Amazon warehouse fee rules are about to change!

This adjustment directly affects sellers' wallets, especially those who do self-fulfillment only—their costs are very likely to rise.

But if you use Amazon's official logistics service, you might actually save some money.

How exactly should you operate? TuKe will break down the key information from the announcement for everyone.

Image source: Internet

Storage fees remain unchanged, but transportation fees have increased

Starting April 1, 2025, the base rate for Amazon Warehousing & Distribution (AWD) will still be $0.48 per cubic foot per month for storage, but transportation fees will rise to $1.15 per cubic foot. The most painful part is the handling fee, which used to be a unified charge but is now split into inbound and outbound fees, each box charged $1.35. For example, if you process 100 boxes a month, these two items alone will cost you $270, which is double the previous expense.

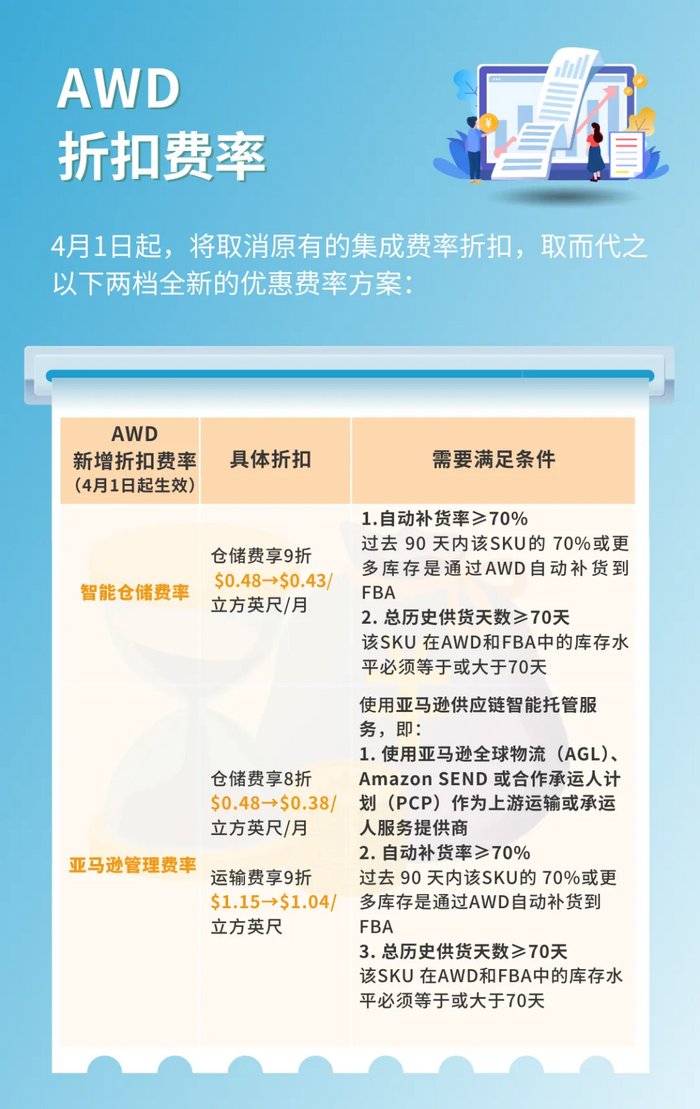

However, Amazon hasn't blocked all the paths. They've canceled the old integrated discount and replaced it with two new tiers of discounts, but the prerequisite is you must "bind" to platform services.

Image source: Amazon Global Selling

Want to save money? Bind to the automatic replenishment feature first

The first tier discount is called "Smart Storage Rate," which gives a 10% discount on storage fees, lowering it to $0.43. But to get this benefit, you must meet three conditions: use AWD's automatic replenishment feature, have an auto-replenishment rate over 70% in the past 90 days, and ensure the participating products have at least 70 days of inventory in both AWD and FBA warehouses. In other words, this is forcing sellers to hand over all their inventory to Amazon for management.

The second tier discount is even more aggressive, called "Amazon Managed Rate." Storage fees are directly cut to $0.38 (20% off), and transportation fees are also discounted to $1.04 (10% off). What's the catch? You must use Amazon's newly launched Supply Chain by Amazon (AMS). This service claims to be a "hands-off mode," where sellers only need to provide product information and pickup address, and Amazon takes care of all the logistics.

Image source: Amazon Global Selling

What is Amazon's strategy?

It's obvious that this round of adjustments is meant to push sellers to use more of Amazon's services. After all, last year the platform delivered over 9 billion next-day packages to Prime members alone, and claimed to have saved users $95 billion. But ultimately, the cost of logistics falls on the sellers.

Amazon delivered 9 billion fast shipping items last year. Image source: aboutamazon

However, Amazon's competitors are not sitting idle. Walmart recently expanded its same-day delivery service to cover 93% of US households (it was only 80% last October), and even more impressively, their Q4 delivery costs dropped another 20%, marking the fourth consecutive quarter of cost reduction. The two giants are competing on speed and cost, leaving small and medium sellers to struggle to keep up.

Walmart's same-day delivery coverage increases. Image source: retail dive

The logistics war is at sellers' doorsteps

Now, e-commerce platforms are no longer competing on who has the best-looking pages, but on who has faster and cheaper logistics.

The data from Amazon and Walmart already tells the story: one relies on scale to cut costs, the other on efficiency to expand market share. For sellers, following the big platforms' policies may be the safest choice, but don't be blind—first, understand your own volume, turnover rate, and cash flow. Otherwise, the shipping savings might not even cover the cost of inventory backlog.

This rate adjustment is like a wake-up call. In the future, sellers who want to go solo with "self-pack and ship" will find their survival space shrinking. Either cling to the platform and trade services for discounts, or shift to refined operations and maximize inventory turnover. In this logistics war, those who survive will always be the ones who can calculate their accounts clearly.