When it comes to scrolling through short videos, Europeans are even more hooked than we imagined.

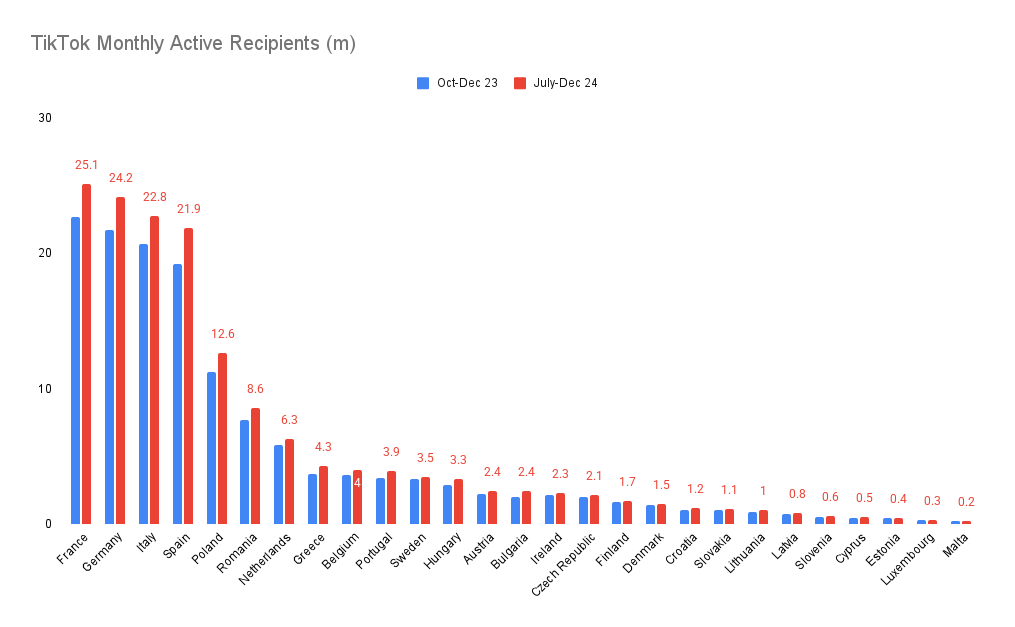

According to the latest EU operational data released by TikTok, its monthly active users surged to 159 million between July and December 2023, with 9 million new users added in just half a year—a figure that already exceeds the entire population of Finland. In France, one out of every four young people opens the app with the black musical note logo at least once a day.

TikTok EU monthly active users: 159 million. Image source: musically

Looking at individual countries, France leads with 25.1 million users, followed closely by Germany with 24.2 million, while Italy and Spain contribute 22.8 million and 21.9 million respectively. Poland is particularly noteworthy: with a population of 38 million, it boasts 12.6 million users, a penetration rate of 33%. Although the UK is not included in the statistics due to Brexit, its user base has already surpassed 30 million.

With user growth firmly established, TikTok is beginning to reveal its true ambitions. In November last year, Spain and Ireland became the first EU countries to launch TikTok Shop, and local users suddenly found they could order local agricultural products while watching short videos. By February this year, Germany, France, and Italy—the three major economies—simultaneously opened e-commerce portals, causing weekly registrations from small and medium-sized businesses to soar by 200%.

Image source: euronews

The construction of the logistics system demonstrates even greater determination. Across the UK, Fulfillment by TikTok next-day delivery service is now available, and distribution centers in Germany and Spain are being rapidly established. According to LinkedIn job postings, TikTok has recently posted hundreds of logistics positions in Düsseldorf and Madrid, assembling complete teams from warehouse management to transportation scheduling.

Image source: ecommerce bridge

This combination of moves has directly stirred up the global market. In Latin America, Mexico—with 85 million users—became the first overseas stop for TikTok Shop, achieving sales equivalent to 2.36 million RMB in its first week. E-commerce professionals have observed that home appliances and 3C accessories are the best-selling categories, which aligns closely with the main user demographic of 18-34 year olds. If the Mexico model proves successful, Brazil, with its population of 150 million, may be the next stop.

The Southeast Asian battlefield is even more dramatic. Last year, TikTok e-commerce temporarily withdrew from the Indonesian market due to policy changes, but this year it has made a comeback through a local joint venture model. Data shows that from February 2024 to January 2025, local FMCG sales grew by 34.2%, and live-streaming sales transactions soared by an average of 30 times. Individual merchants in Jakarta admit: "If you don't do live-stream selling now, you simply can't compete with those peers who are still streaming at midnight."

Image source: detikfinance

This approach clearly replicates Douyin's successful path in China, but cultural differences remain a real barrier. German consumers focus more on product specification pages than on influencer pitches, and French users have limited acceptance of "flash sales" marketing tactics. However, data proves these do not affect conversion rates: European sellers who have enabled live-streaming features saw their average sales grow 30 times in 2024—a figure that makes any hesitant merchant sit up and take notice.

TikTok's current expansion speed in Europe is reminiscent of Pinduoduo's rise in China around 2018. But the complexity of overseas markets far exceeds expectations: the 27 EU countries each have different consumer protection laws, logistics costs are 40% higher than in China, and TikTok must also contend with established platforms like Amazon and AliExpress. The more practical question is whether the current model can continue to create business value once the user growth dividend fades.

Image source: Internet

From initial cultural export to current commercial penetration, TikTok is replicating the classic path of Chinese internet companies. But whether this "short video + instant shopping" model can break through traditional consumption habits in Europe and America may be the key to determining how far it can go.