Recently, Amazon's Haul marketplace has become a hot topic in the cross-border community.

This low-price marketplace, which has only been online for half a year, has suddenly started aggressively recruiting people, not only sending out invitations to sellers but also hiring engineers and product managers globally.

Some sellers revealed that just in terms of storage fees, Haul is half the price of the main site. On the other hand, product reviews on the platform are highly polarized, with many overseas consumers complaining about logistics timeliness and product quality.

However, behind this apparent contradiction is actually Amazon's big strategy: using the extreme efficiency of the Chinese supply chain to build a super platform targeting the lower-tier market.

Image source: Google

Direct Global Shipping from Dongguan Warehouse

Haul marketplace's boldest move is setting up its warehouse directly in Dongguan, China. Sellers only need to deliver goods to Amazon's logistics center (FBA warehouse) in Dongguan, and the platform takes care of the rest—delivery and after-sales. This directly relieves small and medium sellers from the pressure of overseas stockpiling, especially factory-type sellers of low-priced daily goods and clothing, who can now do global business right at their doorstep.

What attracts sellers even more is the fee reduction: storage fees are cut in half, return and disposal fees are only one-fifth of Amazon's main site, and other fees like inbound and quality inspection are all waived. A seller in home goods did the math: selling the same $10 storage box on Haul earns $1.2 more per order. Although the profit margin doesn't look high, the volume makes up for it.

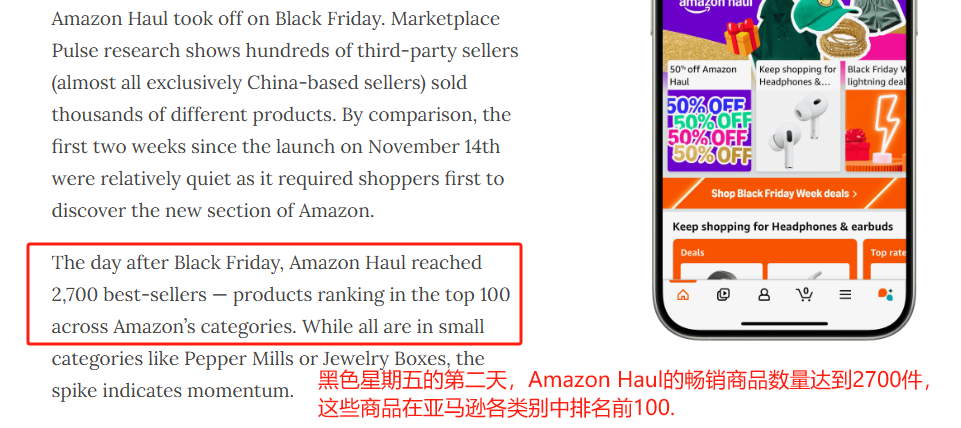

On the second day of last year's Black Friday, Haul had 2,700 best-selling items, which jumped to 4,200 by January this year—a 55% surge in just two months.

Amazon Haul has good traffic. Image source: Marketplace Pulse

The Giant Steps In to Compete with Temu

This time, Amazon is clearly targeting Chinese players like Temu and Shein. Previously, it watched others sweep the US and European markets with $9.9 free shipping, but Amazon held back for two years without making a move.

Until the end of last year, when Haul suddenly launched, and big moves followed at the start of this year. CEO Andy Jassy personally led an elite team, and the KPIs set are reportedly sky-high. The recruitment information released in February was even more direct: engineers are being hired for "global promotion," and product managers are explicitly responsible for the Mexican market. It seems that this time, Amazon is not only aiming for the US but also wants a piece of the Latin American market.

However, seasoned cross-border sellers know that low prices are easier said than done. Some sellers complain that Haul's traffic is still unstable—sometimes hundreds of orders explode in a day, sometimes it suddenly goes quiet. But because there's no need to stock goods in overseas warehouses, many factories are still biting the bullet and joining in.

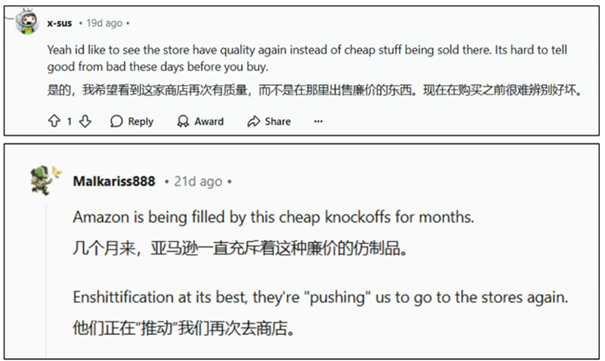

Image source: X

Foreigners Give Bad Reviews—Can This Move Succeed?

However, behind the seemingly hot seller frenzy, consumer criticism has come unexpectedly. On Reddit, many foreigners complain about Haul's products: "Everything sold on Haul is cheap stuff," and some users even call the low-priced goods on Haul "junk" or "cheap knockoffs."

Faced with bad reviews, Amazon hasn't slowed its expansion, still recruiting in new markets like Mexico. But industry insiders point out that the core issue is that consumers want low prices but worry about quality. While Haul's Dongguan warehouse model has cost advantages, compared to Temu's direct-from-China rapid supply chain, cross-border delivery speed is still a weakness.

Image source: BrandsFactory

Final Thoughts

Seeing Amazon pouring money into the low-price market, some say it's out of desperation, while others believe it's a long-planned strategy.

But for Chinese sellers, the most important thing right now is to do the math: should they continue to focus on Temu, or switch platforms to compete?

At least for now, the conditions offered by Haul are indeed tempting—no need to stock goods overseas, costs are halved, which is a lifeline for cash-strapped small and medium sellers.

This cross-border e-commerce battle has only just begun. Can Amazon's bet on the Chinese supply chain help it overtake the competition? Will consumers buy into this new "low price + Dongguan warehouse" model? These questions may only be answered with time.