There’s big news in Indonesia’s e-commerce circle recently: local giant GoTo released its 2024 financial report, showing not only a full-scale increase in revenue and transaction volume, but also slashing its massive loss of 90 trillion rupiah from the previous year by 94% in one go.

And all of this can’t be separated from the “key alliance” with TikTok more than a year ago.

Image source: google

From huge losses to profitability, how did GoTo turn things around?

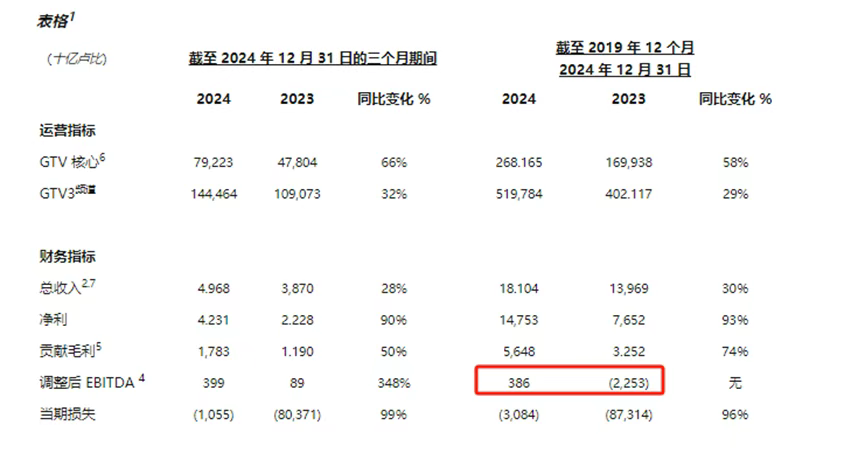

Let’s look at the data: GoTo’s total revenue for 2024 reached 18.1 trillion rupiah, up 30% from the previous year; most impressively, net income doubled directly, jumping from 7.7 trillion to 14.8 trillion rupiah. Even more remarkable, the company’s adjusted profit (EBITDA) actually turned positive—3.86 trillion rupiah may not sound huge, but remember, the previous year they were still losing 90.5 trillion.

GoTo’s adjusted EBITDA reached 3.86 trillion rupiah. Image source: GoTo

Behind these numbers is the comeback of GoTo’s e-commerce platform Tokopedia. In the fourth quarter of last year, Tokopedia contributed 204 billion rupiah in service fee income to its parent company, totaling 690 billion for the year. The turning point for all this was the deal in December 2023, when TikTok bought a 70% stake in Tokopedia for $840 million.

TikTok acquires controlling stake in Tokopedia. Image source: digwatch

Dodging policy “ban,” TikTok’s “backdoor listing” in Indonesia

Anyone following Southeast Asian e-commerce will remember that in 2023, Indonesia suddenly introduced new regulations prohibiting social media platforms from directly conducting e-commerce transactions. This move directly affected TikTok, forcing them to shut down their Indonesia site overnight. But unexpectedly, TikTok quickly turned to GoTo, using a “shell buyout” to make a comeback—taking control of Tokopedia, channeling its own traffic in, and continuing business under a new identity.

Indonesia introduces new regulations. Image source: hktdc research

How clever was this move? Even GoTo admitted that before the merger, Tokopedia had lost a lot of market share to Shopee and Lazada due to reduced subsidies. But after teaming up with TikTok, leveraging short video traffic and live-streaming sales, they managed to restore sales of fast-moving consumer goods and beauty products to pre-shutdown levels in just half a year. During last year’s Double 12, TikTok’s live-streaming room saw transaction volume surge 50 times within an hour, crashing the servers.

Transaction volume surges. Image source: rm.id

They’ve made money, but the giant siege is just beginning

Although the financial report looks good, the pressure on GoTo and TikTok hasn’t eased. Right now, Shopee still dominates Indonesia’s e-commerce, holding 35% market share, and Lazada and Bukalapak are no pushovers either. What’s more troublesome is that Indonesians are all about low prices when shopping, and platforms are still locked in a price war. TikTok may have huge traffic, but most users come for entertainment; to really get people to buy expensive items like phones and appliances, they’ll have to wrestle with local logistics and after-sales systems.

Another concern: TikTok’s user base in Indonesia has already surpassed 150 million, basically covering everyone who can get online. Next, they’ll either have to find ways to get existing users to spend more, or follow SHEIN’s lead and expand into the Middle East and Latin American markets. But whichever path they choose, it’s likely to cost a lot of money.

But then again, was spending $840 million for an entry ticket worth it? At least for now, it seems so. The revenue Tokopedia brought to GoTo last year already covers about half of the partnership cost. If they can really push market share above 30% next, TikTok will have even more confidence to compete with Shopee in Southeast Asia.

Image source: Momentum Works

Final thoughts

GoTo’s comeback serves as a wake-up call for Southeast Asian internet companies: the era of burning money for growth is over, now it’s time to learn to “hug the big leg.” As for TikTok, their win in Indonesia was impressive, but to replicate it in similarly policy-sensitive markets like Vietnam and the Philippines, they’ll probably need to find a few more “GoTo” partners.