The latest reports show that TikTok’s parent company ByteDance saw its revenue grow by about 43% year-on-year in the third quarter of 2023, reaching $30.9 billion (222.4 billion RMB), which is double the growth rate of Facebook’s parent company Meta Platforms!

ByteDance’s Revenue Continues to Grow

According to disclosed data, ByteDance, as the parent company of TikTok, has been in a state of rapid development throughout 2023. In the first nine months of 2023, ByteDance’s cumulative revenue reached $84.4 billion, a year-on-year increase of 40%; operating profit was $23 billion, up 53% year-on-year.

According to Tuke, a large part of ByteDance’s revenue comes from Tuke. Tuke, operating overseas, has nearly 1.2 billion monthly active users globally, and in-app purchase revenue alone reached $4 billion in 2023, with lifetime cumulative revenue surpassing the astonishing $10 billion mark.

The Beauty Track Leads the Way

Tuke’s ability to surpass many established social media platforms is inseparable from its unique content format and innovative features. On Tuke, you can freely share interesting aspects of life, find like-minded friends, and gain recognition from others. All of this continuously attracts young people from around the world to join, feeling proud to become a Tuke Boy or Girl.

Tuke’s outstanding performance overseas has naturally caught the attention of businesses. Many domestic companies have already entered Tuke, launching overseas marketing strategies to open up new markets and achieve new business growth. Tuke has compiled the current industry tracks suitable for Tuke, including beauty and personal care, pet supplies, men’s/women’s underwear, fashion accessories, etc. Beauty and personal care, in particular, have always been a hot topic for going global.

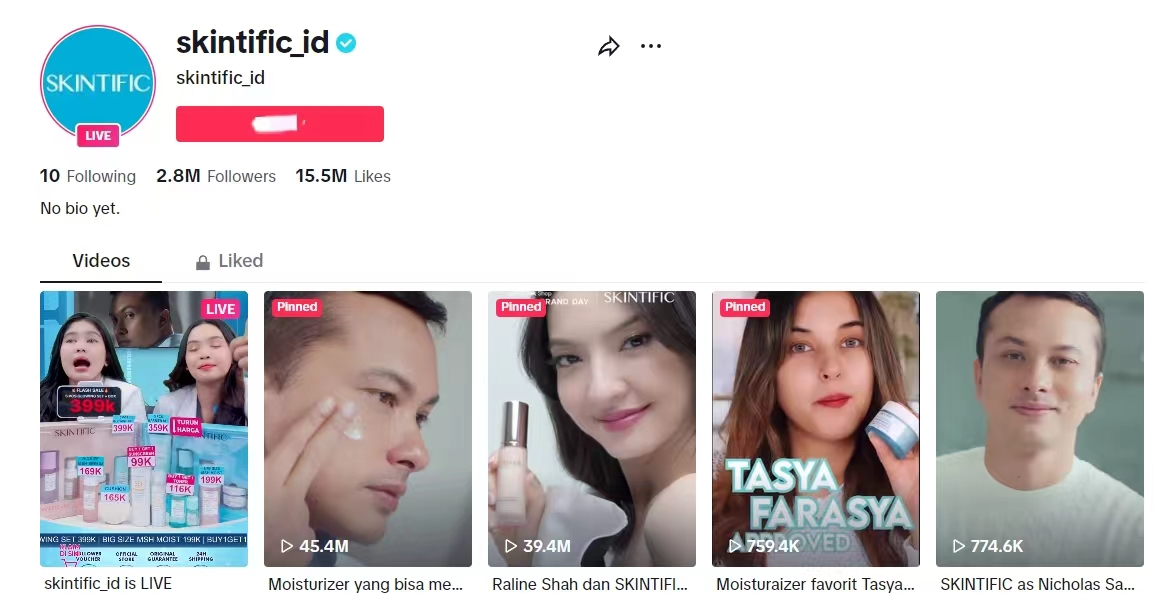

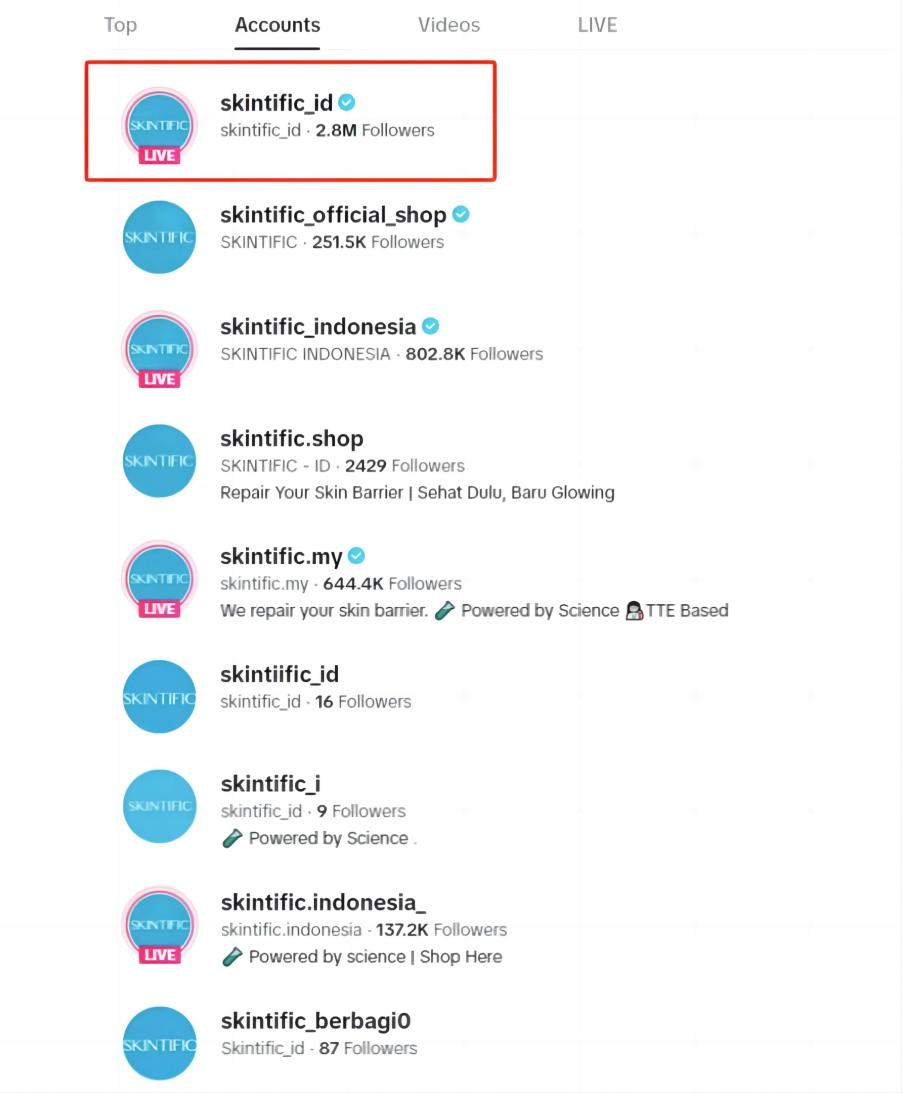

SKINTIFIC, founded by Guangzhou Feimei, has established its “dominant” position in Tuke’s beauty track with a GMV of over $50 million. Its main Tuke account skintific_id has more than 2.8 million followers, and several related accounts have also achieved impressive results, with follower counts comparable to mid-tier influencers.

SKINTIFIC account Image source: Tuke

SKINTIFIC matrix accounts Image source: Tuke

In addition to SKINTIFIC, domestic beauty brands such as FOCALLURE, BIOAQUA, O.TWO.O, and COlORKEY have also made their mark on Tuke, gaining significant attention from overseas users. Their main accounts have 2.6 million, 1.8 million, 995,400, and 268,300 followers respectively. The popularity of the beauty and personal care track on Tuke is evident.

The Southeast Asian Beauty Market Not to Be Missed

△ Indonesia

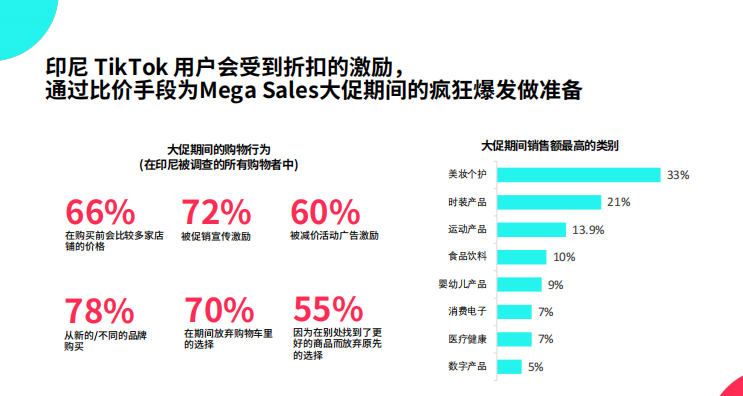

According to Tuke, in Indonesia, 42% of users are keen on buying beauty and body care products online. By 2023, the revenue of Indonesia’s beauty and personal care market is expected to reach $8.78 billion.

In the beauty and personal care category, Indonesian consumers show a strong preference for “local brands,” with localization-based brand preference as high as 97%. This means Indonesian beauty brands are more likely to win over local consumers. However, from another perspective, it also means that with the right approach and by localizing language, values, and brand image, domestic beauty brands have great opportunities to attract Indonesian consumers.

It’s worth noting that Indonesian Tuke users are highly responsive to “discounts.” Data shows that beauty and personal care sales peak during major promotions, with 72% of Indonesian consumers influenced by promotional campaigns and another 60% motivated by price reduction ads.

Image source: Tuke for Business

△ Thailand

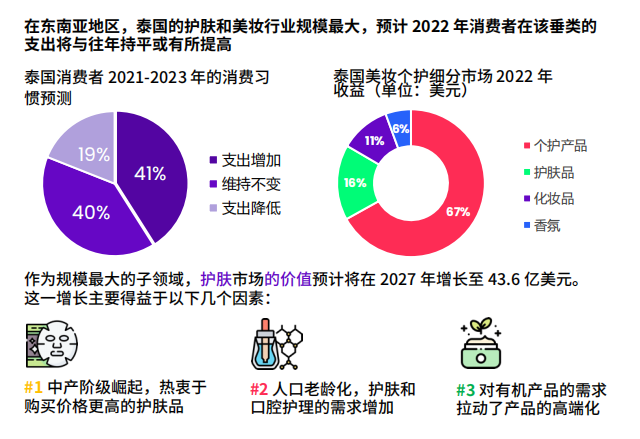

Thailand is the largest skincare and beauty market in Southeast Asia. According to consumption forecasts for 2021-2023, 40% of Thais will maintain their spending, while 41% may increase it.

Looking at the beauty and personal care sub-markets, Thai consumers are especially keen on personal care products. Statistics from 2022 show that personal care products account for 67% of revenue, skincare for 16%, cosmetics for 11%, and fragrances for 6%.

It’s noteworthy that a focus on health and environmental protection has driven Thai consumers’ demand for organic and natural beauty products. Natural ingredients, healthy materials, and products free of additives/chemicals are of particular concern to Thai consumers. Based on this, domestic beauty and personal care brands should be well prepared in these areas when going overseas.

Image source: Tuke for Business

Conclusion

As a globally renowned, phenomenon-level social media platform, Tuke is an excellent choice for overseas companies to deeply connect with international users. In the future, we look forward to seeing more domestic companies rise rapidly through Tuke and make a name for themselves overseas!