In the 3C sector, the overseas stories of Chinese brands are often filled with"internal competition".

According to QY Research data, the global 3C digital accessories market is expected to reach$1.74 trillionby 2030. This huge cake attracts countless Chinese manufacturers to follow one after another; in the power bank field alone, hundreds of brands once emerged simultaneously in Shenzhen Huaqiangbei.

Image source: QY Research

After ten years of fierce competition, those who have truly established themselves in overseas markets are mostly industry giants like Anker and UGREEN.

However, a "grassroots" brand founded in Shenzhen in 2012 has become a dark horse, selling power banks to more than 80 countries over ten years of going global, consistently ranking first in online sales in markets such as the Philippines, South Africa, and Vietnam, with annual revenue exceeding 200 million yuan. This brand isRomoss.

In the highly homogeneous charging market, how does this brand, without the backing of industry giants, manage to stay at the top of sales in Southeast Asia, the Middle East, and Africa?

Image source: Romoss

Identifying Industry Gaps, Becoming the "National Power Bank"

In 2011, the release of theiPhone 4scompletely changed the mobile phone industry. The non-removable battery design madepower banksa necessity rather than an optional accessory, but the market at that time was flooded with counterfeit products, with frequent issues such as false capacity claims and safety hazards.

It is reported that at that time, Romoss founderMr. Leiwas still running a notebook battery OEM factory. Facing the rise of smartphones, he decisively cut the original business andfounded Romoss in 2012, betting on online channels.

Image source: Google

Early trials were not smooth; consumers' perception of power banks was simply "as long as it works," and the industry lacked unified standards, with low-priced, poor-quality products rampant.

The turning point came in 2013. Romoss launched its first blockbuster product,Sense 4 Power Bank, with a 10,000mAh capacity, pure white minimalist design, and a price of 99 yuan, directly breaking the market's psychological barrier. On Singles' Day that year, this product sold300,000 unitsin a single day, with sales exceeding20 million yuan, instantly taking thetop spot in the 3C category.

Romoss Sense 4 Power Bank Image source: Google

But what truly helped Romoss gain a foothold was itsrelentless pursuit of technology. That same year, they developed theeUSB international patented technology, allowing power banks to be compatible with laptop charging and breaking the technological monopoly of overseas brands; in 2016, they launched the first fast-charging product under 100 yuan,"Sherlock", pushing the industry into the fast-charging era.

Romoss eUSB Power Bank Image source: Google

Behind these technological breakthroughs is Romoss's precise grasp ofuser needs.

To address the issue of power banks overheating in Southeast Asia's high-temperature environment, they improved materials and added sweat-proof and antibacterial features; facing the extreme cold climate of Northern Europe, they developed a low-temperature version that works normally at -20℃.

This kind of"localized strategy for each region"enabled Romoss to quickly become a TOP brand in markets like the Philippines and South Africa.

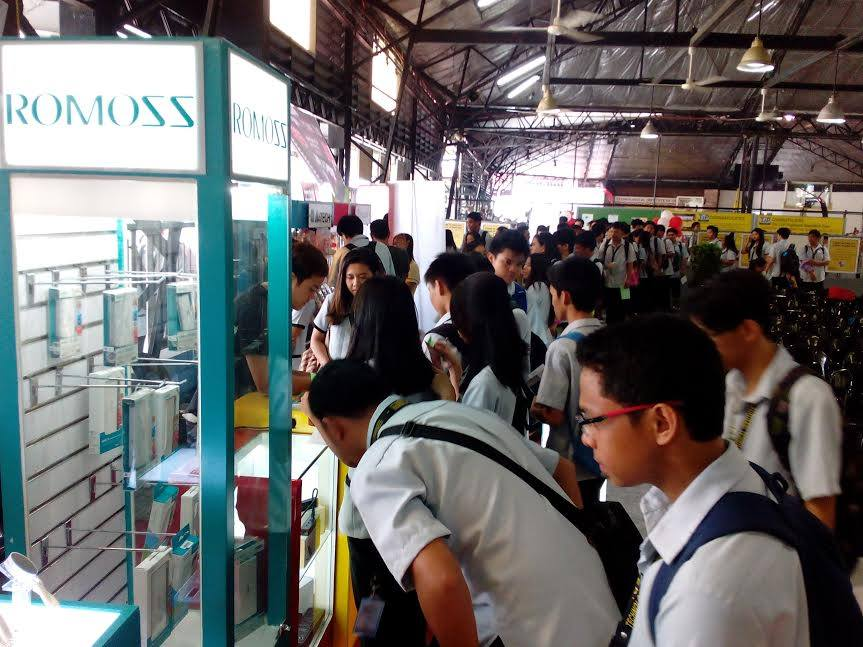

Philippine students lining up to buy Romoss power banks Image source: X

Omni-channel Layout: Not Putting All Eggs in One Basket

Reportedly, as early as2016, Romoss launched a crowdfunding campaign onKickstarterto test the overseas market. This crowdfunding not only validated the product's potential but also made the team realize that a single channel could not support their global ambitions.

Image source: Kickstarter

So they quickly adjusted their strategy, dividing channels into"mature markets"and"emerging markets": in mature regions such as Europe, America, and Japan, they focus on platforms like Amazon and Rakuten, using standardized products to drive sales; in emerging markets like Southeast Asia and the Middle East, they build user awareness through localized platforms such as Shopee, Lazada, and TikTok Shop.

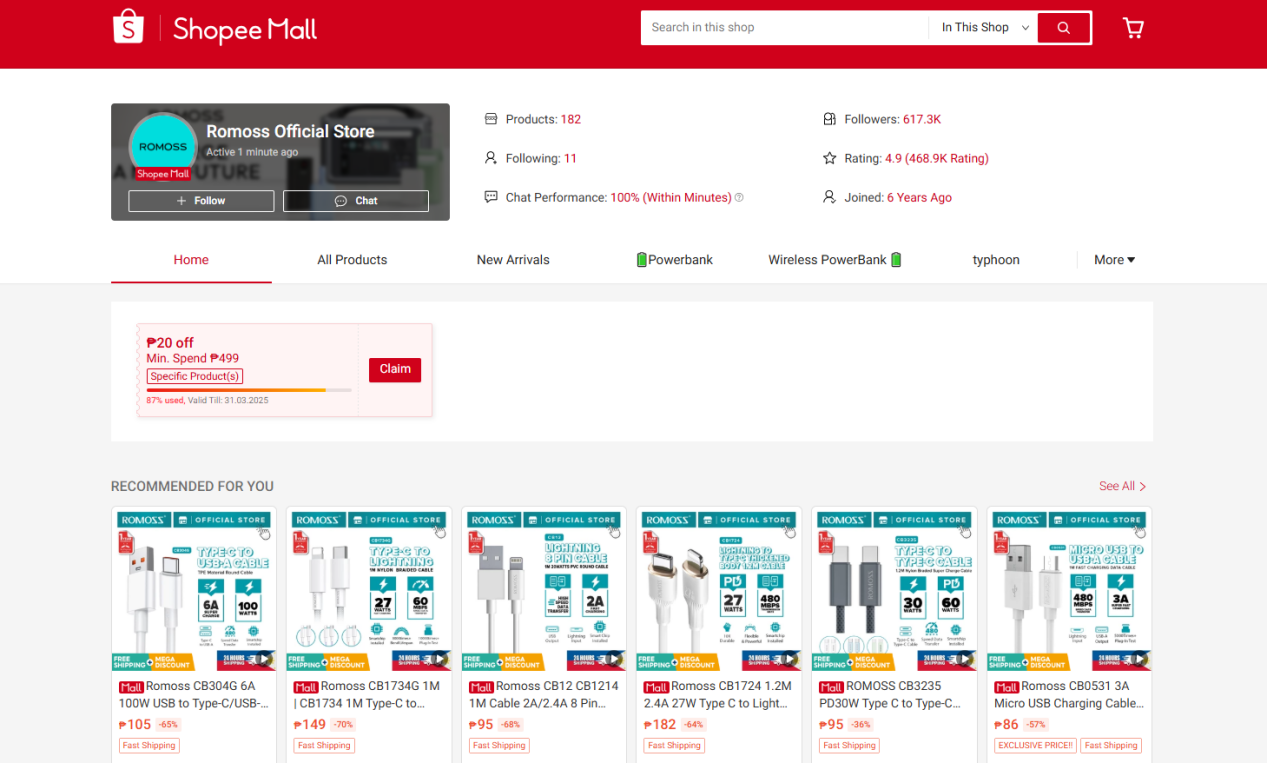

Romoss store homepage Image source: Shopee

Romoss's channel choices in different markets are also well-considered. The traffic cost on Amazon US is high, but users have strong willingness to pay, so they promote high-end fast-charging products; TikTok Shop in Southeast Asia has a high proportion of young users, so Romoss focuses on "magnetic power banks," "mini ice cream models," and other products with high aesthetics and portability.

Image source: Romoss

Social Media Operations: Speaking with Real Data

Channels alone are not enough; Romoss knows well that "good wine also fears a deep alley." Therefore, they have put a lot of effort into overseas promotion, such as operating on TikTok, Instagram, and Facebook to expand brand exposure and promote products.

TikTok: Opening the Market with Livestreams and Influencers

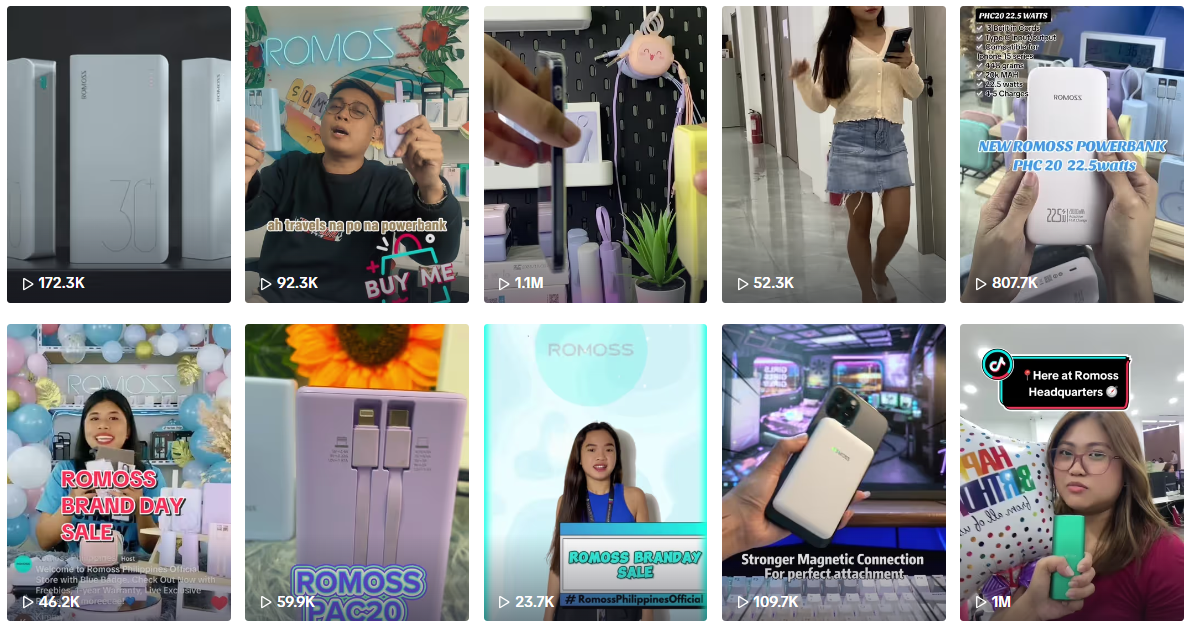

In key markets like Southeast Asia, Romoss operates three TikTok accounts:@romossph (149,600 followers, 119,500 likes),@romossphilippines (101,300 followers, 37,900 likes),@romoss.philippines (44,900 followers, 18,900 likes).

Image source: TikTok

The content posted by these three accounts is verysimple—either detailed shots of power banks, previews of promotional activities, or clips of product testing from livestreams. This down-to-earth content strategy actually hits the pain points of Southeast Asian users.

Image source: TikTok

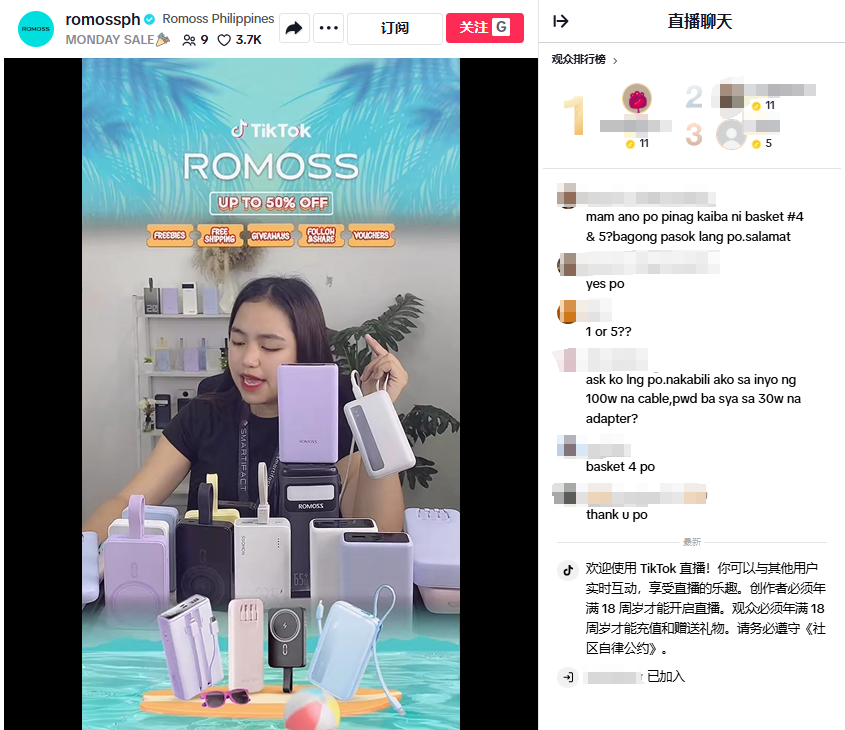

The three accounts take turns livestreaming every day, with each session averaging over 3 hours. The livestream content is straightforward, mainly showcasing charging speed, capacity comparisons, and occasionally distributing coupons.

This"no gimmicks, just product"livestream style has proven effective in the Philippine market. During the 2023 major sales event, Romoss's monthly sales on TikTok Philippines exceeded one million, with most orders coming from livestreams.

Image source: TikTok

In influencer collaborations, Romoss also focuses on practicality. For example, with271,200 followersinfluencer@paulisabeeel, they released a review video detailing the selling points of three Romoss power banks and sharing user experience. The video reached200,000 viewsand received2,957 likes, with many users in the comments asking for purchase links.

Image source: TikTok

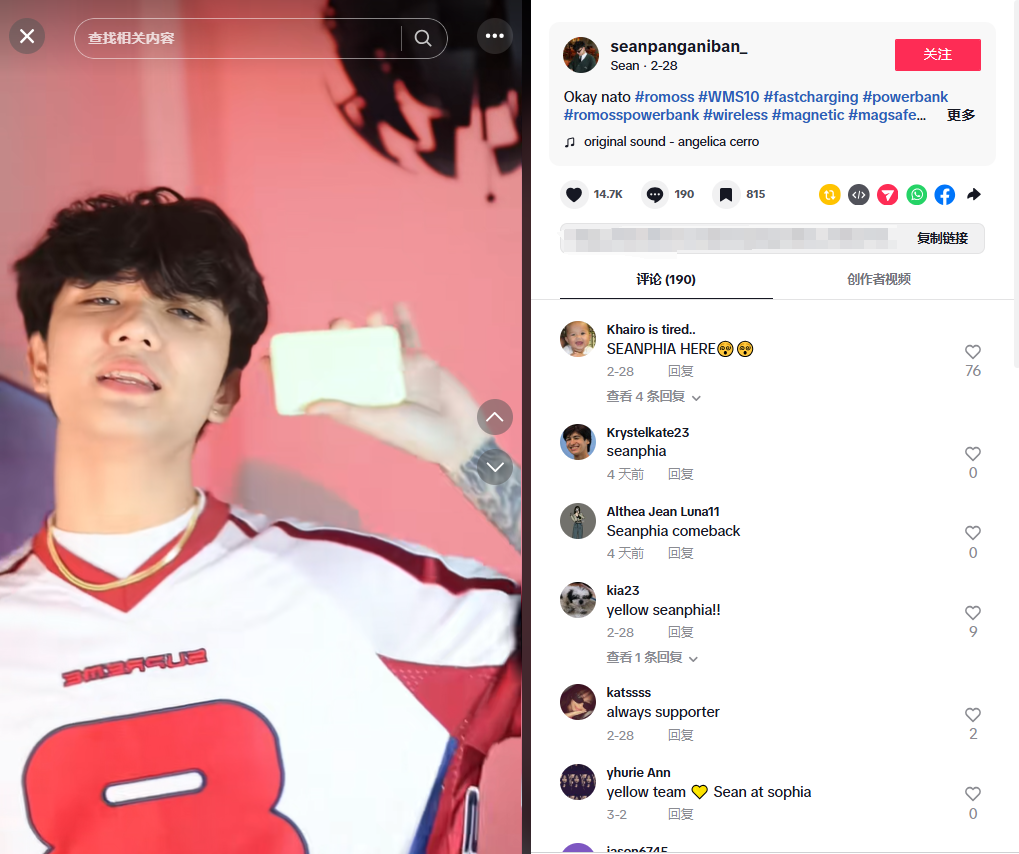

Another influencer with4.8 million followers,@seanpanganiban_, introduced the product in a rap format, incorporating fast-charging power, capacity, and other specs into the lyrics. The video reached479,900 viewsand14,700 likes, with impressive spread.

Image source: TikTok

Instagram: Attracting Users with Visual Content

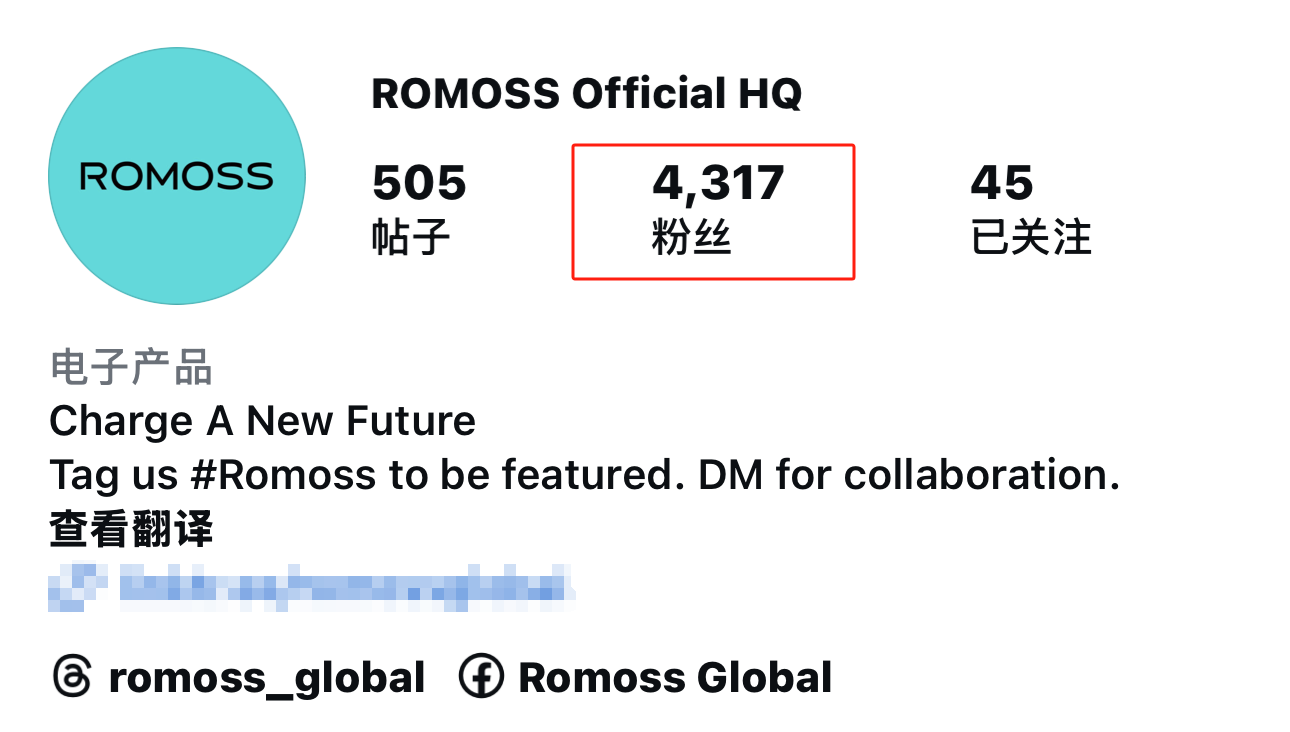

On Instagram, Romoss's official account@romosshas currently accumulated4,317followers.

Image source: Instagram

The homepage is full of"straightforward"content: white power banks shot in close-up against solid backgrounds, real product photos for new launches, and occasionally staged photos of models holding power banks.

This "product manual" style content, combined with precisetag targeting(such as #TravelEssential, #TechGadgets), has attracted a group of pragmatic consumers.

Image source: Instagram

Facebook: User Reputation Drives Brand Communication

On Facebook, Romoss changes its style again, posting mainly product showcases and real user feedback. As of now, its official account@Romoss Globalhas27,000 followers. Many user feedback posts have received hundreds of likes, indicating that real user stories may be more convincing than official promotions.

Image source: Facebook

The Answer to Going Global Lies in the "Details"

Romoss's ten years have proven one fact: as the traffic dividend of the domestic e-commerce market gradually fades, opportunities in overseas markets are beginning to emerge.

With logistics, payment, and other cross-border infrastructure becoming increasingly mature, it is the right time for domestic companies to go global with differentiated capabilities.

Rather than fighting in a stock market, it is better to leverage the flexible supply chain capabilities and product iteration speed accumulated by Chinese manufacturing to meet those needs that have not yet been fully addressed.

When "going global" evolves into "weaving a network," every blank space in each niche may give rise to a new coordinate for Chinese brands.