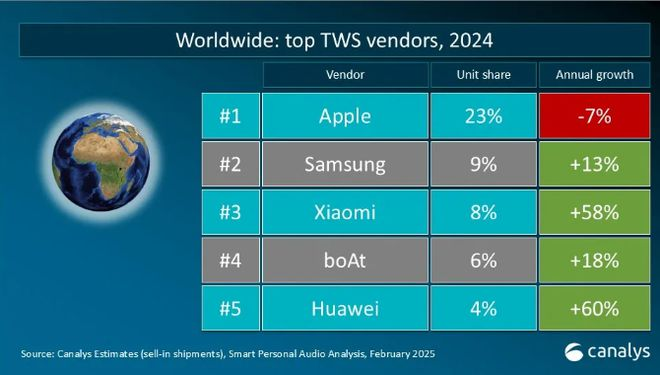

How fierce is the competition in the headphone industry? Just look at the global market data.

According to data from market research agency Canalys, the global shipment of true wireless headphones (TWS) in 2024 reached330 million units, a year-on-year increase of13%.

Image source: canalys

In this rapidly growing market, the three giantsApple, Samsung, and Xiaomi firmly control the market dominance, making it extremely difficult for emerging brands to get a share of the pie.

But surprisingly, an emerging brand from China has successfully broken through. In Latin America, its market share has entered thetop five; in Brazil, it even directly rivals Samsung and Apple, firmly sitting in thetop three. This brand isQCY.

So, how did this once little-known Chinese brand manage to overtake competitors in overseas markets?

Image source: Google

The Counterattack Script of the OEM Factory

It is understood that QCY belongs toDongguan Hele Electronics Co., Ltd.. This company was originally just a factory that did OEM headphone manufacturing for overseas brands, gradually accumulating production experience and technical capabilities through its production lines. But OEM is ultimately"making wedding dresses for others", and as profits kept thinning, in2011they made a big move andcreated their own brand QCY, officially stepping from behind the scenes to the front stage.

Image source: QCY

The first battle of the transformation was a success. In 2013, QCY entered Tmall and took thetop spot in the Bluetooth headphone categorywithin 50 days, sellingover 100,000 unitsin three months, and remained thesales championforfour consecutive yearsduring Double 11. This wave of e-commerce dividends propelled QCY into rapid expansion. They built a36,000 square meterself-owned factory, lined up140production lines, and monthly production capacity was directly raised to3 million units, with the entire process from parts procurement to logistics delivery under their own control.

QCY factory interior photo Image source: Baidu Baike

However, the domestic market was seriously saturated, so QCY began to turn its attention to the broader overseas market.

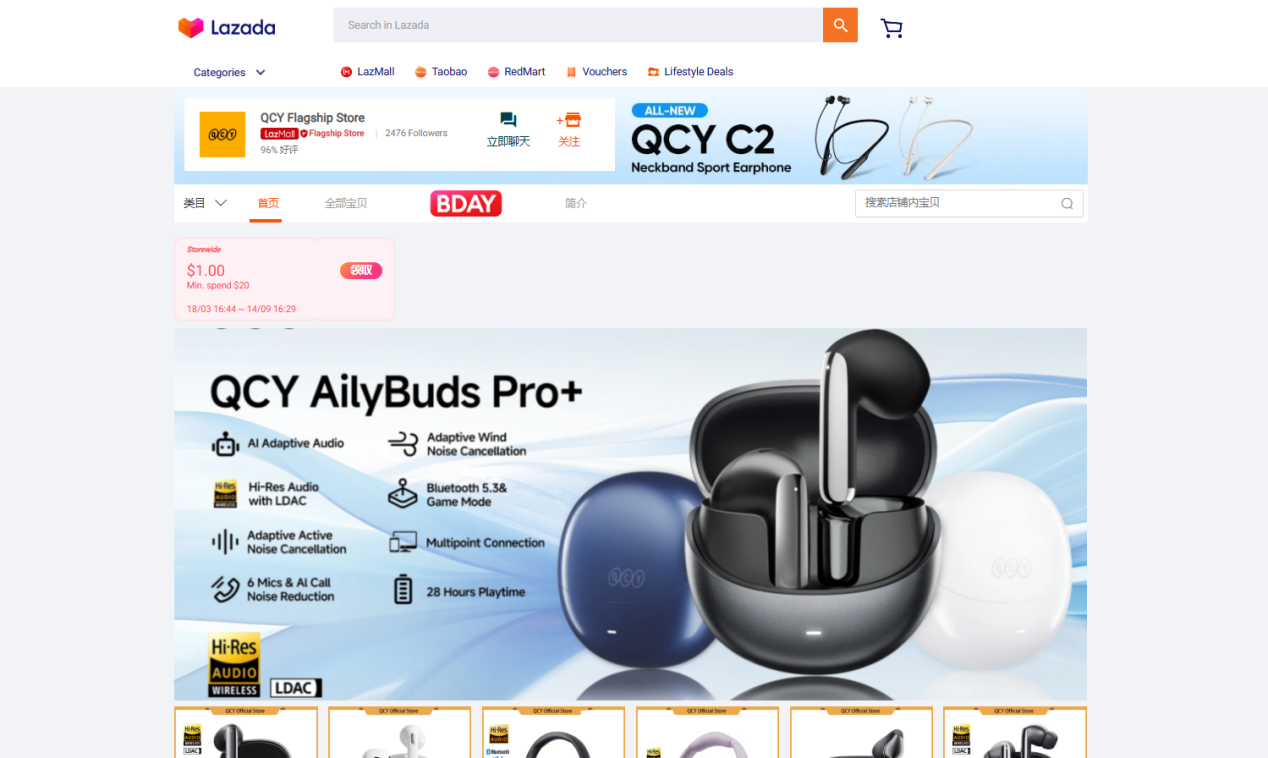

Unlike most brands, QCY did not go head-to-head with giants in Europe and America, but instead targetedLatin America, Southeast Asia, and the Middle East—these "potential stocks". In the early days, they tested the waters through distributors, and when cross-border e-commerce matured, they decisively enteredShopee, Lazada, and Amazon Brazil, and even set up11national-level agents in Korea and Japan.

By 2020, its TWS headphone shipments had entered theglobal top four. As of March 2025, QCY's annual product shipments exceeded10 million units.

However, market layout is only the first step in going overseas. What really determines success or failure is the localization challenge that follows.

Image source: Lazada

The Localization Code Hidden in the Details

Many overseas brands easily fall into the trap of"one trick works everywhere", but QCY offered a different solution, which is to develop products separately for each market.

Take theBrazilian marketas an example. Local consumers have very clear requirements for headphones: good sound quality and low price.

So QCY used its high cost-performance hit productT13as a door opener, retaining core features such as dual-ear four microphones and 40-hour battery life, but optimized the supply chain to keep the price within the 100-yuan range. This pricing strategy directly hit the market pain point. As of 2023, T13's total sales in all channels in Brazil exceeded3 million units, and it still ranks in thetop ten on Amazon Brazil's BS list.

Image source: Amazon Brazil

When moving to Southeast Asia, QCY found that young people here spend more than 3 hours a day on mobile games, so they immediately addedgame modeto theT5headphones. This seemingly small change, combined with the low price strategy, quickly made the product a standard for mobile game enthusiasts, eventually setting a sales record of7 million units worldwide.

QCY T5 Image source: Google

Even for details such ascolor selection, QCY made precise adjustments. Brazilian users prefer basic colors like black, white, and gray, so they simplified the design language. Southeast Asian consumers love trendy colors, so macaron-colored headphones immediately became the main products.

This deeply adapted operation strategy ultimately pushed QCY's shipments in the Latin American market to theTop 5, and its market share in Brazil entered thetop three in the industry.

Image source: Google

Leveraging Social Media to Drive Overseas Traffic

Just doing "localization" is not enough. QCY's layout on overseas social media is also very methodical.

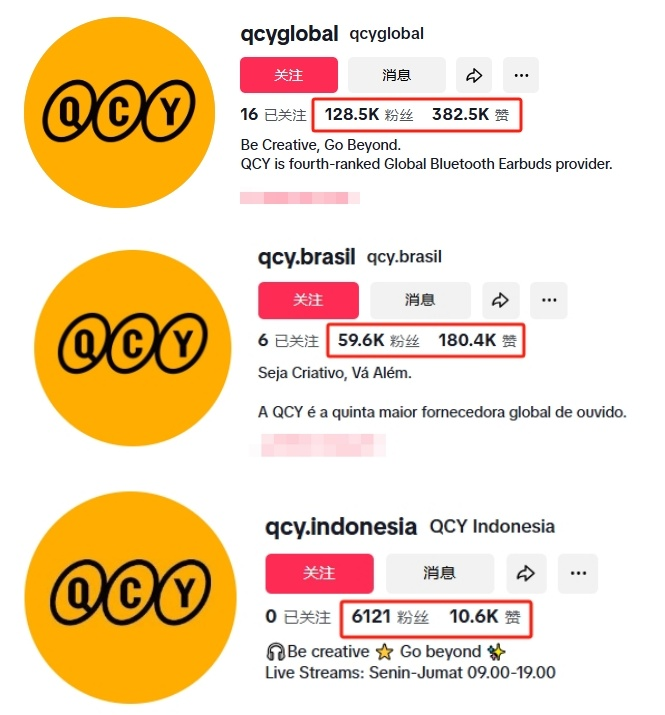

They implemented a strategy of"different platforms have different functions", not distributing unified content, but designing exclusive approaches based on platform characteristics.

Let's talk aboutTikTokfirst. QCY has three accounts for different markets: the global market-focused@qcyglobal(128,500 followers, 382,500 likes), the Brazil-focused@qcy.brasil(59,600 followers, 180,400 likes), and the Indonesia-focused@qcy.indonesia(6,121 followers, 10,600 likes).

Image source: TikTok

Thecontent styles of the three accounts are obviously different: the global account focuses on product shots, model try-ons, and unboxing videos to intuitively showcase features; the Brazil account focuses on performance comparisons and user reviews, such as testing noise reduction effects in the subway; the Indonesia account uses funny skits to embed products, and the video covers are lively and interesting.

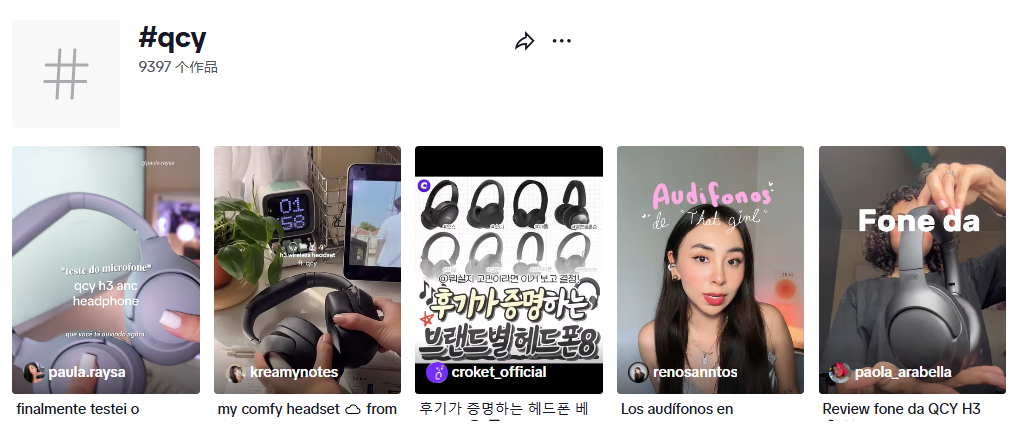

Image source: TikTok

QCY also has a unique approach tocollaborating with influencers. They do not blindly pursue top influencers for traffic, but precisely target mid-tier influencers whose style matches the brand.

For example, Indonesian fashion blogger@renosanntos(99,800 followers) made a video about over-ear headphones, naturally integrating the product into daily outfits, reaching 1.4 million views and 124,700 likes; Brazilian blogger@paula.raysa(42,300 followers) made an unboxing video of over-ear headphones, using real experiences to impress viewers, achieving 408,500 views.

Image source: TikTok

The advantage of this cooperation model is obvious: local influencers understand the real needs of target users better, and the content they create is more likely to resonate. Moreover, compared to spending heavily on top influencers, this precise placement is much more cost-effective.

Image source: TikTok

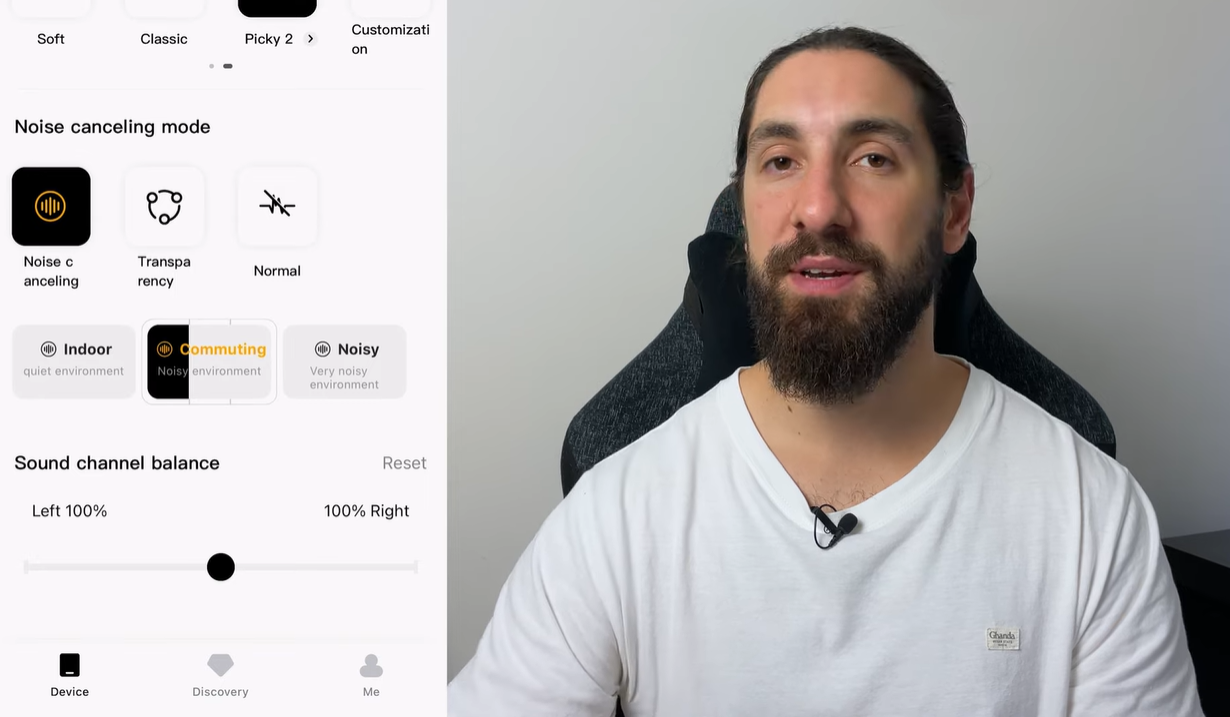

OnYouTube, QCY's approach is also very smart. Their official account@Qcybranddoesn't have many followers, only8,650, but they found a more effective way to promote, which is to focus on cooperation withvertical fieldprofessional bloggers.

Image source: YouTube

For example, audio equipment review blogger@Picky Audio(91,300 followers), whose videos analyze the cost-performance advantages of QCY headphones in depth from parameter comparison to actual listening tests. After the video was released, it reached79,000 viewsand was loved by European and American users.

Image source: YouTube

OnFacebookandInstagram, QCY has established amatrix of 3-5 accounts.

Facebook (left), Instagram (right)

The content published on both platforms is mainlyhigh-definition product images and function comparison charts, such as showing the battery life of headphones crushing competitors in one picture, or demonstrating waterproof performance with short videos.

At the same time, they regularly post limited-time discounts, positive user reviews, and brand stories to maintain account activity.

Although there is no complex plot design, throughhigh-frequencyproduct exposure, they have also attracted many users to inquire about prices.

Facebook (left), Instagram (right)

From the overall data, QCY's social media approach is verypragmatic, not pursuing inflated follower numbers, but using limited resources where they can bring the mostconversion, which is very valuable for reference for small and medium-sized brands with limited budgets.

Image source: Google

The Next Battlefield for Chinese Brands

QCY's practice confirms a trend:emerging overseas markets are becoming the key breakthrough point for Chinese manufacturing.

For companies wanting to go overseas, the first thing is to break the obsession with"big and comprehensive". Rather than going head-to-head with giants in Europe and America, it's better to find high-growth, low-penetration market gaps like QCY.

The global consumption pattern is far from being finalized, and this is the opportunity for Chinese brands.

Instead of waiting and watching, it's better to get involved,let go of "empiricism", and adapt to the overseas ecosystem with a more open attitude.