In the world of internet giants, what appears to be a battle of technology and business is, in reality, a fierce fight for interests and market share. This time, tech giant Google has been directly taken to court by Ceneo, a subsidiary of Polish e-commerce platform Allegro, accusing it of abusing its market position and demanding compensation of 2.33 billion zlotys (about $568 million). This cross-border lawsuit reflects the antitrust pressure faced by tech giants worldwide.

Ceneo sues Google and claims $570 million. Image source: Market Watch

Ceneo’s Accusation: Who Does Monopoly Hurt?

Ceneo is Poland’s largest price comparison website and an important player in the e-commerce sector.

Users can quickly compare product prices, check reviews, and ultimately find the best purchasing channel through Ceneo. However, according to Ceneo, Google, as the world’s most important search engine, has used its dominant market position to prioritize its own price comparison service in search results, directly squeezing Ceneo’s market space.

This is not a minor issue. In the lawsuit, Ceneo explicitly stated that Google’s unfair competition led to direct economic losses of 1.72 billion zlotys from 2013 to November 2024, plus 615 million zlotys in interest. In addition, Ceneo plans to charge statutory interest on the total claim of 2.33 billion zlotys until Google pays in full.

Google does not agree with this, insisting that its shopping solution has operated for years and has always been committed to supporting brands, retailers, and third-party comparison shopping platforms worldwide. Clearly, this lawsuit will not be easily resolved.

Google expresses disagreement with the lawsuit. Image source: Market Watch

Google’s “Record”: Monopoly Issues Are Nothing New

Ceneo’s lawsuit is not an isolated case. In fact, Google has long been repeatedly brought to the antitrust bench for similar behavior.

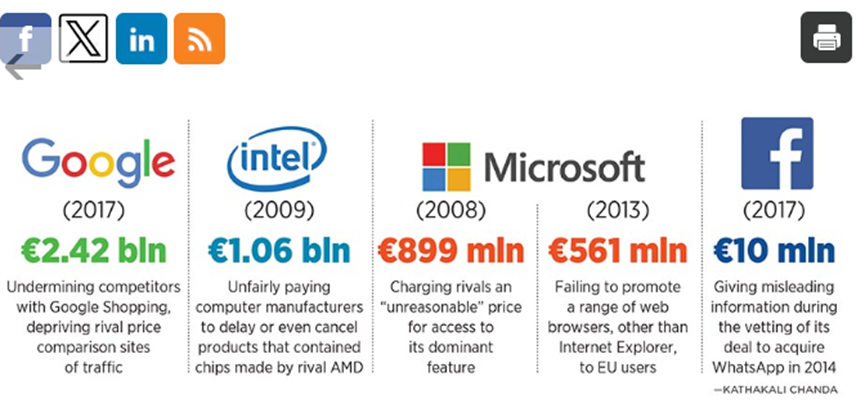

As early as 2017, the EU antitrust authority imposed a record fine of 2.42 billion euros on Google for prioritizing its own comparison service in search results, seriously harming competitors’ interests. This case not only forced Google to pay a huge fine but also provided a reference for regulatory agencies in other countries.

Recently, the Japan Fair Trade Commission (JFTC) also ruled that Google’s online search service violated Japan’s antitrust law. In the United States, the Department of Justice even proposed divesting Google’s Chrome browser to weaken its monopoly in the search market. These cases show that Google faces increasing regulatory pressure worldwide.

Google fined 2.42 billion euros by the EU. Image source: Forbesindia

The Algorithm War of E-commerce Platforms: Not Just Google

Google’s problem seems to focus on search engines, but the issue of “algorithms favoring their own products” is not uncommon in the global e-commerce sector.

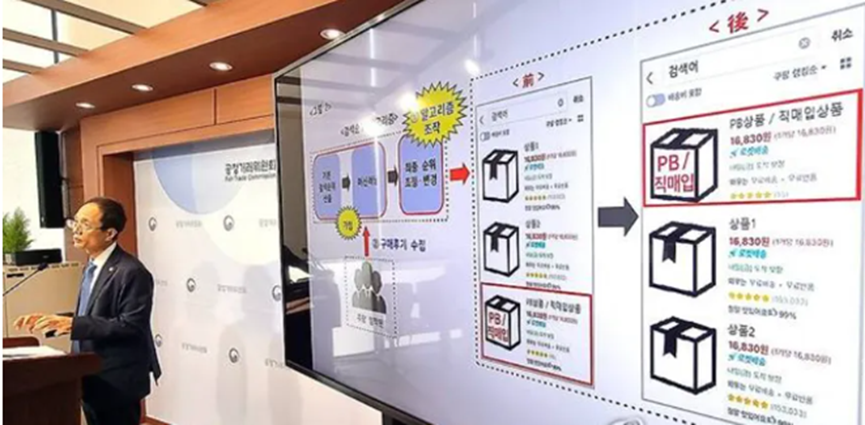

In June this year, Korean e-commerce giant Coupang was also fined for similar behavior. The Korea Fair Trade Commission accused Coupang of algorithmic bias, boosting the search ranking of its own products so that they “appear first” to users. This practice was deemed unfair competition, and Coupang ultimately paid a fine of 162.8 billion won (about 850 million yuan).

These cases reveal a common business logic: platforms use their control over user behavior and search algorithms to direct traffic to their own businesses, thereby gaining more benefits. Although this approach can bring short-term business growth, it may undermine fair competition in the market.

Coupang manipulates product rankings. Image source: Newsis

Conclusion: The Road to Antitrust Is Still Long

Ceneo’s lawsuit against Google is yet another reflection of the global antitrust pressure faced by tech giants. In a digital economy dominated by a few giants, fair competition is a rare luxury. Whether it’s Google, Coupang, or other companies suppressing competition by leveraging market position, these actions reflect a deeper issue: who will regulate these multinational giants?

In the future, the game of “monopoly versus antitrust” will only become more complex. The outcome of this lawsuit may inject more hope into the global landscape of fair market competition.