On the chessboard of the global economy, trade policies are like key chess pieces, with every move potentially triggering a chain reaction. The high tariff policies implemented during Trump’s administration were undoubtedly a huge stone thrown into the lake of the US economy, stirring up waves. Among those most directly impacted are American domestic enterprises, which are bearing increasingly heavy cost pressures.

Image source: Visual China (file photo)

According to the Atlanta Fed’s April survey, US enterprise unit costs are expected to grow by 2.8% over the next year, 0.3% higher than in March. This figure is lower than the peak of 3.8% in April 2022, but still above the pre-pandemic average of 2%. The survey also revealed three key trends:

1. Differentiation in cost pass-through ability: The cost pass-through ability in the goods sector is slightly stronger than in the service sector, and small and medium-sized enterprises find it harder to pass on costs than large enterprises;

2. Continued price pressure: S&P Global data shows that tariffs have pushed up the cost of manufactured goods, and the increase in goods and services prices in April hit a 13-month high;

3. Rising recession concerns: The survey shows that 25% of enterprises regard economic recession as a "major concern," and 73% of their worries point directly to trade policy as the main reason. Although the CPI fell by 0.1% month-on-month in March, the latest tariff policies may reverse the trend of easing inflation, and enterprises are facing the dual test of market demand and cost control.

It is not difficult to see that US enterprises are facing multiple challenges such as rising costs, difficulty in passing on costs, sustained price pressure, and concerns about economic recession. These issues are interrelated and may form a vicious cycle, posing a threat to the stability and growth of the US economy.

Image source: Internet

However, even under such a trend, the issue of the US high tariff policy remains unresolved, especially regarding tariffs on China. It is said that previous rumors of Trump "softening his stance" are not true.

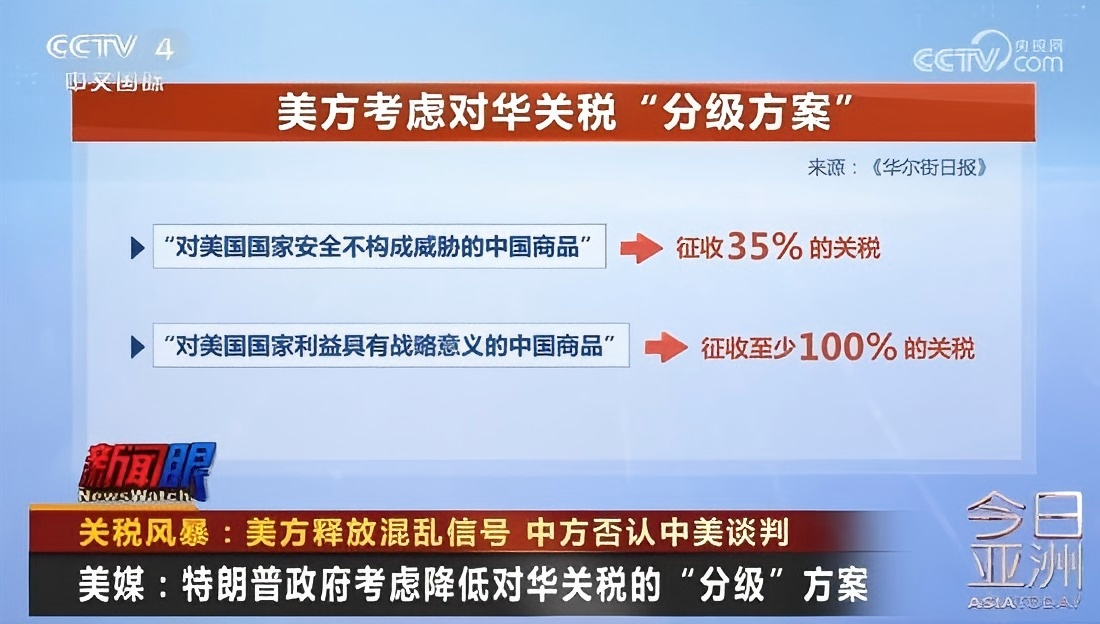

According to the latest foreign media reports on the 23rd, Trump is considering two options for adjusting tariffs on China: one is to lower the current rate to 50%-65%; the other is to implement a "tiered plan," dividing Chinese goods into "non-threatening to national security" and "strategically significant" categories, imposing tariffs of 35% and at least 100% respectively. The White House emphasized that Trump has "not softened" his stance on tariffs against China, and specific measures are still under discussion.

It is therefore foreseeable that US enterprises’ concerns about the economy will persist.

Image source: Internet

From previous analysis, Trump’s tariff policy was intended to help US enterprises, but in actual implementation it has trapped them in a quagmire of costs, making it difficult for US enterprises to move forward in this storm of trade policy. The road ahead will test the adaptability of the enterprises themselves.

Faced with such a complex economic situation, US enterprises need to plan and manage their costs and operations more cautiously, and always pay attention to changes in trade policy. Only in this way can they better take the initiative in future global economic competition.

As for domestic enterprises, although the US high tariff policy has brought certain challenges to our overseas expansion, it also provides opportunities to look beyond the US to broader markets such as Europe, Asia, Africa, etc., which have huge consumption potential and development space.

In summary, it is hoped that all domestic and foreign enterprises can find their own way to break through in this unpredictable storm.