In the eyes of Indonesian sellers, that moment in mid-October last year felt like a sudden disaster.

The announcement of the closure of Tuke Shop Indonesia was like a bucket of cold water extinguishing what had been a booming business.

01 Part From Peak Season Adversity to Restarting

Last October was supposed to be the peak season for e-commerce, especially with only one month left before the Double 11 shopping festival.

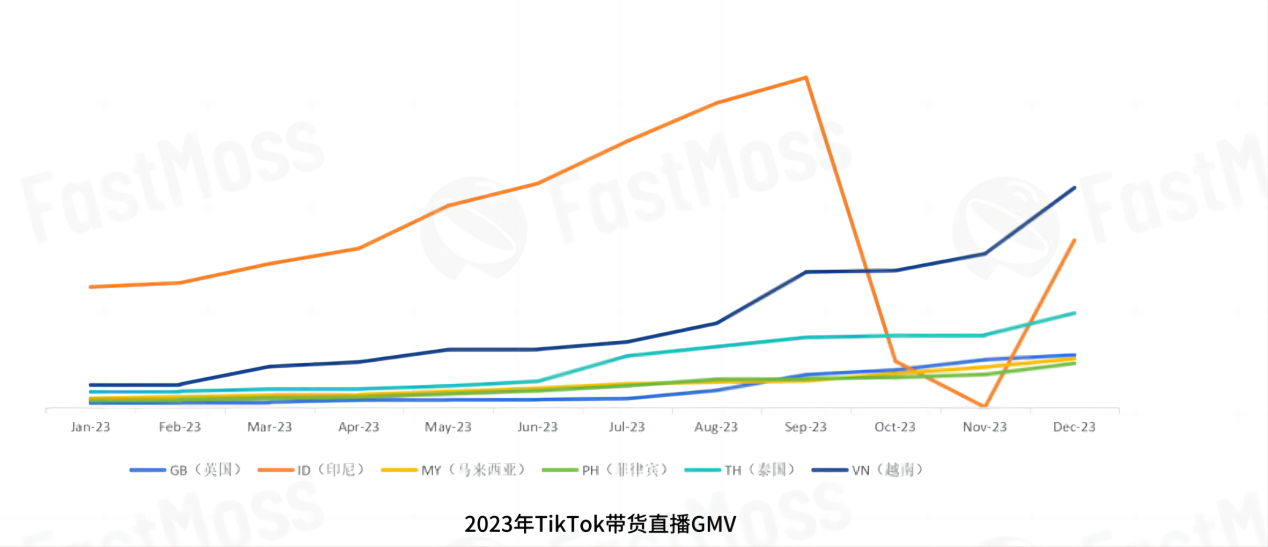

Looking back at the same period in 2022, Tuke Shop sparked a wave of online shopping frenzy across six Southeast Asian countries, with the Indonesia site standing out. On November 11 alone, the live-streaming GMV surged by 408%.

However, no one could have predicted that Double 11 in 2023 would become a blank. Many sellers saw their sales plummet from the peak to the bottom overnight. Suddenly, without the Tuke Shop platform, they found themselves in deep trouble.

"That period felt like entering the darkest hour. Many merchants and MCN agencies simply shut down, some switched to other platforms, and some even disbanded altogether," recalled one seller.

Surprisingly, after holding on for more than 60 days, those sellers who stayed put finally saw the dawn!

Tuke made a high-profile announcement that it would return to the Indonesian market by merging with Tokopedia, the e-commerce product under Indonesian tech giant GoTo. At that time, merchants on the original Tuke platform would be able to relist their shopping carts and prepare for the Double 12 shopping festival.

The news sent countless Indonesian sellers into a frenzy of joy.

Although Tuke paid a hefty price, such as spending $840 million to acquire shares, the explosive sales after its return during Double 12 provided some comfort. After the big promotion, many sellers even had to schedule order deliveries into February and March.

Image source: Fastmoss 2023 Tuke Ecosystem Development White Paper

02 Part The Crisis Is Not Over, Localization Becomes a Trend

However, after the turnaround, the crisis did not disappear.

On one hand, the platform's operating model has yet to be finalized.

Indonesian stakeholders are still arguing that social media platforms should not engage in e-commerce business. This could lead to the e-commerce transaction system and merchant backend operations migrating from Tuke Shop to other platforms, or even switching to external link transactions.

On the other hand, localization of merchants has become an inevitable trend.

Since Tokopedia is a local Indonesian platform and had not previously introduced cross-border merchants, after merging with Tuke, the management system for cross-border merchants has become more stringent to comply with Indonesian regulations.

For example, merchants need to have three basic pieces of information: KTP (ID card), NPWP (Taxpayer Identification Number), and SIUP (Trading Business License). All products sold on Tokopedia must pass Indonesia's SNI national standard certification, have user instructions for Indonesian users, and be labeled in Indonesian, etc.

This means that cross-border merchants need to register a company locally in Indonesia, bring their taxes under Indonesian supervision, and pay taxes according to regulations. Although Indonesia has not yet clarified how to tax cross-border e-commerce enterprises, judging from the regulations of other Southeast Asian countries, the tax rate will not be low.

Once the hidden tax benefits for cross-border e-commerce sellers disappear, costs will rise, price competitiveness will decrease, and operational methods will inevitably need to be adjusted.

03 Part Supply Chain Migration Sparks Indonesia "Assembly Plant" Boom

With changes in the market environment, new adjustments have also emerged in the supply chain. Indonesia has already seen the rise of assembly plants closely cooperating with Chinese supply chains, taking on the final stage of product manufacturing.

At the same time, some Chinese overseas merchants have started cooperating locally in Indonesia, setting up assembly plants to meet market demand. However, supply chain adjustments also face many challenges, such as assembly plants being unable to adapt to Tuke's pulse-style sales rhythm, requiring long periods of adaptation and adjustment.

It's not just the Indonesian market; global markets are also facing changes. Some merchants choose multi-channel operations to reduce risk, while others actively localize and cooperate with local partners to meet market demand and policy requirements.

Now, 120 days later, although the market environment remains challenging, the return of Tuke Shop Indonesia has injected new vitality and opportunities into the market.

With the progress of platform compliance and deepening market localization, the future Indonesian e-commerce market will become more mature and robust.