How competitive is the Korean e-commerce market?

Local giants Coupang, Gmarket, and 11 Street are constantly battling over logistics, services, and promotions.

However, a Chinese cross-border e-commerce platform has managed to break through the fierce competition and take the “center stage” on the Korean e-commerce platform rankings.

That's right, we're talking about Temu, a subsidiary of Pinduoduo.

Image source: Internet

1.17 million new downloads in a single month—why is Temu dominating the charts?

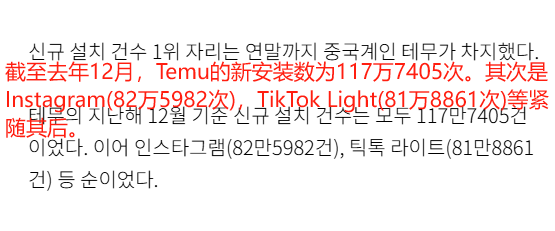

According to Korean data platform IGA Works, in December 2024, Temu gained 1.177 million new downloads, surpassing Instagram (826,000) and TikTok Lite (819,000), firmly securing the top spot on the download chart.

Looking at data from January to November last year, Temu has consistently ranked first in installations among Korean users aged 20 and above, crushing a host of competitors.

What does this mean? You have to know that the Korean market has always been dominated by local e-commerce platforms. Consumers are used to familiar platforms, and Koreans have high demands for service quality, making it difficult for foreign platforms to gain a foothold. But Temu not only managed to do it, it did so brilliantly.

Temu tops the chart for new installations in Korea. Image source: nocutnews

Not just Korea—Temu is surging globally

Korea's success is just the tip of the iceberg in Temu's expansion. This year, its global performance has been equally impressive. In the US, Temu has held the top spot for free app downloads on Apple's App Store for two consecutive years, becoming the shopping app of choice for young people aged 18 to 24. For a newcomer, this achievement is truly top-tier.

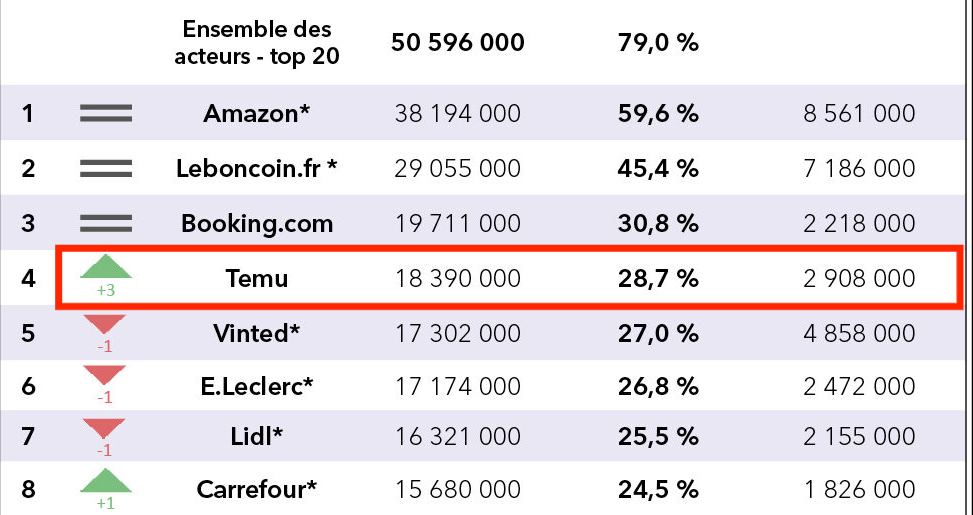

Looking at Europe, Temu's performance in France is also outstanding. In the third quarter of 2024, it ranked fourth among e-commerce platforms, just behind Amazon, LeBonCoin, and Booking, carving out a path in the fiercely competitive French market. In Brazil, Temu has surged ahead, with visits exceeding 100 million in November last year, making it the fastest-growing e-commerce platform in Brazil and leaving established players like Shein and AliExpress far behind.

Temu's success proves one thing: with the right strategy, low-priced products can also conquer the global market.

Temu becomes the fourth largest e-commerce platform in France. Image source: Fevad

Why is it so competitive?

Temu's success is not due to luck, but to two trump cards: low prices and localization.

Simply put, the products are cheap and practical, and the service is thoughtful. In times of economic pressure, consumers are especially sensitive to price, and Temu has seized this opportunity, winning over global users with a variety of “dirt-cheap” products. Especially in high-consumption markets like Korea and Europe, Temu's low-price advantage is a game changer.

But its “cheapness” is not just about price. Temu also pays special attention to localized operations, striving to make local consumers feel that it “really understands them.” For example, in the UK and the Netherlands, it recruits local sellers, offers products that better meet local needs, and speeds up logistics for fast and reliable delivery. Good products, low prices, and thoughtful service—who can refuse?

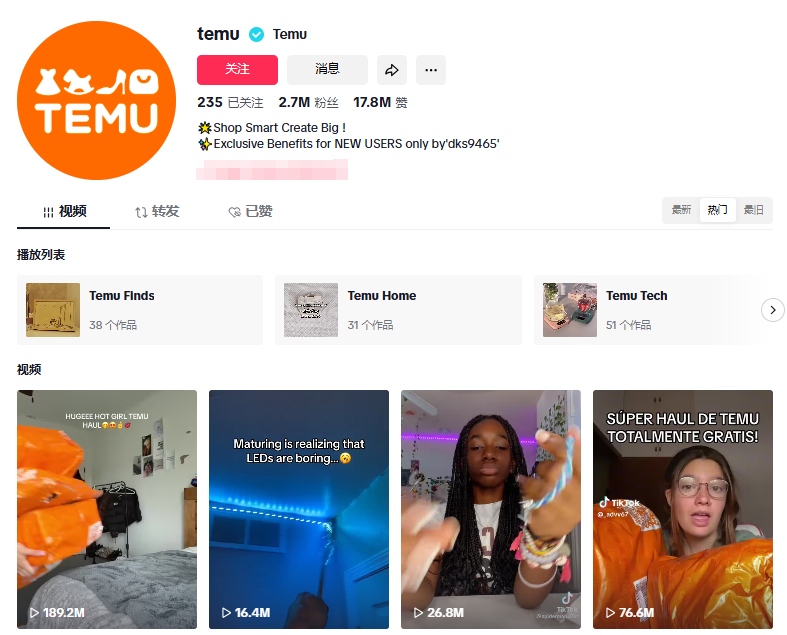

More importantly, Temu really understands young people. Its main user group is Generation Z, who love good value and enjoy sharing their shopping experiences on social media. Temu has moved its marketing battlefield directly to TikTok, winning over this generation of consumers with precise “recommendation” content.

Image source: TikTok

In conclusion

Temu's popularity is not only the result of its own successful strategies, but also shows us the potential of Chinese cross-border e-commerce in the global market. From Korea to the US, from France to Brazil, it has proven with data and reputation that the low-cost, high-efficiency business model still has great potential.

Will Temu continue to surge ahead in the future? No one can be sure, but one thing is certain: its successful experience has already provided a highly valuable template for Chinese brands going global.