand image. Its official account @SONGMICS HOME has59,000 followers, with content themed around“Living Together with SONGMICS HOME”, regularly posting beautiful images and short videos of home essentials.

Image source: Instagram

For example, a photo of a storage rack under warm lighting with the caption “Make life more organized” can attract many likes. This“magazine style”content precisely targets middle-class users who pursue lifestyle aesthetics.

Image source: Instagram

On Facebook, Zhiou Technology also operates several official accounts, including@SONGMICS HOME (6,161 followers),@SongmicsHome FR (41,000 followers), and@SongmicsHome De (22,000 followers). These accounts together form an important base for brand-user interaction, with impressive data performance.

Image source: Facebook

The content focuses onproduct displaysandauthentic user feedback, such as posts showing balcony makeovers, where users often spontaneously share their matching tips, creating a unique community atmosphere.

Image source: Facebook

This refined “one platform, one strategy” operation has enabled Zhiou Technology to establish a differentiated advantage in the European and American markets.

However, as more and more Chinese home brands enter the cross-border e-commerce field, the biggest challenge they face is how to avoid falling into homogeneous competition.

Image source: Zhiou Technology

The Next Stop for Made in China

Today’s overseas market is no longer an era where “low prices win all.”

With platforms like Amazon and TikTok Shop ramping up overseas warehouse construction, cross-border logistics efficiency has greatly improved, and e-commerce growth in emerging markets such as the Middle East and Latin America has far exceeded expectations. However, the local supply chains in these markets are still immature, providing huge opportunities for Chinese companies.

For domestic companies, the real opportunity lies not in copying others’ successful paths, but in finding their own niche markets. As globalization enters deeper waters, the key to competition is no longer speed, but insight into details.

While others are still chasing “best-sellers,” those “small needs” hidden in living rooms, balconies, and even pet rooms may be the direction that Made in China should truly cultivate.