In February 2024, Amazon Brazil introduced two key policies in quick succession: a commission reduction of up to 3% for 17 core categories including mobile phones, home goods, and apparel, and a reduction in FBA logistics fees for products valued below 79 reais (approximately 110 RMB). These two measures directly reduce sellers' overall operating costs by about 5%, marking a strategic upgrade for Amazon in the Brazilian market. According to official disclosures, the new policies will cover 78,000 sellers on the platform and involve 18.4 million products.

Image source: FORESTSHIPPING

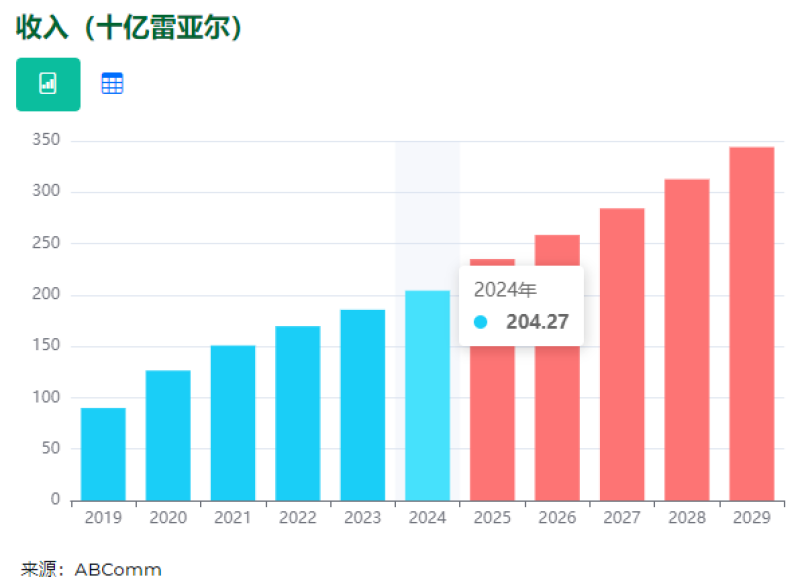

This decision is based on the sustained growth momentum of Brazil's e-commerce market. According to data from the Brazilian E-commerce Association, in 2024, the country's e-commerce transaction volume exceeded 204.27 billion reais (about 281 billion RMB), a year-on-year increase of 10.5%, setting a record of 414.9 million orders. 91.3 million online shoppers contributed an average order value of 492.4 reais (about 678 RMB), with consumers under 30 accounting for 48%, demonstrating huge market potential.

Image source: ABComm

Logistics Infrastructure Supports Market Expansion

To meet business development needs, Amazon's 75,000-square-meter intelligent logistics center in São Paulo state has officially been put into operation. The facility is equipped with an automated sorting system, with a daily processing capacity of up to 500,000 items. Combined with the existing 12 regional delivery stations, delivery times in the São Paulo metropolitan area have been compressed to within 24 hours. Logistics Director Carlos Silva revealed that the construction of an overseas warehouse in Salvador, in the northeast, has entered the site selection stage, and future efforts will focus on improving delivery efficiency in remote areas.

Image source: braziljournal

Competitive Landscape Among the Top Three

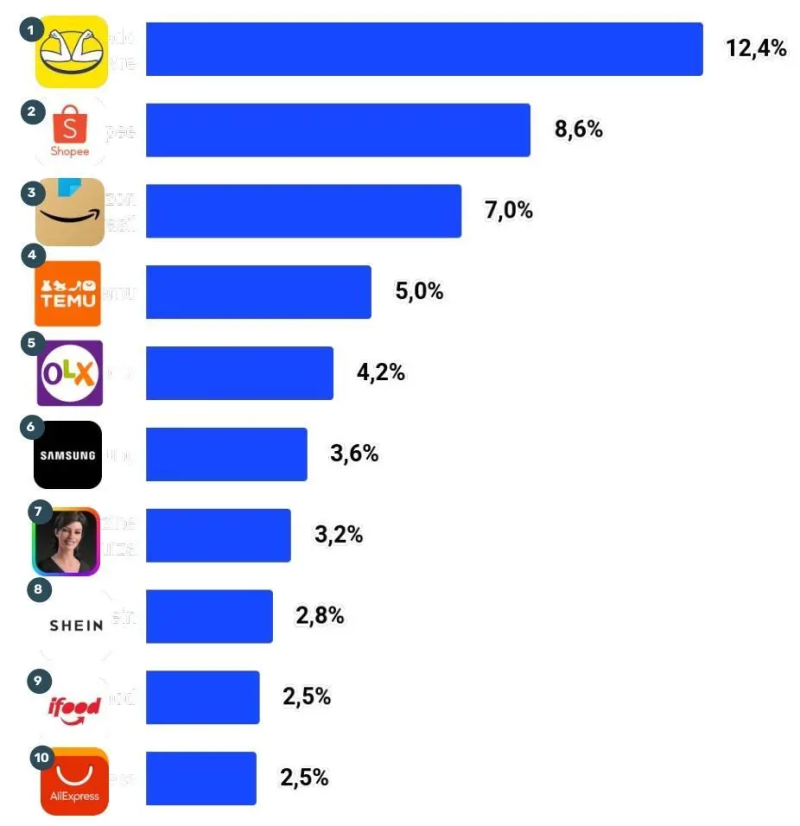

Currently, Brazil's e-commerce market presents a diversified competitive landscape. Local platform Mercado Livre leads with a 12.4% market share, and its logistics network covers 95% of postal code areas. Shopee, leveraging a social e-commerce strategy, holds an 8.6% market share, mainly attracting the 18-25-year-old demographic. Amazon Brazil ranks third with a 7% share but is facing strong competition from TEMU—a platform under Pinduoduo—which achieved a market share jump from 3.7% to 5% within five months of entering the market, especially occupying a 9.2% share in product categories under $30.

Image source: Conversion

Policy Dividends and Compliance Challenges Coexist

Since 2024, the Brazilian government has allowed international cross-border shopping platforms to benefit from reduced import taxes on purchases over $50. This is a direct boon for Chinese sellers. Categories such as 3C electronics and small home appliances have significantly enhanced price competitiveness. For example, Chinese sports headphones are priced 25%-30% lower than local brands. However, this is accompanied by strict compliance requirements: the CPF/CNPJ tax registration system, which will be mandatory from July 1, INMETRO certification for electronic products, and component testing standards for textiles—all of which create entry barriers for cross-border sellers.

Image source: EqualOcean News

Market Prospects and Strategic Layout

Industry forecasts show that Brazil's e-commerce market will continue to expand at a compound annual growth rate of 12%, with transaction volume expected to exceed 250 billion reais (about 344 billion RMB) in 2025. Amazon is accelerating the layout of its logistics hub in the Manaus Free Trade Zone, which, once completed, will cover the markets of five northern states. Coupled with the platform's ongoing seller policy optimization, the advantages of the Chinese supply chain in 3C electronics, household daily necessities, and fashion accessories may be further unleashed.

Image source: Internet

Currently, Brazil's e-commerce market is at a stage where infrastructure is being improved, consumption is upgrading, and policy adjustments are overlapping, presenting a triple opportunity. For Chinese sellers, it is necessary to seize the short-term dividends brought by Amazon's cost reduction policies, but also to build long-term competitiveness, including localization compliance, supply chain responsiveness, and cross-cultural operations. This competition in Latin American e-commerce is essentially a contest of efficiency and localization capabilities.

(Note: All data in this article comes from public information. Please refer to official announcements for specific situations. The exchange rate is calculated at 1 real = 1.376 RMB.)