TikTok Shop has delivered an impressive report card in Mexico.

The recently concluded Hot Sale marked the debut of TikTok Shop’s full-managed model in the Mexican market. According to official platform data, during the 16-day promotion (May 19 to June 3),TikTok Shop’s site-wide GMV increased by 208%, and the number of paid orders rose by 63% year-on-year.

As TikTok Shop’s first site in Latin America, the Mexican market has proven the local implementation capability of content e-commerce + full management with solid growth.

From content to shelf, the entire chain saw an “explosion”

Breaking down the data, the content field (live streaming, short video selling, etc.) saw GMV growth of 239%, while the shelf field (mall, product pages, etc.) also achieved a 191% increase. The GMV explosion coefficient during the preheating and official promotion periods were 174% and 234% respectively, with the entire event cycle almost always in a state of high growth.

These numbers not only mean that the platform’s ability to drive transactions is rapidly strengthening, but also show that local users’ acceptance of content-driven sales is continuously improving—especially in a “mobile-first” market like Mexico, where the boundaries between content consumption and purchasing behavior are becoming increasingly blurred.

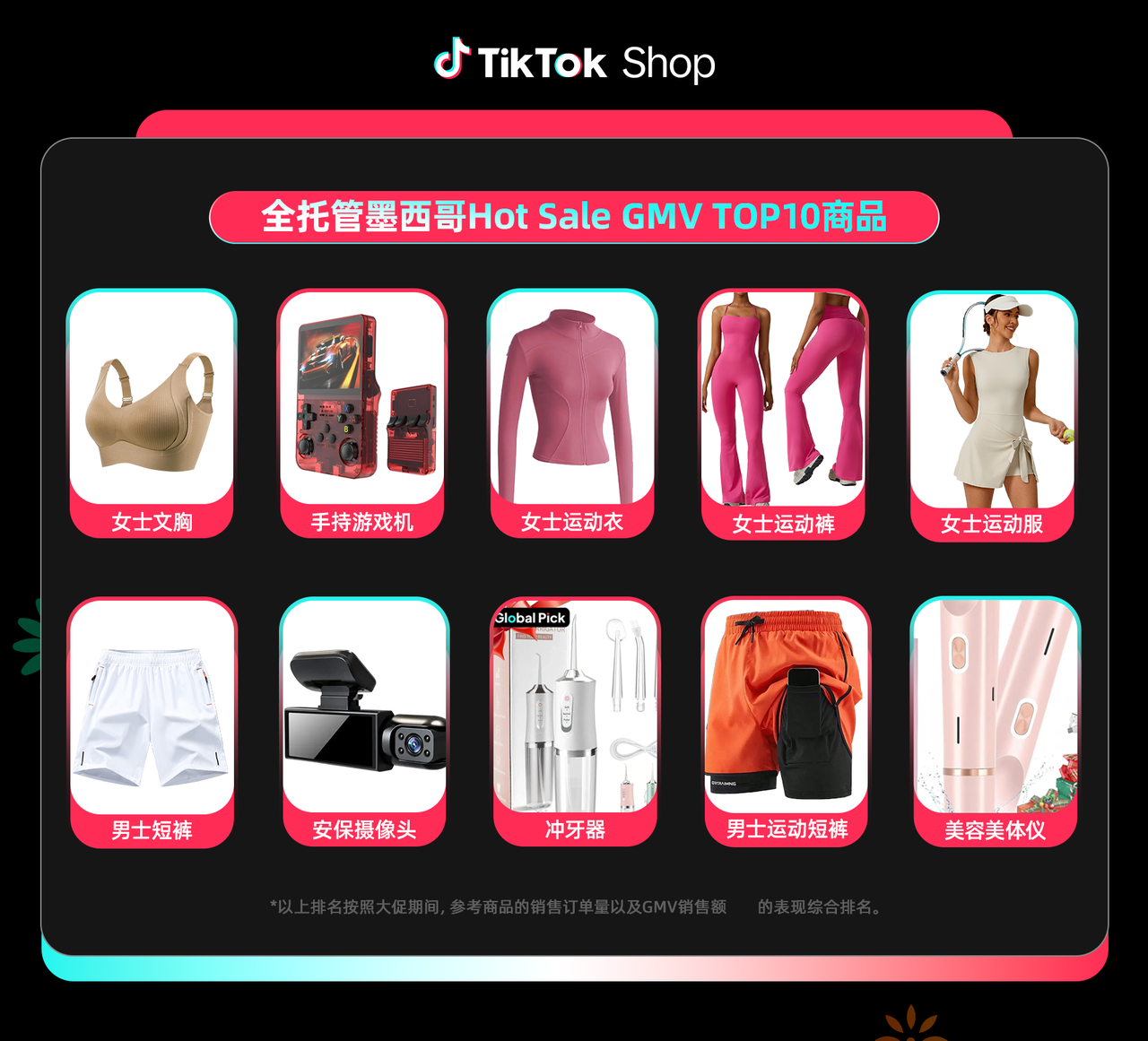

What’s selling hot? Apparel, 3C, and home goods are the three high-potential categories

Looking at specific categories, apparel-related products performed exceptionally well—women’s sports & outdoor apparel, women’s underwear, and standard-size men’s clothing became the top three bestsellers. On the product ranking, women’s bras, sportswear, handheld game consoles, and other items entered the GMV top ten, showing an overall trend of “comfort + practicality + cost-effectiveness.”

The growth of several major categories is also evident: 3C appliances grew by over 50%, apparel/shoes/bags rose by 68%, and furniture/home goods increased by 31%. These sectors are currently the main recruitment focus for TikTok Shop and closely match the local online consumption structure.

Why was the Mexican market chosen by TikTok?

TikTok Shop officially launched its Mexico site in mid-February 2025. In the first week after launch, platform sales reached about $6.64 million, with beauty, 3C electronics, and fast fashion categories accounting for over 60% of the share.

From a more macro perspective, Mexico has multiple advantages:

As of 2024, Mexico’s internet penetration rate has reached 86.51%, with over 125 million mobile users;

The e-commerce market is in a high-growth phase, and Statista estimates that by 2025, the overall market size will reach $45.27 billion;

Users have a high acceptance of overseas products, are price-sensitive, and are easily attracted by content-driven recommendations;

TikTok itself already has a considerable user penetration rate in Mexico, with mature content consumption habits.

This also explains why TikTok chose Mexico as its “first stop” in Latin America—not only is the market large enough, but the digital foundation is solid, meeting the basic conditions for running the “content + e-commerce” model.

From content-driven to ecosystem linkage, localization capability is beginning to show results

The success of this major promotion was not achieved by traffic alone. TikTok Shop’s localization efforts in the Mexican market also played a key role.

Currently, the platform has integrated more than 400,000 local influencer accounts, over 50 agency cooperation resources, and has set up 2 sample centers locally. After merchants send goods to the sample centers, influencers can shoot and distribute content, greatly improving listing efficiency and product display quality.

Combined withthe “high-quality products + reasonable prices + high-quality content” strategy, TikTok Shop is essentially replicating the “explosive product formula” that worked in Southeast Asia, and attempting to reuse it in Latin America.

In conclusion: TikTok Shop full management is just beginning in Latin America

If in the past few years, TikTok Shop has validated the scalability of content e-commerce in Southeast Asia, then the results of this Mexican Hot Sale at least show that the “content e-commerce + full management” system also has the potential to take root and explode in Latin America.

Next, will TikTok Shop replicate this model in more Latin American countries? Which categories are more suitable for entering Latin America? For Chinese cross-border sellers, this may be the next growth point worth paying attention to.