Recently, according to foreign media reports, Meta’s Instagram is considering spinning off its popular short video feature Reels into a standalone app dedicated to short video content distribution. At the same time, it plans to upgrade its recommendation system for U.S. users and support 3-minute long videos. This move is seen as Meta doubling down on the short video track and directly confronting TikTok at a time when TikTok is facing ongoing turbulence.

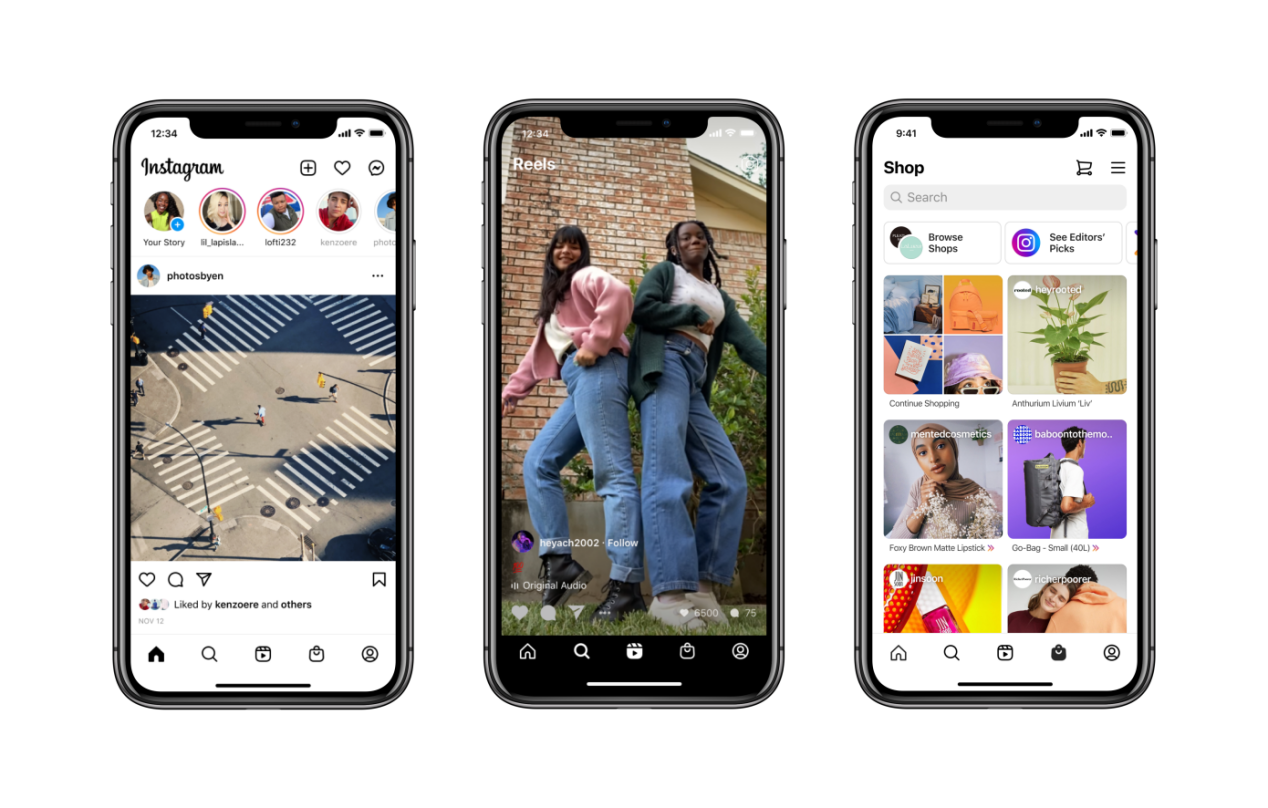

Image source: Internet

The move for Reels to go solo actually signals a major reshuffle among short video platforms, and for sellers, this wave of change also means more opportunities and bonus windows.

Meta Makes a Comeback, Competing for Users and Traffic

Reels was originally launched as a feature on Instagram in 2020, with a clear goal—to compete with TikTok.

At that time, TikTok was exploding globally, and short videos quickly became the key to traffic. Meta was unwilling to fall behind and quickly rolled out Reels on Instagram and Facebook. How did it perform? According to Meta’s recent financial report, global users’ video watch time has achieved double-digit growth, Reels is shared more than 4.5 billion times a day, and it has become the fastest-growing content segment in the Meta ecosystem.

However, as a feature module within Instagram, Reels ultimately lacks the brand power and scalability of an independent platform. In contrast, TikTok has established itself globally with its standalone app strategy. Therefore, Meta’s attempt to spin off Reels into a standalone app is, on one hand, aimed at attracting more short video users with a dedicated product, especially those young people who were once loyal to TikTok; on the other hand, it seeks to take advantage of TikTok’s setbacks in the U.S. market to rapidly expand its user base and capture traffic, creators, and content resources for itself.

At the same time, Meta is also focusing on optimizing its recommendation algorithm, especially for the U.S. market, striving to improve user retention and stickiness. If the new 3-minute long video format is added, it is foreseeable that the future Reels will not only be about short, fragmented content, but may also provide a deeper creative space, thereby attracting more high-quality creators to join.

Image source: Internet

The Competition Among Short Video Platforms Enters a New Stage

Rumors of a standalone Reels app are clearly not good news for TikTok. In recent years, TikTok has dominated the global short video market, especially holding the top spot in the U.S. market. However, as regulatory pressure on TikTok in the U.S. continues to escalate, various competitors are seizing the opportunity to step up, with Meta being the most aggressive “chaser.”

As early as January this year, Meta launched a new video editing tool called Edits and even used cash rewards to poach creators using CapCut (TikTok’s editing tool). At the same time, Meta paid creators to promote Instagram on TikTok, YouTube, and other platforms, aggressively attracting traffic migration. This time, preparing to launch a standalone version of Reels can basically be understood as a full-scale declaration of “war” on TikTok.

Image source: Internet

Opportunities for Sellers: New Platforms, New Traffic, New Business

For cross-border sellers, short video platforms have always been important positions for brand promotion, product sales, and user communication. If Reels truly becomes independent, it not only means the birth of a new traffic pool, but also a brand new opportunity for content operation and business.

On one hand, Meta’s platforms still have a strong traffic base. Facebook and Instagram have stable user groups worldwide, especially in North America and Europe, where they have long been at the top. If Reels becomes independent, it will surely leverage Meta’s capital, advertising system, and data capabilities to scale up quickly. For cross-border merchants targeting the U.S. market, this is an excellent opportunity to test a new platform at low cost.

On the other hand, after Reels becomes independent, it will inevitably launch a series of creator incentives and merchant support policies. Whether it’s live streaming sales, short video marketing, or in-app advertising, all are expected to benefit from an initial traffic tilt. For merchants who already have mature strategies on TikTok, this also makes it easy to quickly transfer and reuse content, with low replication costs and large monetization potential.

More importantly, TikTok’s policy risks always exist, and once the standalone Reels app is up and running, it will undoubtedly provide cross-border sellers with more alternative channels. Sellers can not only do business on TikTok, but also simultaneously distribute and sell on Meta’s new short video platform, forming a “double insurance” to stabilize income sources.

Image source: Internet

Conclusion

In the future, there will only be more and more traffic entry points for short video e-commerce. What sellers need to do is to plan ahead, distribute content across multiple channels, and seize the traffic opportunities brought by competition between platforms. Whoever can secure a position in the new round of short video dividends will gain the upper hand in the upcoming overseas business.